While a rise is expected in the crypto market, notable developments continue in the memecoin sector. Accordingly, the BONK price currently wants to exit its upward trend, but this may not happen. This is because investors‘ pessimism, expecting a downtrend, might overshadow the potential for reversal, and this continues to reflect in on-chain data.

Why is BONK Price Falling?

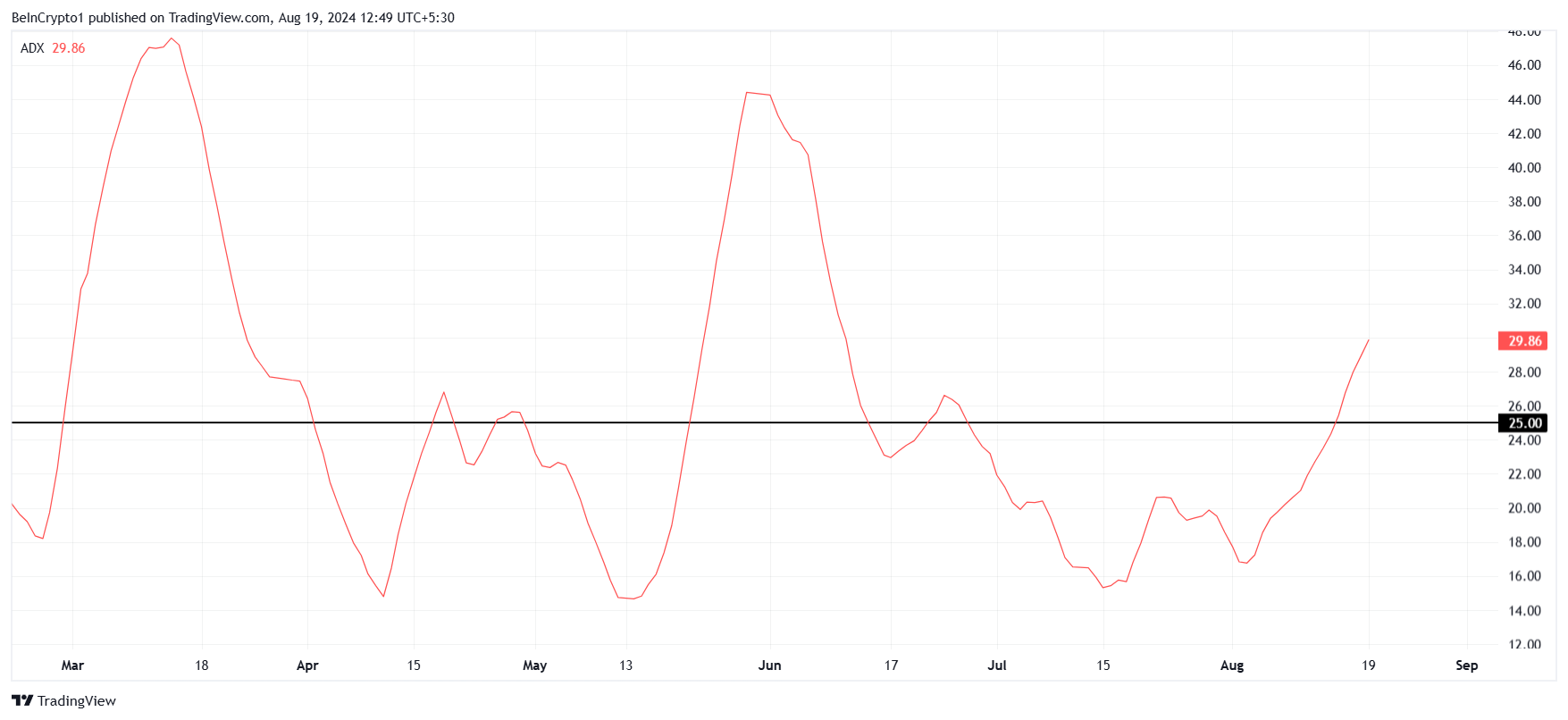

BONK price’s downtrend seems to be gaining momentum as indicated by the Average Directional Index (ADX). The indicator is currently positioned above the critical threshold of 25.0, suggesting that the downtrend could continue to push the price lower. The rising ADX value indicates that the strength of the downtrend is becoming more pronounced. This process could lead to increased selling pressure and further solidify BONK’s pessimistic outlook in the near term.

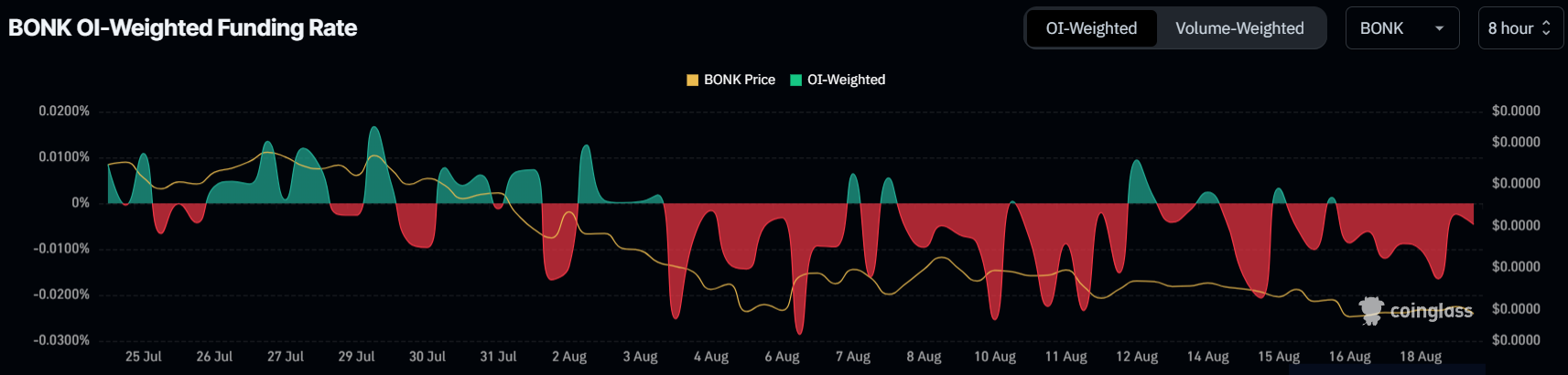

Adding to the concerns is a highly negative funding rate. This indicates that investors are increasingly predicting a decline in BONK’s price. This negative sentiment is reflected in the overall market positioning, where short positions are becoming more dominant.

The combination of a strengthening downtrend and a negative funding rate supports the growing bearish sentiment among BONK investors. If these factors persist, BONK’s price may face further downward pressure, making it difficult for the asset to recover in the short term.

BONK Chart Analysis

BONK price is likely to remain on a downward path as broader market cues do not support recovery. After falling 23% in the last ten days, the memecoin is trading at $0.00001759 and may lose the critical support of $0.00001732. This could send it to $0.00001375, a critical support for the memecoin project. Losing this will create significant selling pressure and lead to further declines. However, if the $0.00001732 support holds, BONK may rise again.

This will give the memecoin project a chance to validate the descending wedge bull formation, but resistance at $0.00002748 will need to be overcome. This may be far off, but even if BONK manages to surpass the $0.00002153 level, the bearish thesis could be invalidated.

Türkçe

Türkçe Español

Español