BNB price is likely to struggle to surpass significant resistance due to several bearish factors. The biggest of these factors is the lawsuit filed by three crypto investors against Binance and its founder over stolen assets. Although BNB’s price has increased by 7% in the last 48 hours, it may not sustain the uptrend. This is due to the class-action lawsuit filed by three crypto investors against Binance and its founder Chengpang Zhao (CZ).

What’s Happening with BNB?

The lawsuit claims that investors faced losses due to Binance’s failure to prevent money laundering. According to a post by Bill Hughes, the court filing stated:

“Binance was aware of its profitable business model and to some extent encouraged it. Plaintiffs say they were harmed because Binance was a significant part of money laundering and constituted an illegal racket violating the RICO Act.”

If the lawsuit goes to trial, it could deal a significant blow to the exchange, its native token BNB, and its founder CZ. CZ is already serving a four-month prison sentence for violating the Bank Secrecy Act, which will end in September.

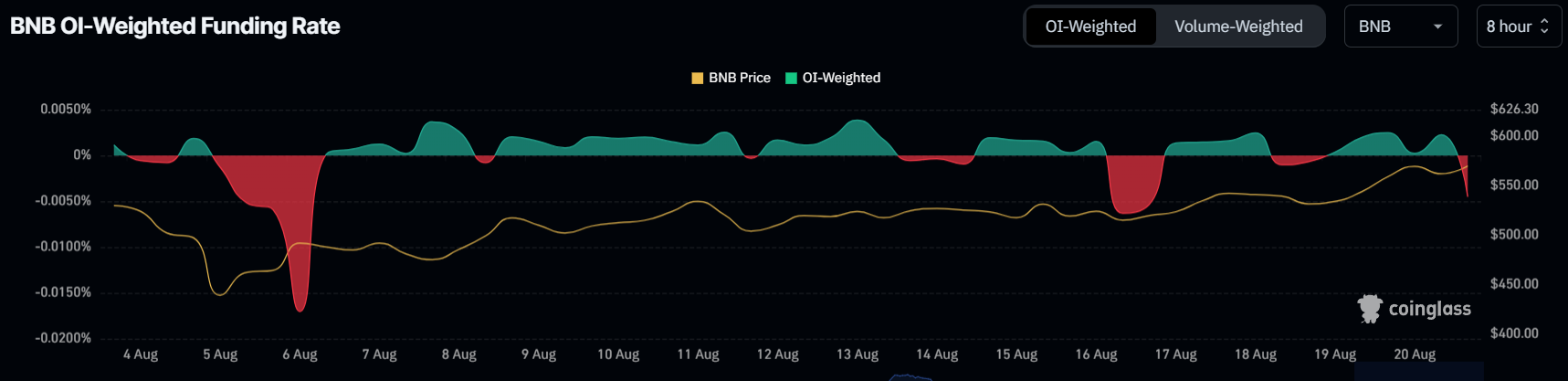

The shift in sentiment among investors is further affecting the BNB price. The negative funding rate in the last 24 hours indicates a shift in BNB holders’ sentiments towards bearishness. This is likely due to the altcoin approaching its well-known resistance block. Therefore, investors have started placing short contracts to capitalize on the potential drop from this block.

BNB Chart Analysis

BNB’s price at the time of writing was $561, just below a significant resistance block. This range, varying between $575 and $619, has prevented a rise in BNB’s price since early March. Although BNB has made multiple attempts to surpass this level, only one was successful in June, leading to a new all-time high of $721.

Given that bullish momentum is currently not strong, BNB price may likely fall below $550. Even if the lower boundary at $575 is successfully breached, the crypto asset may struggle to close above $600 and surpass $619. This would eventually lead to a decline to $550.

Türkçe

Türkçe Español

Español