BNB Chain‘s native token, BNB, extends its impressive recovery streak for the third consecutive week. With approximately 10% weekly gains so far, BNB rose to around $585 on August 22. Key factors fueling BNB’s price increase today and in recent weeks include Binance’s strategic expansion of its compliance team, growing expectations of potential interest rate cuts in the US, and several other market-impacting developments.

What’s Happening on the BNB Front?

Today’s BNB rally coincides with Binance‘s announcement to significantly strengthen its compliance team in 2024. CEO Richard Teng emphasized that at least 20% of the new hires will be dedicated to bolstering the company’s regulatory compliance efforts.

This announcement came about a week after three crypto investors filed a class-action lawsuit against Binance and its former CEO Changpeng Zhao. They claim they were unable to recover their stolen assets due to Binance’s failure to prevent money laundering.

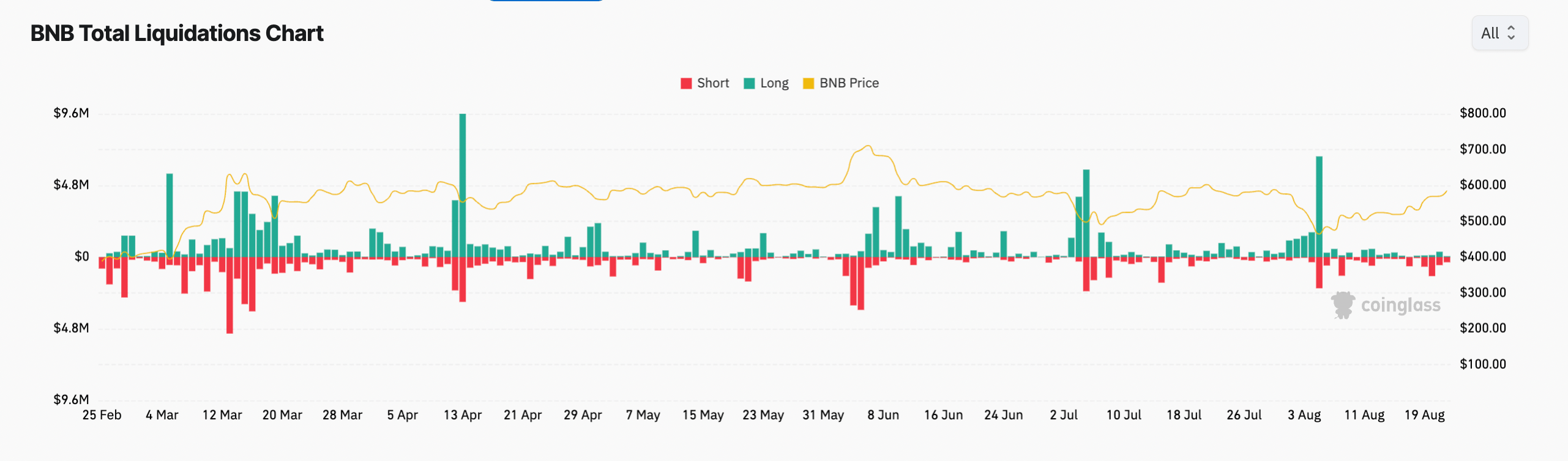

According to data source Coinglass, BNB’s price increase has accelerated due to more short liquidations compared to long ones since the crypto market crash on August 5. Specifically, the BNB futures market has witnessed over $7.21 million in short liquidations compared to $3.86 million in long liquidations since then.

In other words, many bearish investors expecting BNB’s price to drop had to exit their positions as the market moved against them. These short liquidations occur when investors are forced to buy back BNB to cover their losses, creating upward pressure on the price.

BNB Chart Analysis

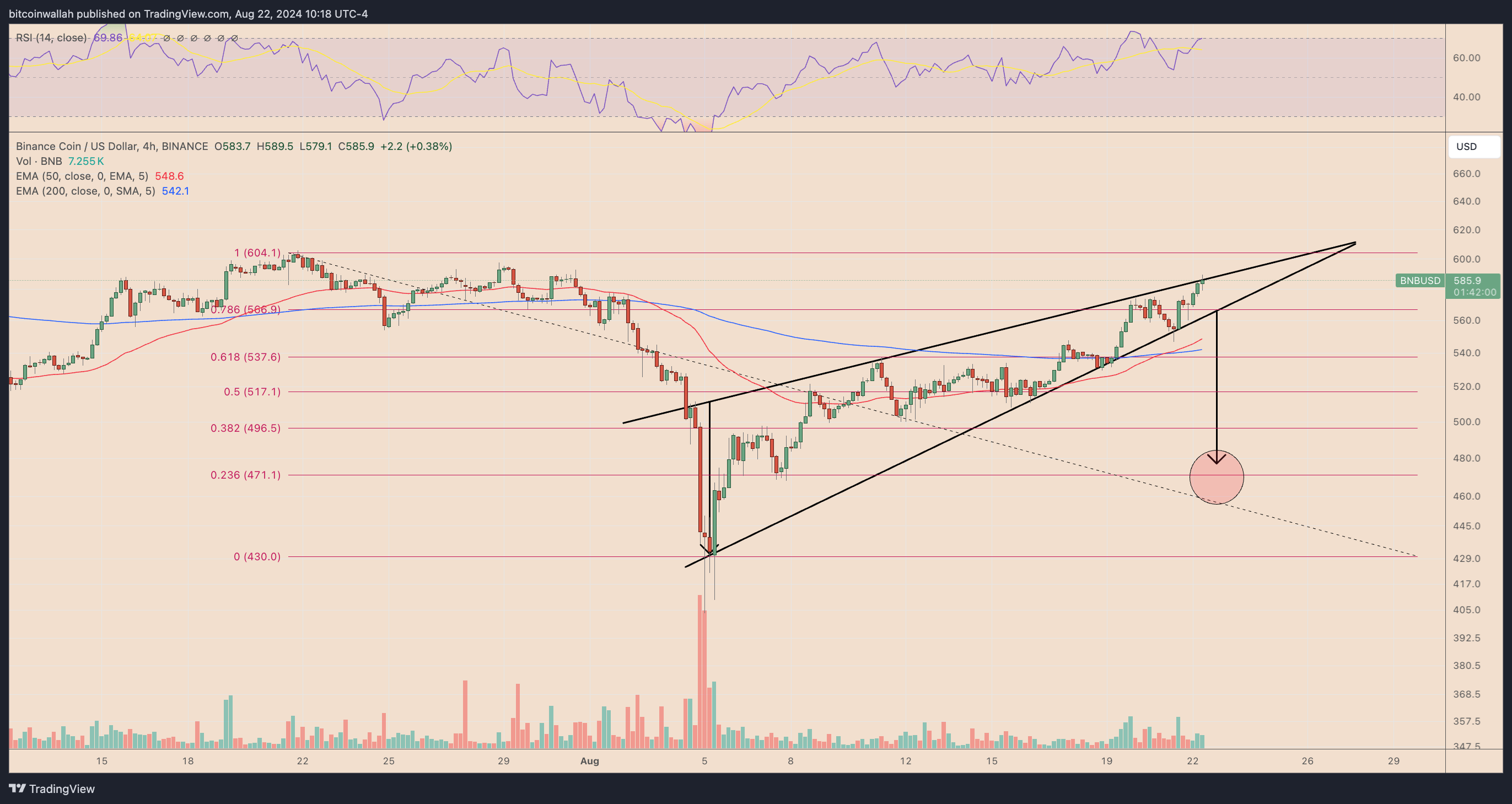

From a technical perspective, BNB‘s gains are notable as part of the price movements within a rising wedge pattern characterized by two converging upward trend lines. However, rising wedge formations are considered bearish reversal patterns that resolve when the price falls below the lower trend line and drops by the maximum distance between the upper and lower trend lines.

Applying the same technical analysis to BNB’s price chart, $586 emerges as a potential breakdown point. If BNB falls below this level with increasing trading volume, it could indicate further declines and potentially target $480 as the rising wedge breakdown target in August.

Türkçe

Türkçe Español

Español