This month marked a decline in demand for the Solana network. As August draws to a close, the Layer-1 network reached its lowest point of the year in terms of transactions and active addresses. This decrease in usage affected network fees and revenue, which dropped by more than 50% last month. So far this month, the total number of unique addresses signing transactions across Solana reached 18.09 million.

What’s Happening on the Solana Front?

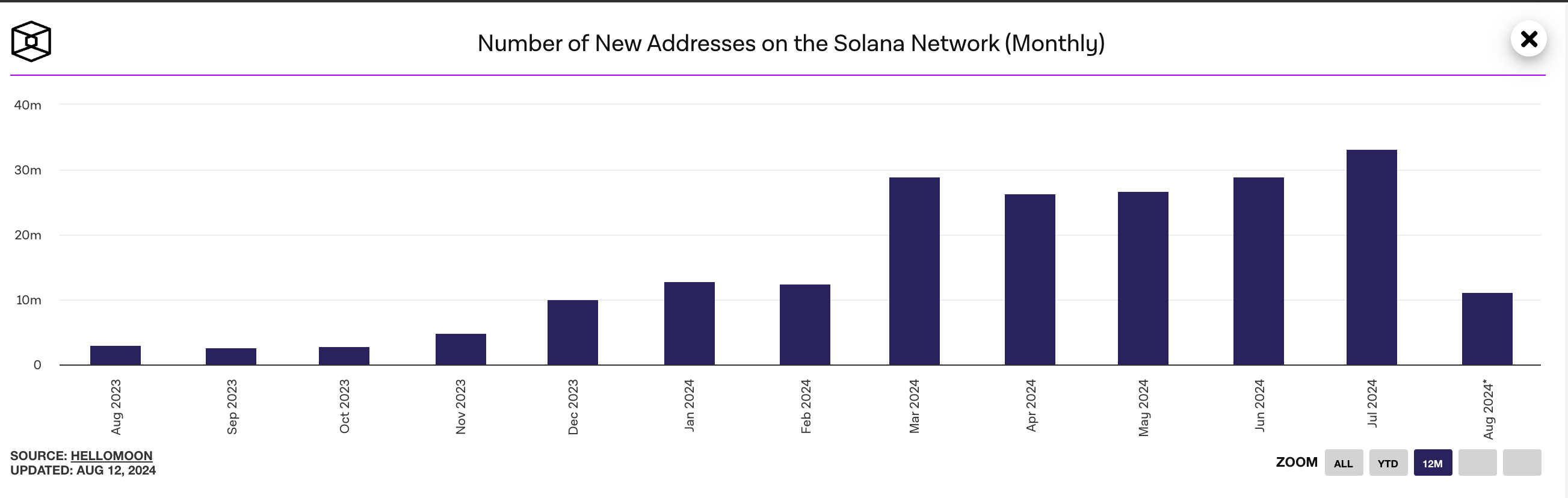

This process indicates a 67% drop compared to the 54.33 million monthly active users recorded in July and a 16% decrease in active usage year-to-date (YTD). The number of unique first signers on the network also fell. According to The Block’s Dashboard platform, the number of new users on the Solana network reached 11.1 million this month, a 66% drop compared to the YTD peak of 33.15 million new users recorded in July.

This decline occurred despite the recent hype around the Solana-based memecoin creation platform Pump Fun. Due to the decrease in the number of users on Solana, the number of transactions on the Layer-1 network also fell. Since the beginning of the month, non-voting transactions on the network reached 486.61 million, marking the lowest level of the year.

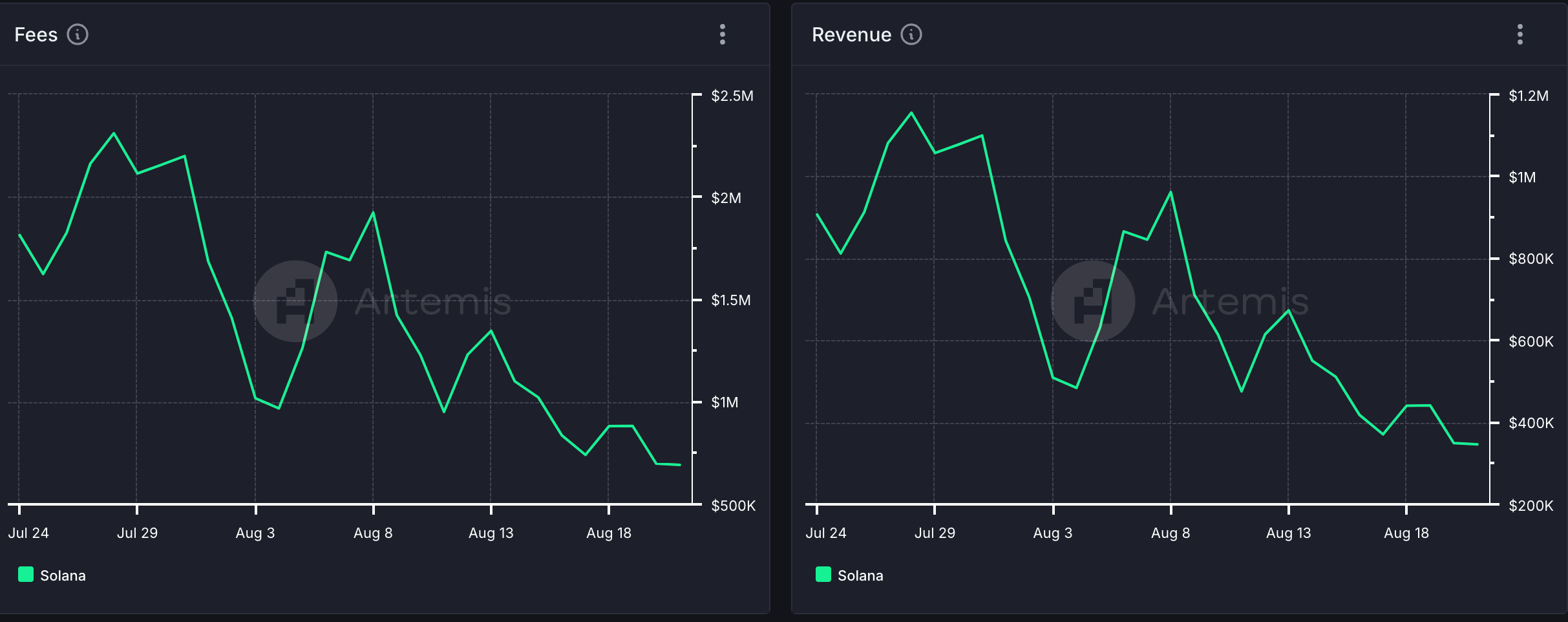

Non-voting transactions on Solana refer to all transactions on the network that do not directly involve block producers voting. These include token transfers, staking and unstaking, NFT sales, etc. With the decrease in activity on Solana this month, network fees and the revenue derived from them were affected. Data from Artemis shows these have dropped by 62% in the last 30 days.

SOL Chart Analysis

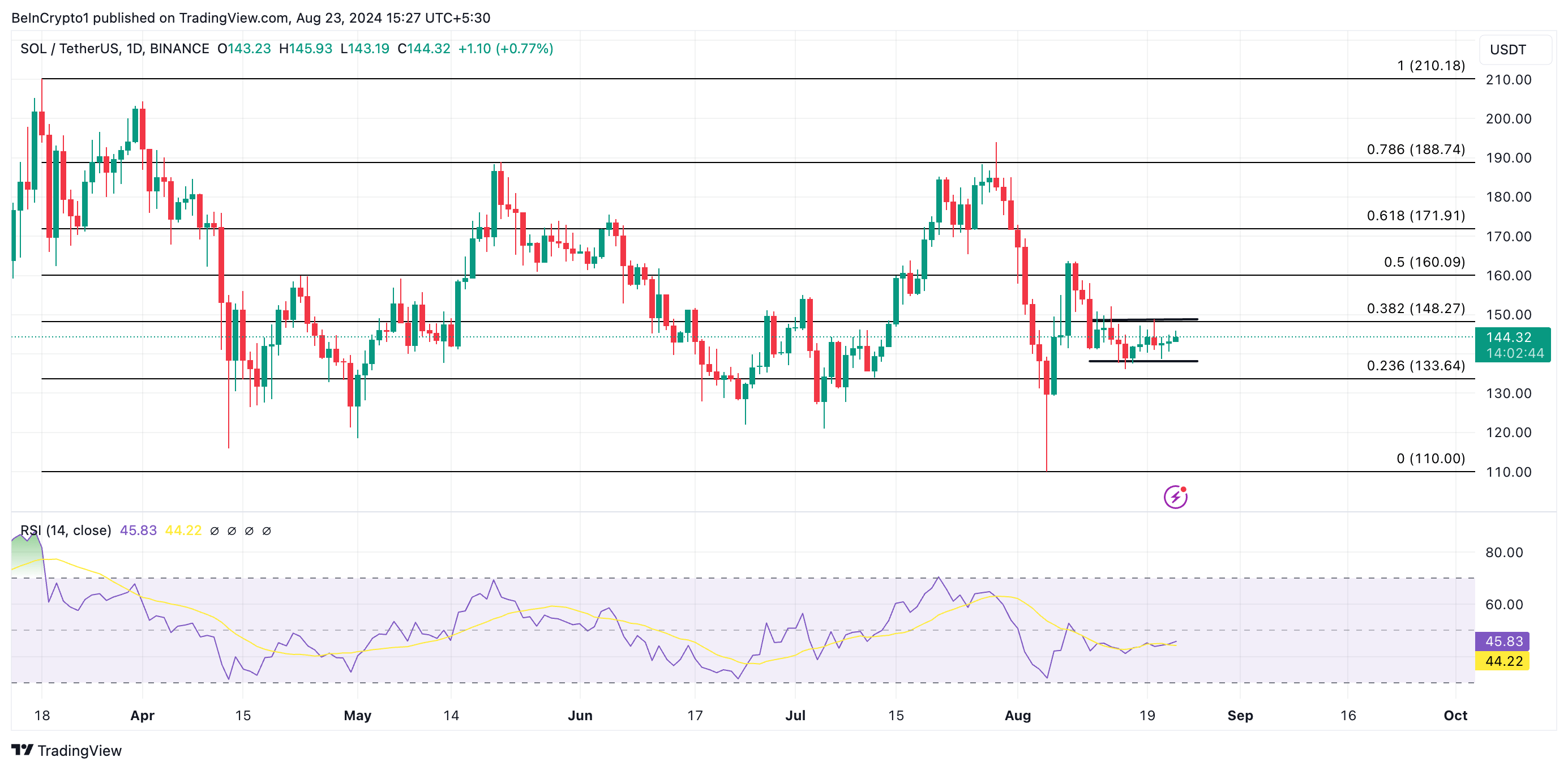

At the time of writing, SOL is trading at $145.58. Since August 12, the token has shown a sideways trend, encountering resistance at $152.12 and finding support at $137.65. The relative balance between buying and selling pressures in the market is evidenced by SOL’s flat Relative Strength Index (RSI). This indicator measures overbought and oversold market conditions of an asset.

If SOL breaks above the resistance line and successfully retests it, its value could increase by 10% to trade at $160.09. However, if selling pressure gains momentum, it could fall below the support to trade at $133.64.

Türkçe

Türkçe Español

Español