Bitcoin price surged above $64,000 early today and touched $65,000 in futures trading. Subsequently, attention turned to Ethereum, which surpassed $2,700 for the first time in a long period. Meanwhile, the broader market also experienced a rise. Following this surge, Wall Street’s last trading day focused on ETFs. So, what happened with ETFs?

Current Status of ETFs

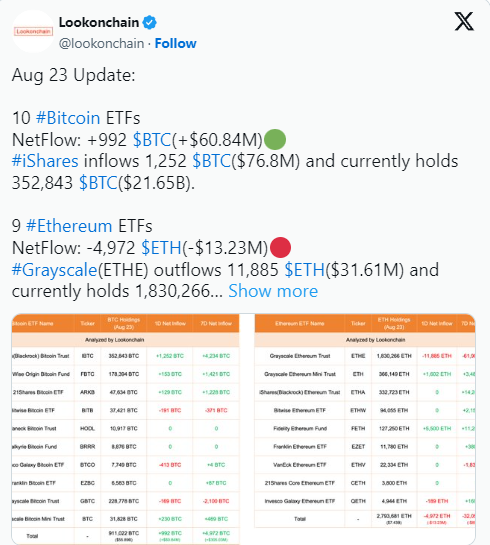

Lookonchain shared important data on August 23, Friday, concerning spot Bitcoin and Ethereum ETFs. According to the disclosed data, Fidelity notably surpassed BlackRock in Ethereum inflows that day, taking the top spot.

BlackRock lost its lead to Fidelity during this period. Lookonchain reported a net outflow of -4,972 ETH in nine spot Ethereum ETFs by the end of Friday’s session, indicating negativity. This situation was driven by Grayscale’s Ethereum Trust, which saw significant outflows of 11,885 ETH worth $31.61 million, leading to a negative trend.

Currently, the ETF fund holds a massive amount of Ethereum, approximately 1,830,266 ETH valued at around $5 billion. A general review showed that Grayscale experienced an outflow of 61,901 ETH last week.

Regarding inflows, the most significant development occurred in the Fidelity Ethereum Fund. During this period, Fidelity saw an inflow of 5,500 ETH, and the total amount increased by 11,250 ETH over the past week.

BlackRock’s iShares Ethereum Trust saw zero inflows. Grayscale Ethereum Mini Trust experienced an increase of 1,602 ETH, while the Invesco Galaxy Ethereum ETF saw an outflow of 189 ETH, and the situation in the remaining ETFs was similar to BlackRock.

What is the Current Ethereum Price?

While the market saw these inflows and outflows yesterday, Jerome Powell’s speech heated the environment, and Ethereum price visibly increased. Following the rise that began last evening, ETH price surpassed $2,700, as reflected in the charts.

ETH price is at $2,770 as of the time of writing, following a 4% increase in the last 24 hours. This rise in ETH also boosted the market cap, which exceeded $330 billion again, reaching $333 billion.

Trading volume also increased in parallel with the price rise. Following this over 38% increase, the value reached $16.1 billion, indicating investor interest.

Türkçe

Türkçe Español

Español