Bitcoin (BTC) price had a tough August, but markets are recovering, and BTC is hovering above $63,000. Continued closures at higher levels may now gradually pave the way for focusing on the $70,000 target. In the last 24 hours, BTC tested $65,000. So, what awaits investors?

Bitcoin Monthly Close

The monthly close is approaching, and cryptocurrency investors may see a nice August close after discouraging days. Generally, monthly closures lead to increased volatility. Daan Crypto Trades does not seem to have much reason to be optimistic because the lack of demand at higher levels makes things more challenging.

“Now let’s see if there is fuel to really push higher for a change. Bitcoin has been in ‘Consolidation’ for almost 6 months at the previous cycle’s highest level. This is the longest time taken to break the previous all-time high. At the same time, we saw the fastest period where the price reached an all-time high before the halving in a cycle. Everything balances each other out.”

PCE and Fed Interest Rate Decision

The PCE data will be released on August 30, and this is the indicator the Fed follows for inflation. It is extremely suitable news to trigger volatility at the end of the month. At the same time, on August 28, we will see the earnings report of NVIDIA, an important indicator for the technology sector. The Fed has been convinced of a cut, and if the PCE comes in at or below expectations, investors aiming for a good start in September may get what they want.

Miners and Short-Term Investors

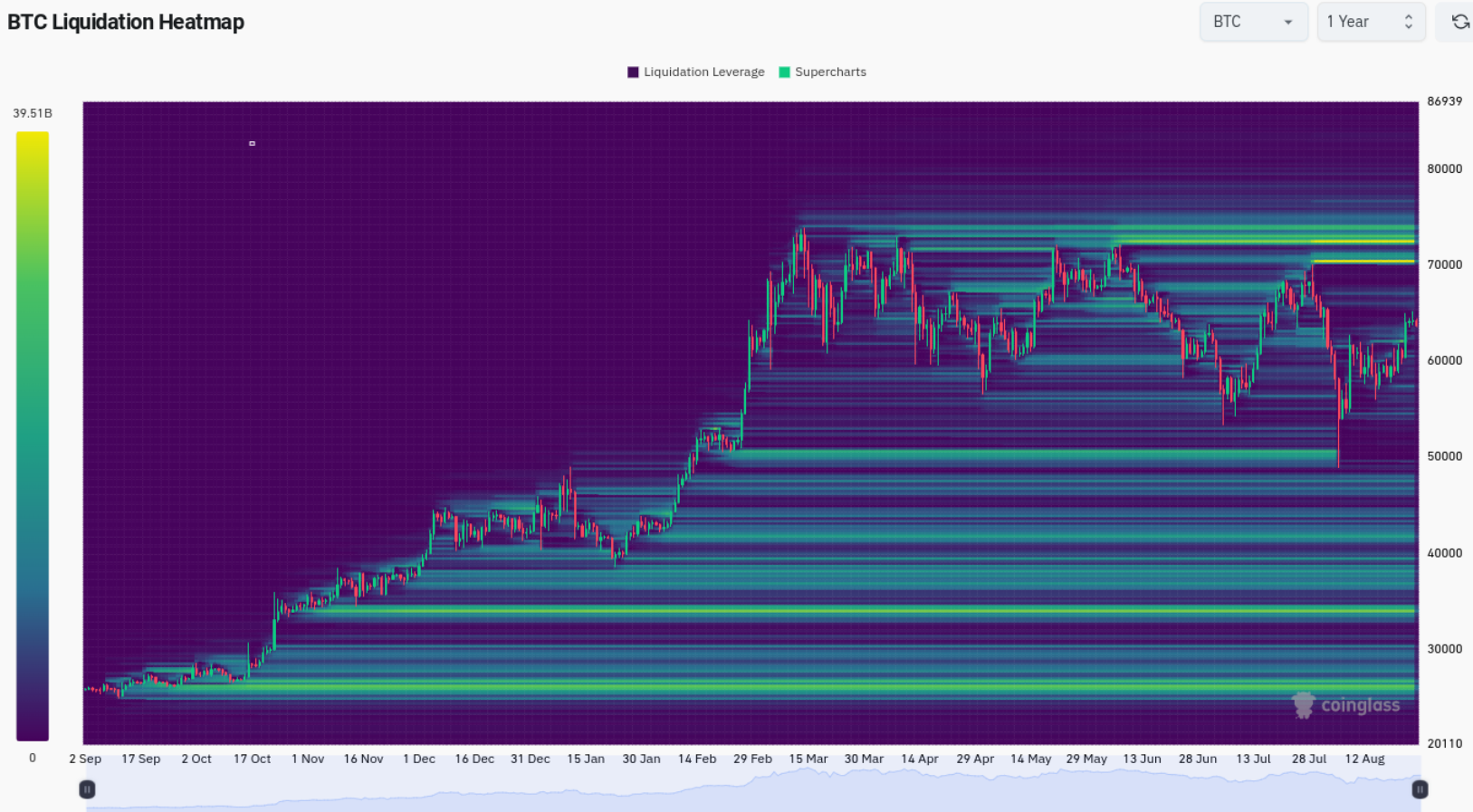

This week, mining difficulty will increase by 2.8%. Although the impact of institutional investors on the market weakens the power of miners, less selling pressure is expected. On the other hand, the fourth significant development is the strong sales of short-term investors. The cost for this group is $63,600, and if the key threshold is maintained, we may see a weakening of sales.

Fear and Greed Index

BTC price recovery has pushed the fear index to 55, returning to the greed threshold. This means that investors’ risk appetite may continue to increase. If the data is supportive as we head into September, we may see this.

Türkçe

Türkçe Español

Español