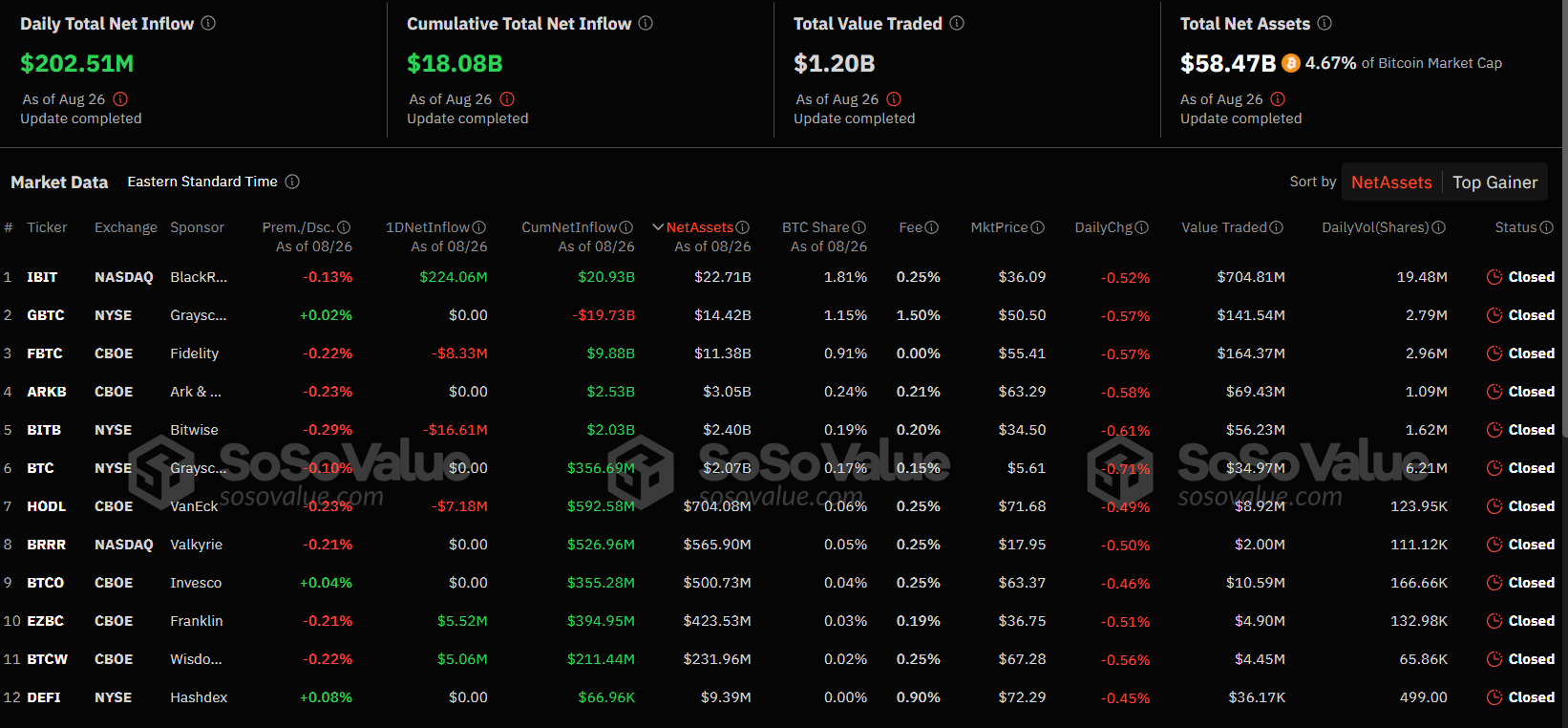

Bitcoin is being referred to as the gold of the digital age, and investors‘ interest in this cryptocurrency is growing day by day. Especially, spot Bitcoin ETFs have been experiencing continuous net inflows for eight days. The positive sentiment is considered an important sign that strengthens Bitcoin’s position in the financial market. On Monday, these funds achieved a notable net inflow of $202.51 million.

Massive Inflow into BlackRock’s IBIT Fund

The largest source of these flows was BlackRock’s IBIT fund. BlackRock’s IBIT fund alone attracted attention with an inflow of $224.06 million. Other funds also continued to experience positive flows, albeit in smaller amounts. Franklin Templeton’s EZBC fund recorded a net inflow of $5.52 million, and WisdomTree’s BTCW fund recorded $5 million.

However, not every fund benefited from this positive trend. Bitwise’s BITB fund faced a net outflow of $16.61 million. Fidelity‘s FBTC and VanEck’s HODL funds also experienced outflows of $8.33 million and $7.18 million, respectively. This showed that interest in Bitcoin was not evenly distributed across all funds.

The trading volume of Bitcoin ETFs remained at $1.2 billion on Monday. Last Friday, this volume was recorded at $3.12 billion, meaning the trading volume returned to its previous levels. Since January, Bitcoin ETFs have achieved a total net inflow of $18.08 billion.

Ethereum ETFs Show Different Behavior

On the other hand, Ether ETFs do not paint the same positive picture. Ethereum has been facing negative flows for eight consecutive days, indicating a loss of investor interest. On Monday, Ethereum ETFs experienced a total net outflow of $13.23 million. Grayscale’s ETHE fund led with an outflow of $9.52 million, while other funds also struggled with similar negative flows.

Bitcoin fell by 1.54% in the last 24 hours to $63,077, while Ethereum traded at $2,689 with a 2.26% loss. This clearly showed that Bitcoin garnered more interest compared to Ethereum, with investors favoring Bitcoin.

As fluctuations continue in the cryptocurrency market, Bitcoin’s strong stance and Ethereum’s weakening performance may lead investors to reassess their strategies.