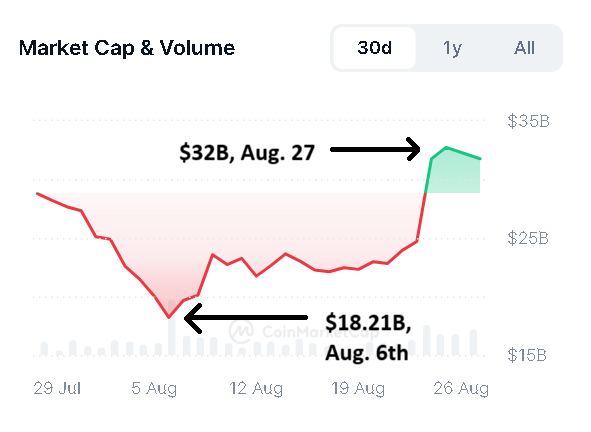

Artificial intelligence and big data cryptocurrency projects have seen a 79.7% market value increase in three weeks, reflecting renewed confidence among crypto investors. On August 6, the market value of AI and big data fell to an annual low of $18.21 billion, mainly due to Bitcoin’s and the overall crypto market‘s poor performance.

What is Happening in the Field of Artificial Intelligence?

During this period, data from TradingView showed Bitcoin’s price sharply fell below $50,000. According to CoinMarketCap, the AI and big data token ecosystem responded to Bitcoin’s price recovery, and its market value comfortably surpassed $38 billion on August 25.

As of August 27, the top AI and big data tokens by market value include Near Protocol with $5.5 billion, Internet Computer with $3.8 billion, Artificial Superintelligence Alliance (FET) with $3.4 billion, and Bittensor (TAO) with $2.8 billion.

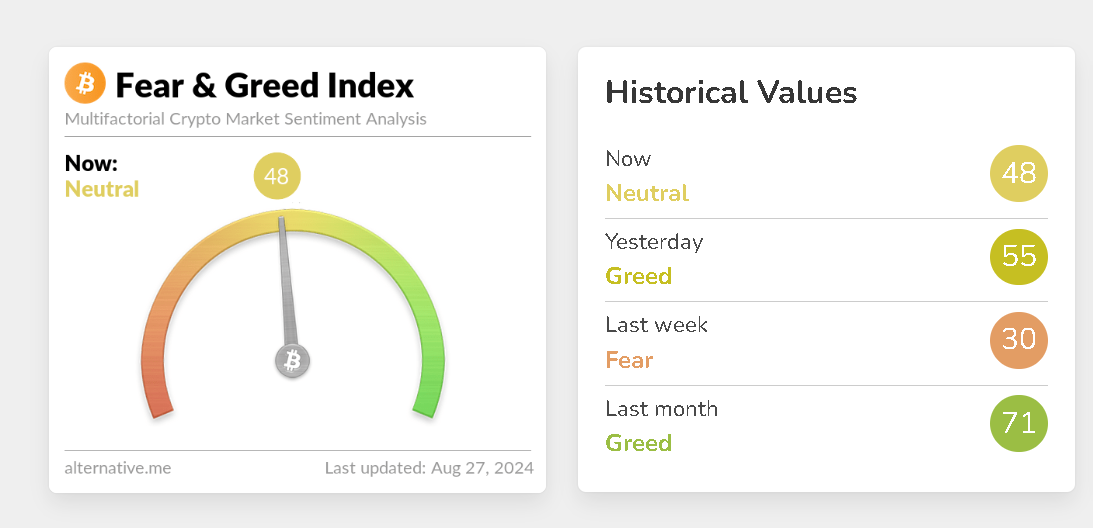

During this period, market volatility negatively impacted investor sentiment as the Alternative.me Fear and Greed Index reached extreme fear levels. This development could lead many investors to face selling pressure and significant losses. The financial report from Nvidia, to be announced on August 28, could play a significant role during this period.

Details on the Subject

As markets began to recover and crypto investors tried to recoup their losses, sentiment returned to neutral. The Fear and Greed Index aims to measure the emotions of crypto investors and now serves as a useful indicator for making investment decisions.

Onchain data analysis platform Lookonchain, in an August 26 X post, observed significant gains in FET and recorded unusual whale transaction behavior. It noted that a whale seemed to regret selling at a lower price before spending $2.38 million worth of Tether to buy back 1.79 million FET tokens from Binance at a higher price of $1.33 on August 25.

Türkçe

Türkçe Español

Español