Ethereum has long been recognized as an “ultra” solid currency in the crypto world. However, recent developments indicate that this status is in jeopardy. The increase in ETH’s inflation rate to 0.73% and the rise in total supply raise concerns that Ethereum may lose this title. Since the Dencun upgrade in March, Ethereum’s supply has increased from 120,060,000 ETH to 120,309,508 ETH. This increase seems to have taken back some of the post-Merge gains.

Supply Increase and Inflation Concerns Worry Investors

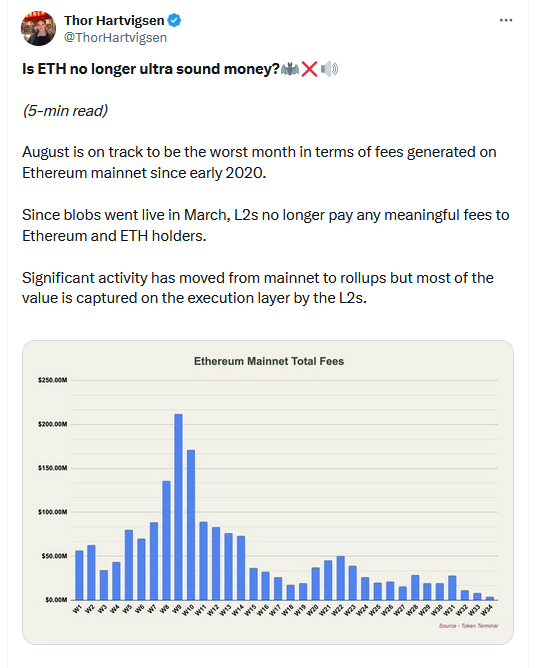

While the increase in Ethereum’s supply is seen as positive for staking investors, it represents a net loss in value for those who do not stake. Crypto analysts like Thor Hartvigsen note that the high supply benefits stakers but results in a net value loss of around 0.7% for non-stakers. Although this loss rate is low compared to other Layer-1 projects, it still worries investors.

Ethereum rose by 0.5% to $2,520 in the last trading day. Technical analyses show that ETH is moving between the support level of $2,320 and the resistance level of $2,817. The double bottom movement in the daily chart is noteworthy and could signal a potential rise. If Ethereum surpasses the resistance at $2,817, the price is expected to reach up to $3,300. The $3,300 level also increases the likelihood of the 100-day SMA crossing above the 200-day SMA. Such a scenario is considered a bullish signal in the markets.

However, if the resistance at $2,817 is not surpassed, a pullback for Ethereum is likely. In recent weeks, this level has been approached twice, and both times ETH pulled back.

Market Indicators and Possible Scenarios

The Relative Strength Index (RSI) is currently at 42 and is attempting to rise above the SMA. The 42 level could indicate a short-term bullish trend. However, red bars in the Awesome Oscillator suggest that the bearish trend in the markets continues.

If the daily close occurs below the $2,320 support level, the bullish scenario may become invalid, leading to further declines in ETH.

Türkçe

Türkçe Español

Español