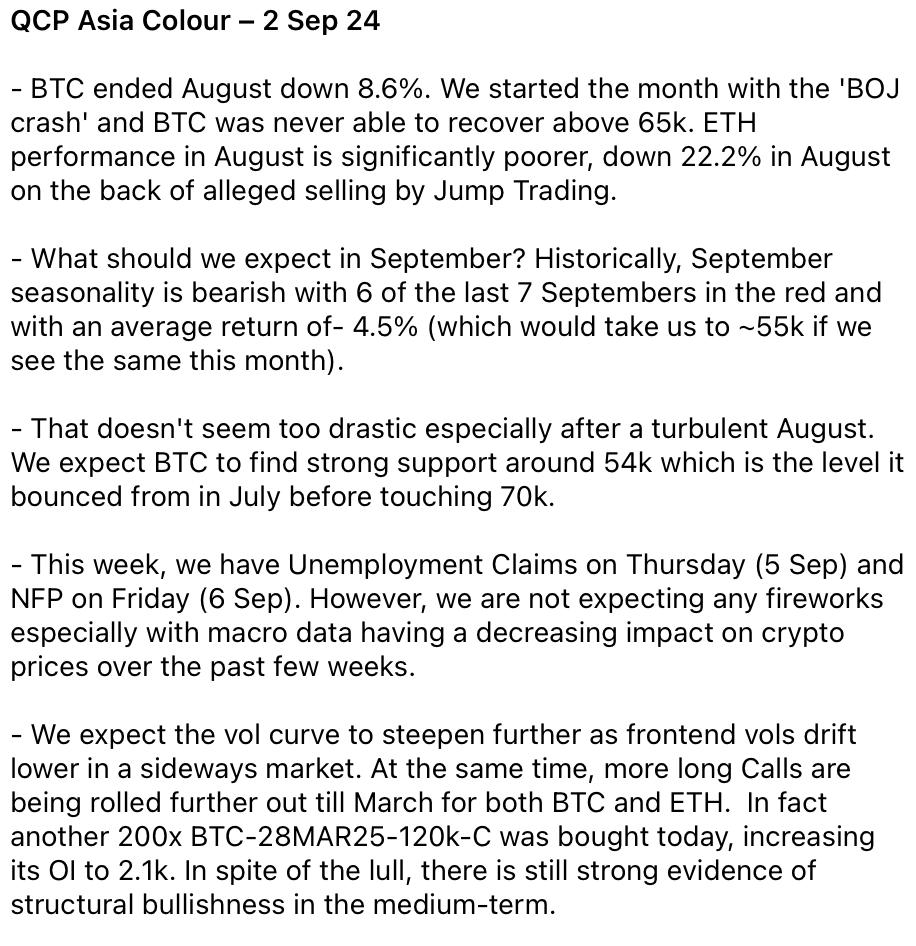

Singapore-based trade and consultancy firm QCP Capital warned cryptocurrency investors by examining Bitcoin’s (BTC) market performance in past Septembers. According to the analysis, Bitcoin’s price fell in six of the last seven years in September, with an average decline of 4.5%. If this trend repeats this year, Bitcoin‘s price could drop to around $55,000.

$54,000 Level Emerges as a Strong Support Point

QCP Capital analysts predict that the $54,000 level will be a strong support point. This level acted as a springboard in July, causing the price to rise to $70,000. Therefore, analysts do not expect a drop below this level and anticipate that this critical support will hold the price.

Moreover, analysts predict that significant macroeconomic data such as US unemployment claims (September 5) and non-farm payrolls (September 6) to be released this week will not have a major impact on the cryptocurrency market. On the other hand, QCP Capital added that the impact of macroeconomic data on cryptocurrencies has decreased recently. This leads to Bitcoin’s price movements being more influenced by market dynamics and investor sentiment.

Investors Take Positions Expecting a Rise in the Options Market

Despite the short-term market stagnation, QCP Capital analysts emphasized that the medium-term outlook in the options market is still optimistic. The volatility curve in the options market is expected to steepen further, with many long positions extended until March 2024.

Notably, Bitcoin’s $120,000 call options expiring in March 2025 increased by 200 contracts today, reaching a total of 2,100 contracts. This increase in contracts for $120,000 call options indicates that investors continue to trust Bitcoin in the medium term and expect a rise.

According to analysts’ analysis, the performance of the Bitcoin market in the upcoming period should be closely monitored, especially whether certain support levels are maintained. While medium-term options data show that investors still maintain long-term bullish expectations, short-term downward attacks in the market can be expected.