According to recent data from Deribit, which controls a large portion of the crypto options market, approximately $1.07 billion worth of Bitcoin (BTC) and Ethereum (ETH) options will expire on September 6. The weekly options, set to expire at 11:00 AM UTC, could trigger significant market movements as investors focus on key price levels known as ‘maximum pain points’.

$780 Million in Bitcoin and $290 Million in Ethereum Options Expiring

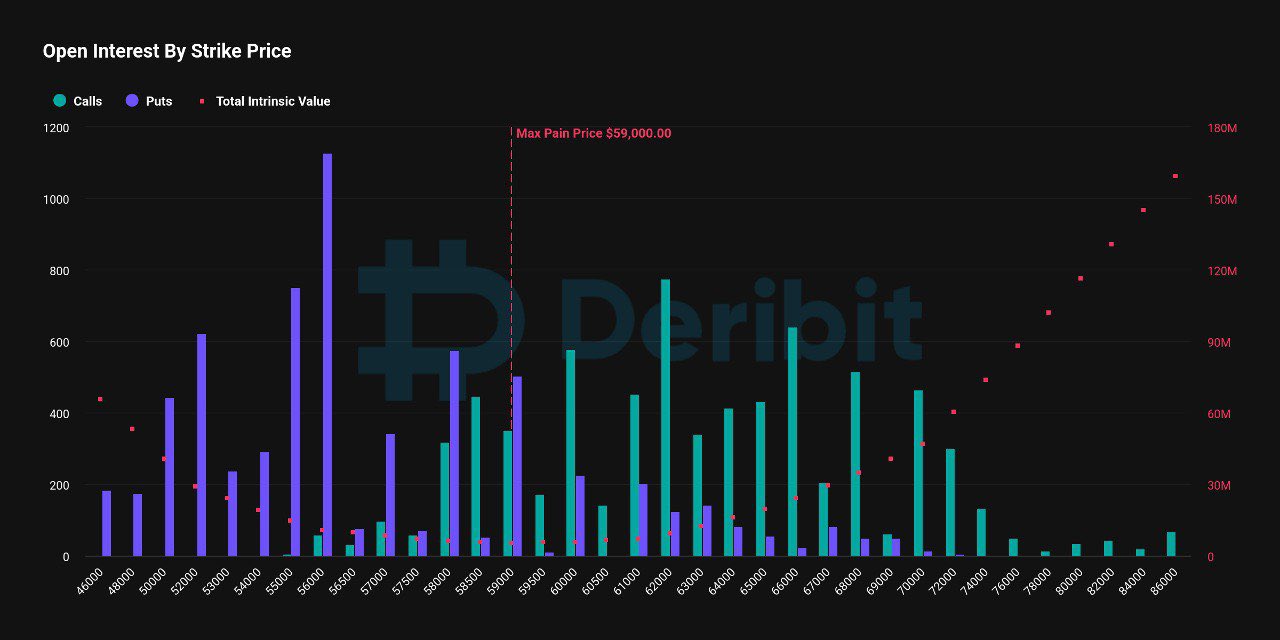

Firstly, tomorrow, options worth $780 million in nominal value for Bitcoin will expire. The call/put ratio for these options is 0.90, indicating a preference for puts over calls among investors. The maximum pain point, where most options will expire worthless, is at $59,000. This level is crucial as it represents the price at which option sellers will maximize their gains and could trigger potential price movements as the expiry approaches.

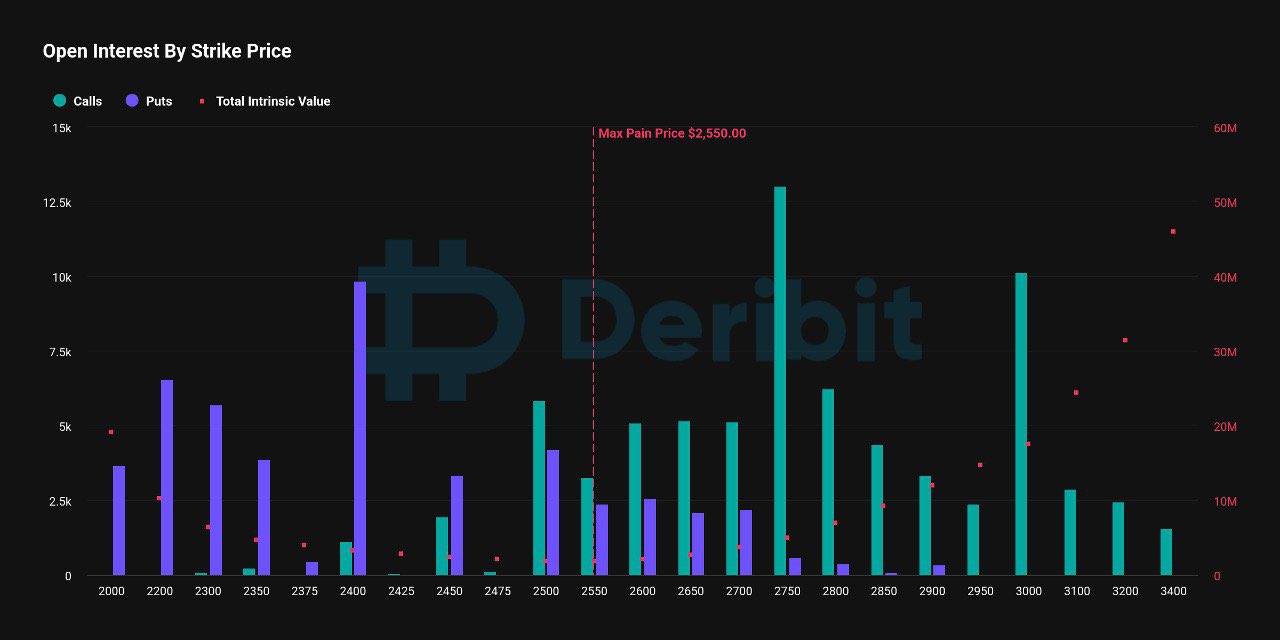

On the other hand, options worth $290 million for Ethereum will expire tomorrow. The call/put ratio for ETH options is 0.65, lower than that of Bitcoin options. This ratio indicates more interest in call options, suggesting that investors generally expect more upside in ETH compared to BTC.

The maximum pain point for Ethereum options is at $2,550. Similar to Bitcoin, this level could act as a magnet, pulling the price towards it as the expiry approaches.

Potential Market Volatility

As investors adjust their positions in response to the expiring options, the crypto market could experience volatility. The current call/put ratios and maximum pain points indicate higher bets on prices compared to current levels for both BTC and ETH, providing insights into market sentiment. Experts warn that the expiration of significant Bitcoin and Ethereum options could trigger sharp price movements in the short term. Therefore, those taking new positions or holding existing ones should prepare for potential market fluctuations.

Türkçe

Türkçe Español

Español