In 2024, Bitcoin  $82,630 began with significant events. On January 10, spot Bitcoin ETFs started trading, followed by an unexpected ATH of $73,750. Finally, the fourth halving occurred towards the end of the first quarter. Despite these events, Bitcoin experienced a noticeable decline. Whales continued their purchases, and analysts remained optimistic. Let’s take a look at the current state of Bitcoin.

$82,630 began with significant events. On January 10, spot Bitcoin ETFs started trading, followed by an unexpected ATH of $73,750. Finally, the fourth halving occurred towards the end of the first quarter. Despite these events, Bitcoin experienced a noticeable decline. Whales continued their purchases, and analysts remained optimistic. Let’s take a look at the current state of Bitcoin.

Analyst’s Bitcoin Commentary

August 4 went down in history as a day of disaster for Bitcoin. During this period, the BTC price fell to $48,800, marking a periodic low. Although the price rebounded to $65,000, it couldn’t sustain and continued to decline.

Despite the decline, whale wallets continued to show positive developments. Recently, 1,700 BTC worth approximately $92.845 million was transferred from TronDAO to a new unknown wallet. While the reason is unknown, considering the potential pressure on supply, such moves could lead to a rise.

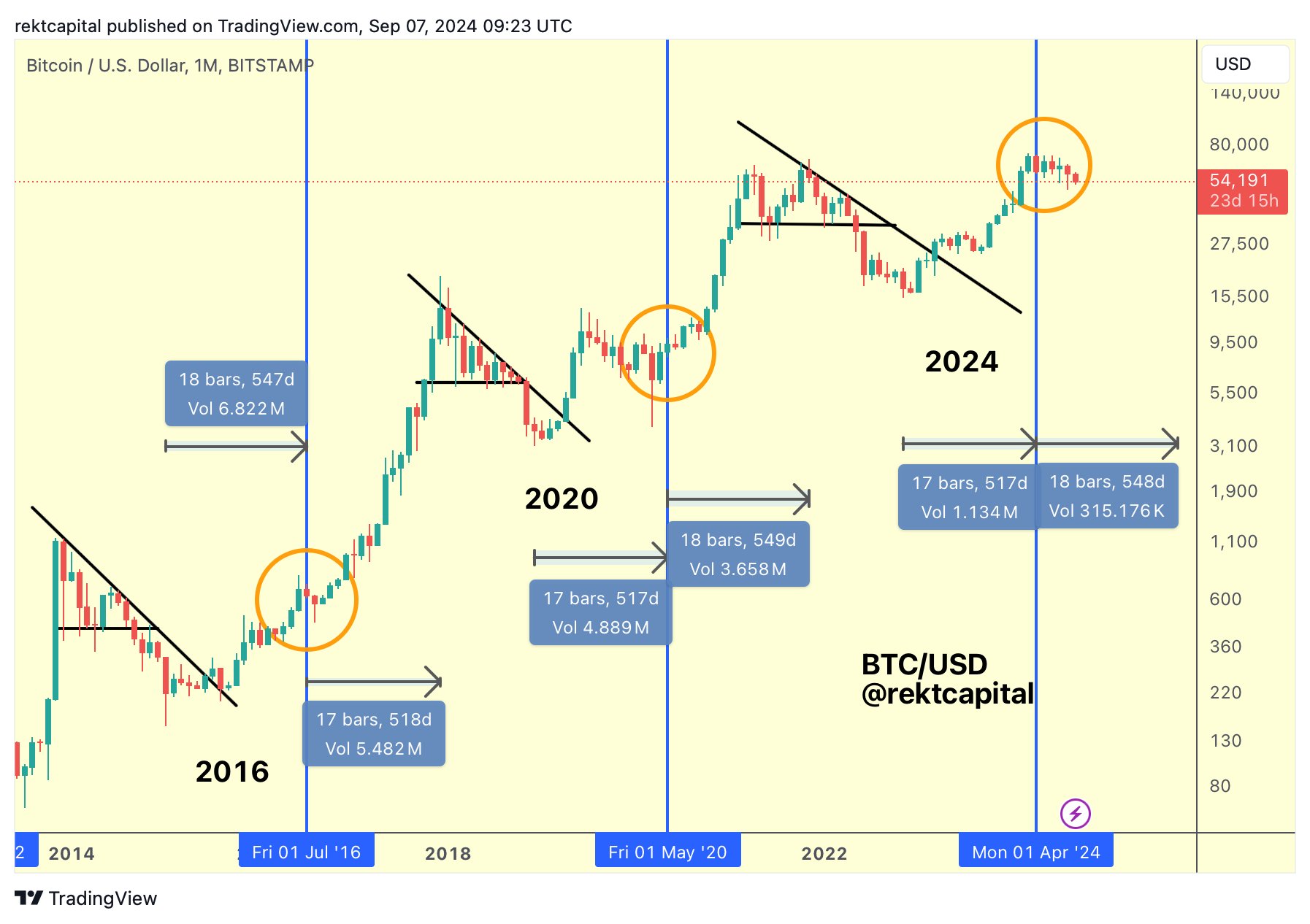

In addition to this movement, well-known analyst Rekt Capital made significant statements on X, emphasizing the bull cycle.

The analyst’s statement was as follows:

Bitcoin hit bottom 547 days before the 2016 Halving but peaked 518 days after.

Bitcoin hit bottom 517 days before the 2020 Halving but peaked 549 days after.

Bitcoin hit bottom 517 days before the 2024 Halving but could peak ~549 days after.

This is October 2025.

History suggests two conclusions:

1. The Halving acts like a mirror. Bitcoin Bear Market Bottoms occur a similar number of days before the Halving as the number of days needed for Bitcoin to form Bull Market Peaks after the Halving.

2. This Bull Market is not over yet.

How Much is 1 Bitcoin Worth?

The ongoing decline in Bitcoin has turned into a slight rise today. After a 0.60% increase, BTC is trading at $54,450. This value increase also boosted market volume, keeping the total volume above $1 trillion.

The 24-hour trading volume, which had been rising due to short sales and whale purchases, sharply declined today. The decline was 64.7%, amounting to $16.3 billion. Following the decline, investor interest seems to have decreased, and the market appears to be calming down.

Türkçe

Türkçe Español

Español