The new management of the bankrupt FTX and Alameda Research has begun a significant move that could shake the cryptocurrency market by withdrawing a substantial amount of Solana  $146 (SOL) from staking, valued at over $1 billion. According to data from Lookonchain, the firms have transferred approximately 530,000 SOL coins worth about $71 million from staking to multiple addresses in the past three months. This trend indicates a monthly withdrawal of around 176,700 SOL coins or $23.5 million from staking.

$146 (SOL) from staking, valued at over $1 billion. According to data from Lookonchain, the firms have transferred approximately 530,000 SOL coins worth about $71 million from staking to multiple addresses in the past three months. This trend indicates a monthly withdrawal of around 176,700 SOL coins or $23.5 million from staking.

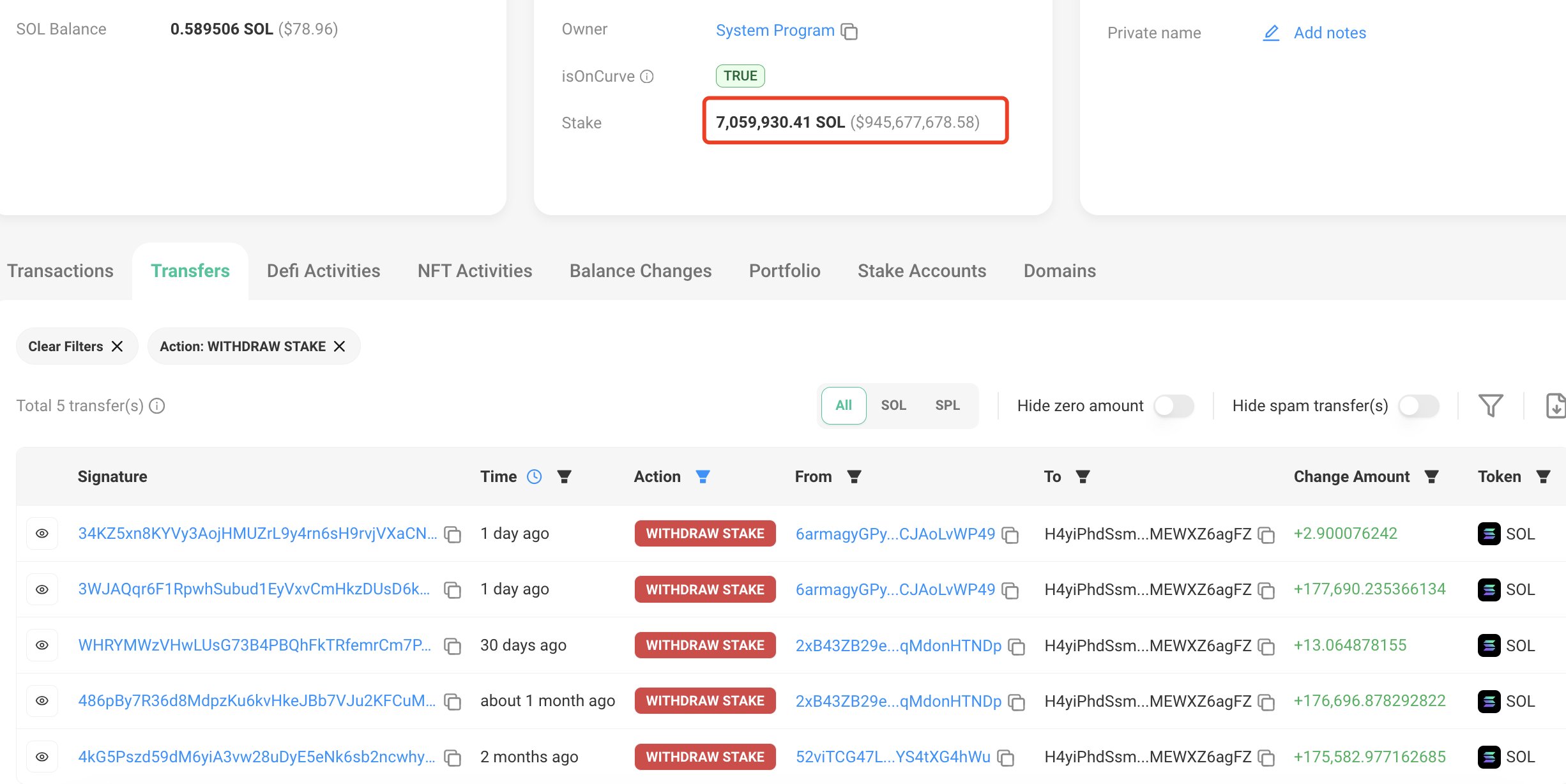

Companies Still Hold 7.06 Million SOL Coins

Despite these significant withdrawals, FTX and Alameda still hold a substantial stake in Solana. The companies retain approximately 7.06 million SOL coins valued at about $945.7 million in staking positions. This remaining stake shows that even if the companies liquidate some of their assets, they still possess significant locked assets in the Solana network.

The ongoing withdrawals from staking activities are being used as a warning signal by investors and analysts. While the reasons behind this strategic shift remain speculative, some believe it could be a move to reallocate assets, meet liquidity needs, or prepare for upcoming opportunities. The transfer of SOL coins to various addresses is likely part of a distribution strategy that diversifies or reallocates assets to different portfolios or clients.

Potential for Significant Market Movements in Solana

The cryptocurrency world is no stranger to such fluctuations, and massive transactions by powerful institutions often lead to significant market movements. While the exact intentions of FTX and Alameda regarding Solana remain unclear, their actions warrant close monitoring, as the distribution of withdrawn SOL coins to different wallets could create selling pressure that may impact the altcoin‘s price. At the time of reporting, the altcoin was trading at $134.30, experiencing a 0.42% decrease in the last 24 hours.