MicroStrategy, a software company led by Bitcoin advocate Michael Saylor, has increased its Bitcoin (BTC)  $85,200 assets once again. The company recently announced that it purchased 18,300 BTC for approximately $1.11 billion. With this latest acquisition, MicroStrategy’s total Bitcoin assets have risen to around $9.45 billion, consisting of 244,800 BTC as of September 2024.

$85,200 assets once again. The company recently announced that it purchased 18,300 BTC for approximately $1.11 billion. With this latest acquisition, MicroStrategy’s total Bitcoin assets have risen to around $9.45 billion, consisting of 244,800 BTC as of September 2024.

MicroStrategy’s Aggressive Bitcoin Accumulation Strategy Continues

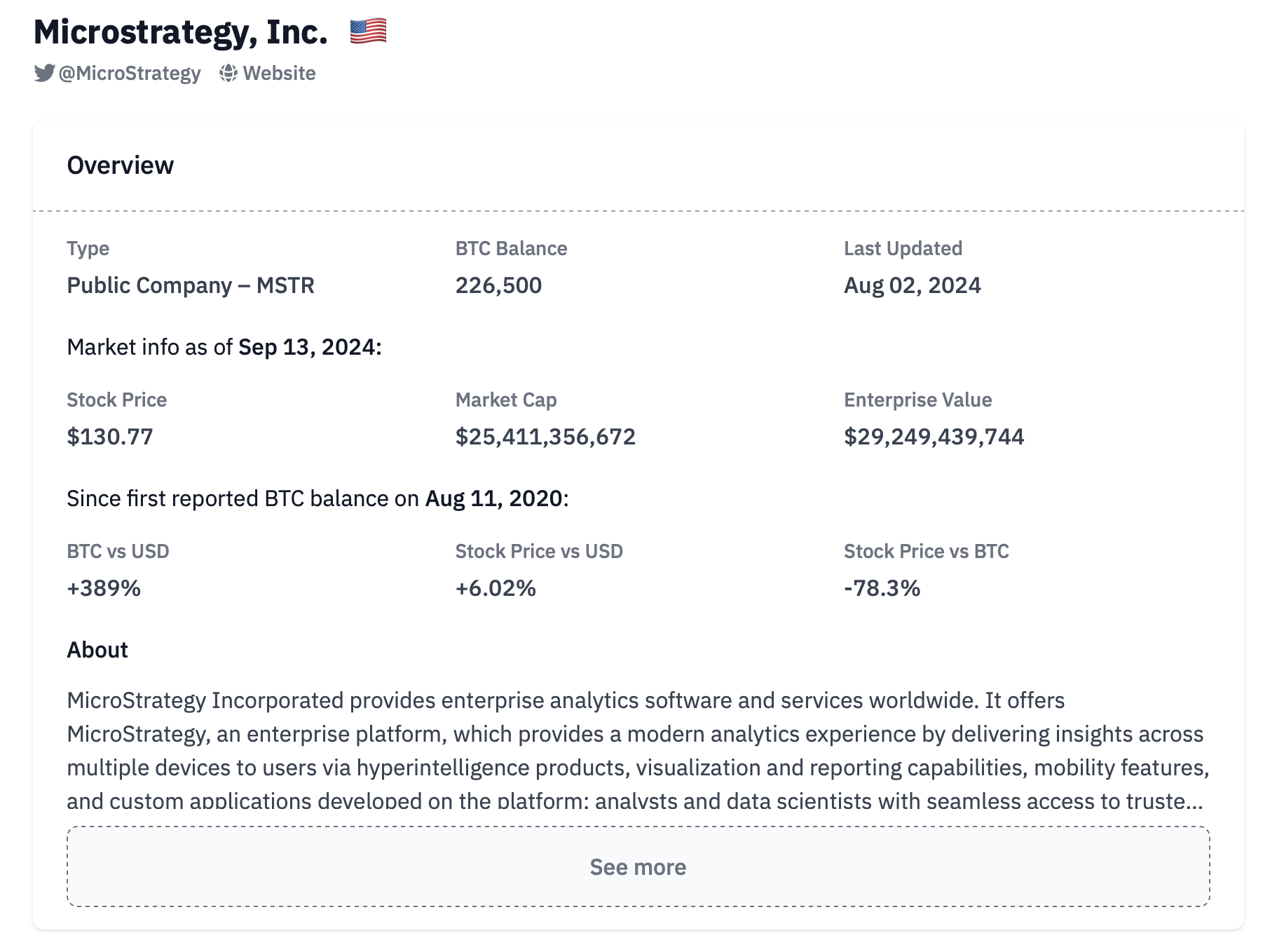

This latest purchase solidifies MicroStrategy’s position as the largest publicly traded corporate investor in Bitcoin. The company has been pursuing an aggressive accumulation strategy since 2020, driven by a belief that Bitcoin serves as an exceptional store of value compared to traditional fiat currencies.

Michael Saylor, CEO of MicroStrategy, frequently expresses confidence in Bitcoin’s long-term potential, arguing that the leading cryptocurrency provides protection against inflation and economic uncertainty.

The recent purchase was financed through a combination of cash reserves and a recently completed $750 million bond issuance. This funding strategy has become a cornerstone of the company’s approach, enabling it to leverage both existing assets and external financing to bolster its Bitcoin reserves.

With this acquisition, MicroStrategy now controls approximately 1.3% of the total Bitcoin supply (21 million BTC). The company had previously announced another purchase on August 1, where it acquired 169 BTC.

Bitcoin’s Initial Reaction Was Negative

Interestingly, Bitcoin’s response to MicroStrategy’s latest purchase was negative. The leading cryptocurrency, which was trading above $58,000 recently, dropped to as low as $57,830 following the purchase announcement.

As of the time of writing, Bitcoin is trading at $57,834.

Türkçe

Türkçe Español

Español