A significant moment approaches for the risk markets as the Fed is set to announce its interest rate decision this Wednesday. While market expectations strongly suggest a rate cut, Powell confirmed this during his Jackson Hole speech. However, there are numerous other details to focus on beyond just the interest rate decision. Let’s take a closer look at these critical points ahead of the Fed’s announcement.

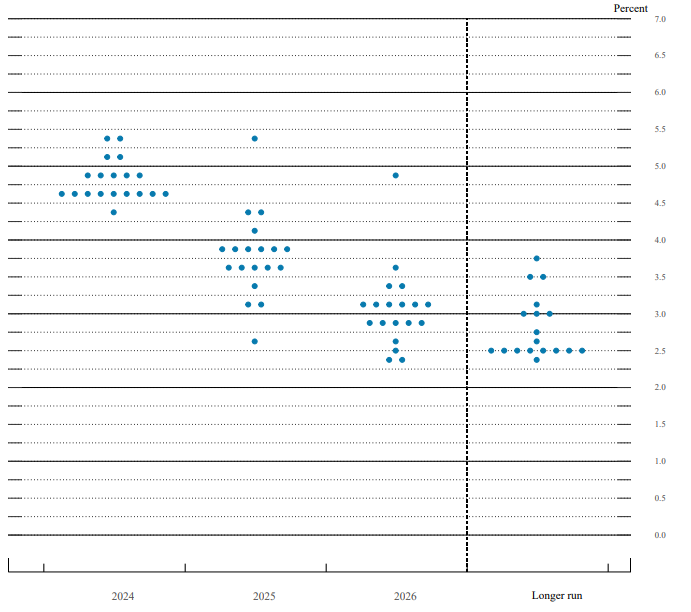

Fed Dot Plot Overview

In March, we observed the dot plot reflecting members’ three-year interest rate forecasts. For those who may not recall, the shared table from that day is included below. It showed that only one member anticipated more than three cuts in 2024. The median view among Fed officials for year-end 2024 was at 4.6%.

The forecasts for 2025 are at 3.9%. Considering the previous estimate of 3.6%, this change was quite disheartening. The long-term rate expectation was at 2.6% in March 2024. These figures are crucial, as we will see an updated dot plot from the Fed this Wednesday following the latest inflation and employment data.

Five Key Details to Watch

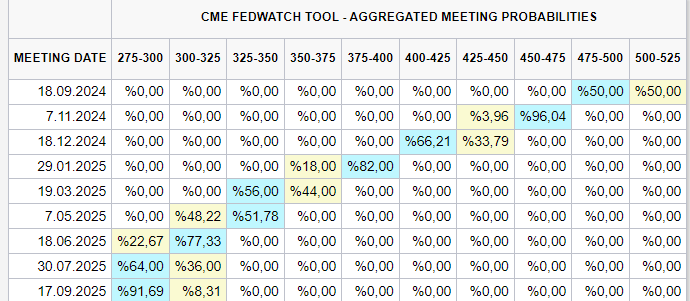

- The larger the average rate cut estimates for 2024 and 2025, the more BTC may surge.

- Powell’s statements 30 minutes after the rate decision will be critical regarding the pace of cuts.

- August witnessed one of the largest corporate bankruptcies in four years; how the Fed addresses recession concerns will be significant.

- Powell’s comments about achieving “partial victory” regarding inflation nearing 2% will impact market appetite.

- As the meeting approaches, positive news potential often leads to a bullish market trend, prompting short-sellers to seek sudden tops.

As seen above, expectations for a 50bp cut surged to 50% just days before the meeting.