Matrixport‘s latest market analysis reveals that Bitcoin (BTC)  $109,005 experienced a noteworthy 10% recovery last week, primarily attributed to robust purchases in the spot market. The cryptocurrency financial services company emphasized that the retreat of funding rates into negative territory highlighted the dominance of spot market transactions over leveraged futures trading, triggering the recent price surge.

$109,005 experienced a noteworthy 10% recovery last week, primarily attributed to robust purchases in the spot market. The cryptocurrency financial services company emphasized that the retreat of funding rates into negative territory highlighted the dominance of spot market transactions over leveraged futures trading, triggering the recent price surge.

Matrixport: Price Rises Independently of Futures Traders

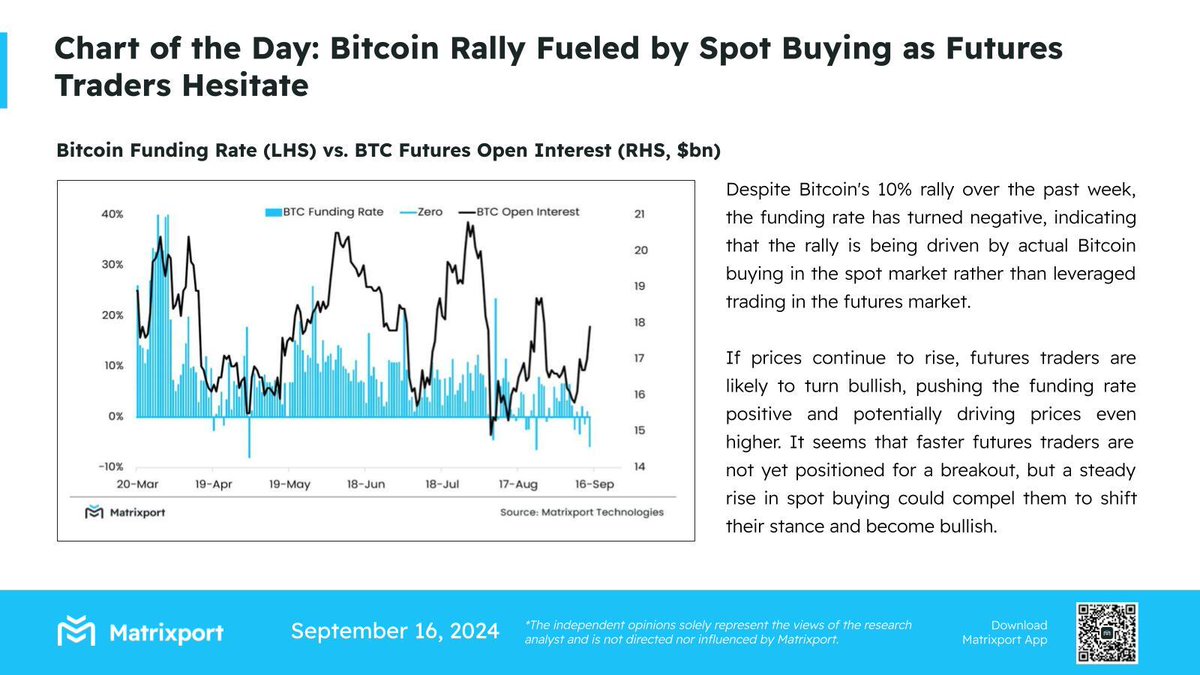

According to Matrixport’s report published on September 16, the current upward trend in Bitcoin lacks support from short-term futures traders who are not yet prepared for a potential market breakout. The negative funding rates indicate that the upward momentum is being sustained through direct Bitcoin purchases rather than speculative bets via futures contracts. This distinction is considered significant as it reflects genuine investor interest and demand for the underlying asset, rather than more volatile leveraged positions.

Matrixport anticipates that if Bitcoin’s price continues to rise, futures traders may become more optimistic, potentially shifting funding rates back into positive territory. Such a change could exert additional upward pressure on the largest cryptocurrency as leveraged positions amplify market movements.

However, current data suggests that short-term futures traders are holding off for a breakout, with existing volatility linked to spot market dynamics.

Increase in Spot Purchases May Signal Confidence

The steady increase in spot purchases indicates a growing confidence among investors regarding Bitcoin’s short-term outlook. Matrixport’s analysis suggests that the continuation of this trend will compel futures traders to reposition, with expectations of further price increases potentially reinforcing the upward trend.

Historical data shows that BTC price movements are influenced by trends in both the spot and futures markets. Positive funding rates typically signal bullish sentiment among leveraged investors, potentially leading to stronger price movements. Conversely, as observed in recent volatility, negative funding rates reveal that sudden momentum comes from spot purchases rather than leveraged transactions.

Türkçe

Türkçe Español

Español