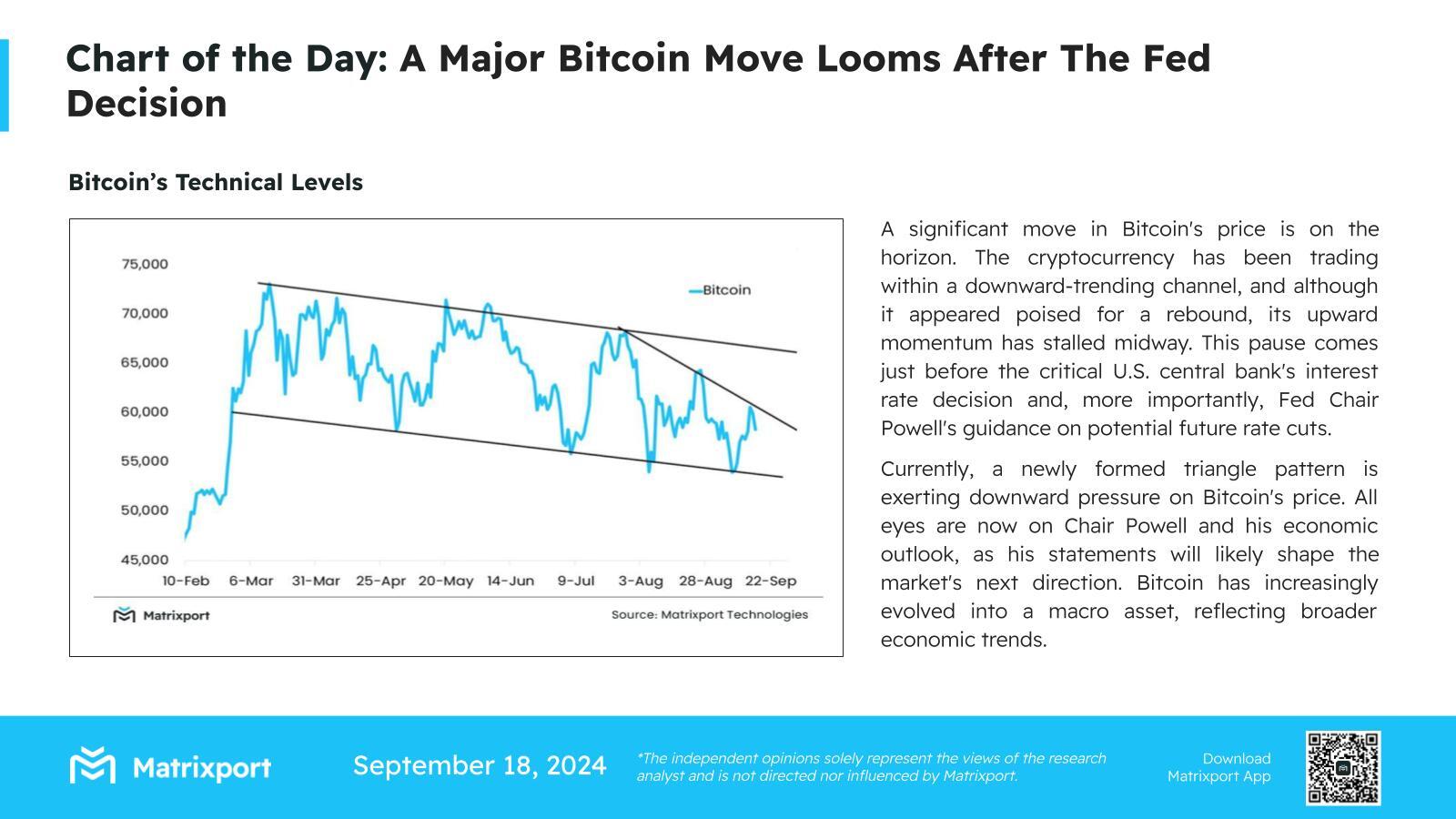

According to a report published on September 18 by the cryptocurrency service provider Matrixport, Bitcoin’s (BTC) price may experience significant movements following the upcoming Federal Reserve interest rate decision. Recently, Bitcoin’s price has fluctuated within a descending channel formation and, although it showed brief signs of recovery, this upward momentum appears to have stalled. Investors are particularly awaiting statements from Fed Chairman Jerome Powell regarding future interest rate decisions. Powell’s remarks will play a critical role in determining the direction of not only Bitcoin  $98,267 but also the broader cryptocurrency market.

$98,267 but also the broader cryptocurrency market.

Triangle Formation and Downward Pressure

Bitcoin is currently under downward pressure due to the formation of a new triangle pattern. This technical formation indicates that the largest cryptocurrency may be trending toward further declines. Markets are focused on Powell’s speeches, as the decisions and forecasts concerning the Fed’s monetary policy will significantly influence risky assets like Bitcoin.

The increasing adoption of Bitcoin as a reflection of overall economic trends has prompted investors to closely monitor developments in this area.

In this context, Matrixport’s recent analysis emphasizes the high impact of the Fed’s interest rate decision on the cryptocurrency market, indicating that investors should proceed with caution.

Bitcoin as a Risky Asset and the Impact of Fed’s Interest Rate Decision

In recent years, Bitcoin has become a highly sensitive asset to macroeconomic developments. The Fed’s interest rate decisions and Powell’s statements can directly affect both stock markets and the broader cryptocurrency market, including BTC.

Therefore, the decisions emerging from the Fed meeting and Powell’s forthcoming statements could lead to sharp and significant fluctuations in Bitcoin and altcoins. Particularly, guidance on future interest rate decisions and economic growth will notably shape short-term price movements of Bitcoin and altcoins.