Some economists anticipate a surge in sell-offs in risk markets following the Fed’s interest rate decision. Historical data and past experiences drive a cautious approach among investors. This raises the critical question: Is the U.S. economy signaling a recession? Will the Fed implement a 50 basis point cut? How will today’s interest rate decision affect cryptocurrencies?

Interest Rate Decisions and Cryptocurrencies

It is beneficial to analyze the current situation from multiple perspectives to devise effective strategies. The prevailing belief is that the Fed’s interest rate cut will lead to increased market volatility. However, many economists point downwards regarding market direction. Notably, JPMorgan, Goldman, and others predict weakness in stocks, highlighting factors beyond just the interest rate decision.

The health of the U.S. economy is more crucial under current conditions than the interest rate decision itself. Let’s delve deeper into these issues.

Historical Rate Cuts and Market Responses

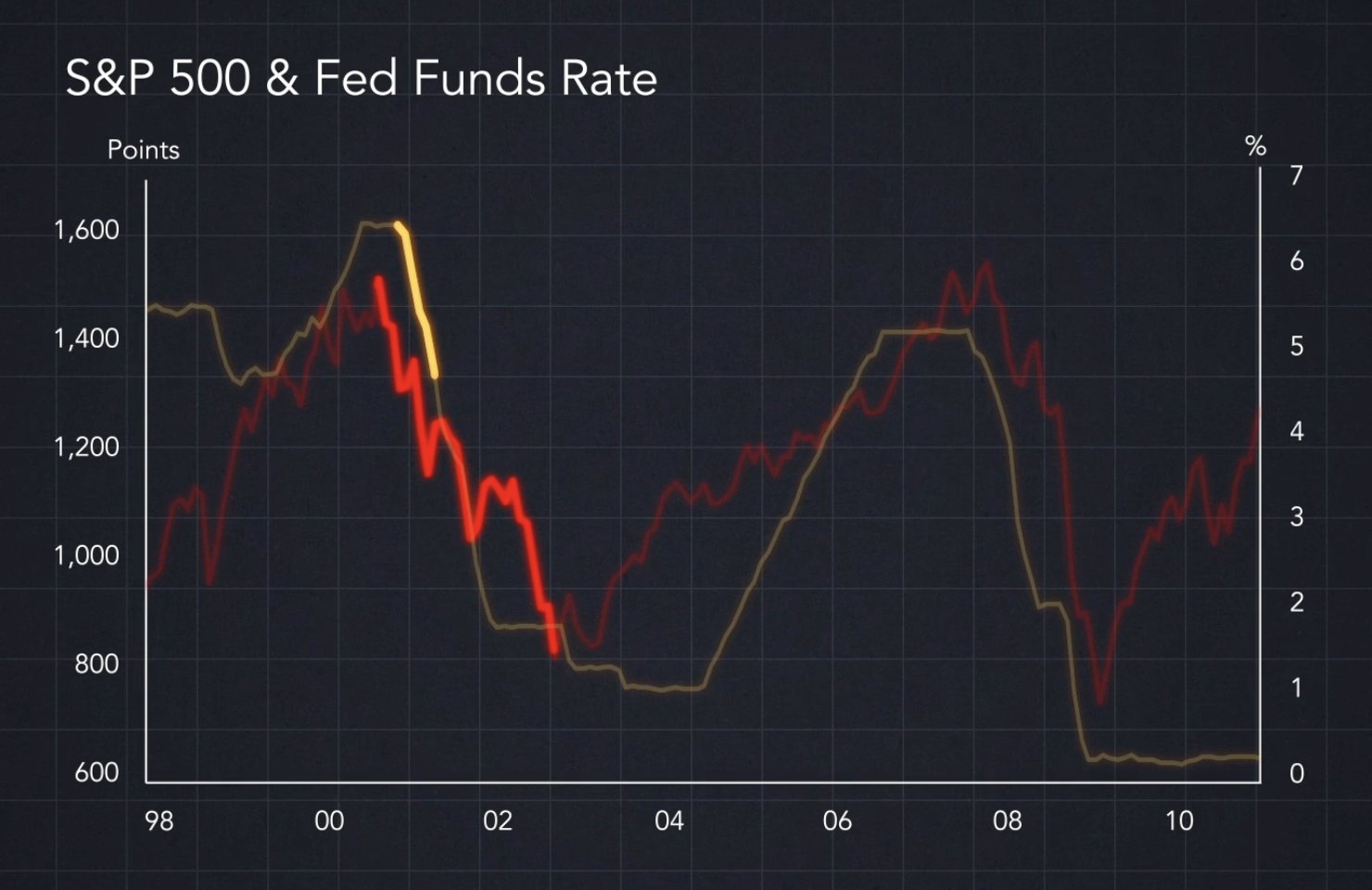

On September 18, 2007, the Fed announced its first interest rate cut in the cycle. Investors experienced a short-term rally in risk markets as the cost of borrowing decreased. However, as signs of economic recession emerged, markets quickly declined.

Currently, while the S&P 500 reaches historic highs, the interest rate decision positively affects it.

In October 2000, the Fed also made its first rate cut around this time of year, leading to a long-term 50% decline in the markets due to recession impacts.

Today, interest rates are above their 2007 peak, and markets are at all-time highs. The Fed is expected to cut rates by 50 basis points with a 61% probability, while a 25 basis point cut has a 39% probability.

Warren Buffet has raised cash reserves to a ten-year high. However, it is important to note that it’s not the Fed’s rate cuts that devastate markets but rather the onset of recession. Despite the positive outlook of interest rate cuts due to monetary expansion, fears persist as recessions and cuts have historically coincided.

Are we currently in a U.S. recession? Metrics like PMI and unemployment rates suggest that recession has not yet begun. Just last year, massive layoffs by major tech companies were perceived as preparatory moves for a recession that ultimately did not materialize.

Experts are currently detecting early signs of a potential recession, despite the economy not being in one yet. Significant layoffs in tech companies, accounting for over 50% of total layoffs, and a rise in bankruptcies are among the many factors at play. Time will tell if history repeats itself.

Ethereum (ETH) Price Forecast

The market chart appears bleak, and Michael Poppe, known for his optimism in the cryptocurrency market, discusses potential declines due to recession fears. He predicts that ETH may fall back to levels seen in April 2021 against BTC.

“If interest rates drop, we will likely see significant momentum towards DeFi and $ETH. I’m excited to see what Ethereum  $1,603 will do after the Fed begins cutting rates.”

$1,603 will do after the Fed begins cutting rates.”

“The chart currently looks terrible.”

Türkçe

Türkçe Español

Español