Bitcoin (BTC)  $104,514 faced a slight decline, retreating to the $62,500 range after hovering above $63,000. Altcoins continue to experience minor losses, maintaining a red status at the start of the day. What is the latest situation in the ETF sector? What insights do expert analysts provide on Bitcoin and altcoins as October approaches?

$104,514 faced a slight decline, retreating to the $62,500 range after hovering above $63,000. Altcoins continue to experience minor losses, maintaining a red status at the start of the day. What is the latest situation in the ETF sector? What insights do expert analysts provide on Bitcoin and altcoins as October approaches?

Current Status of BTC and ETF Entries

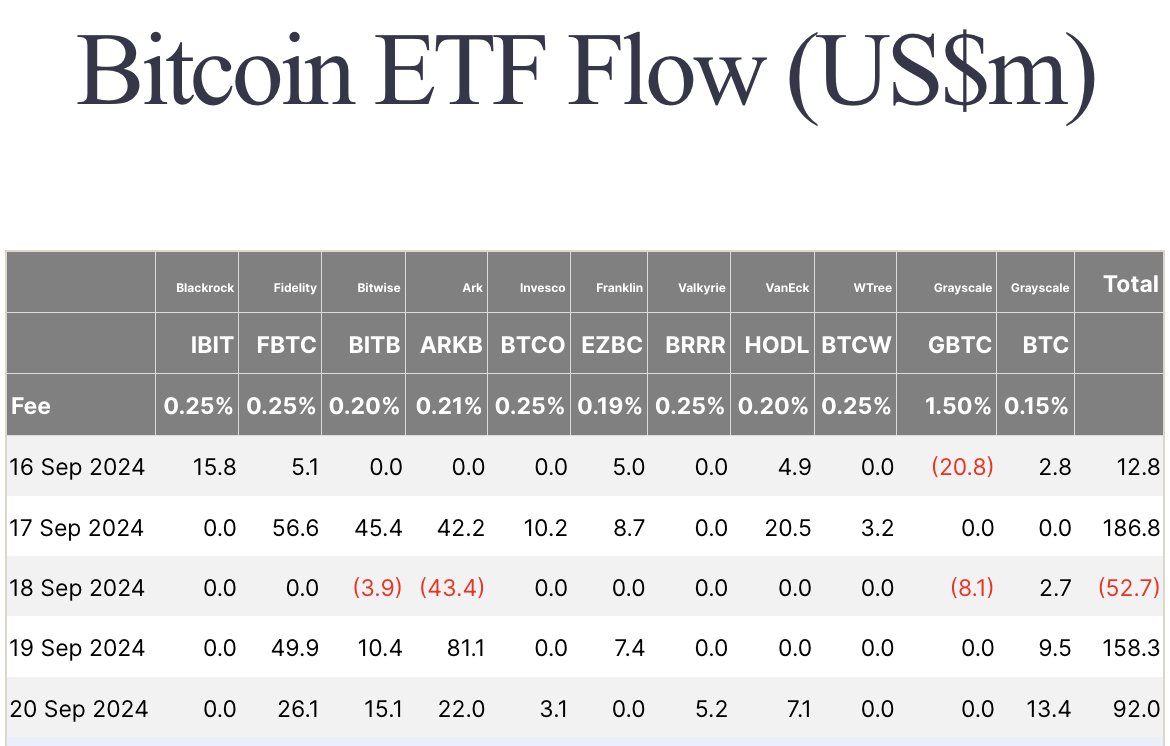

On Friday, the SEC granted permission for spot Bitcoin ETF options, particularly concerning BlackRock. This development indicates more liquidity and, consequently, volatility due to specific price options. Moreover, BNY Mellon received an SEC exemption to offer cryptocurrency custody services, leading to expectations of increased banking involvement in the crypto space.

The situation in the ETF sector remains relatively stable, with continued demand from stock market-savvy investors for Spot Bitcoin ETFs. In his latest market assessment, Lark Davis highlighted that 6,574 BTC were accumulated this week, surpassing the weekly miner production rate of 2,250 BTC.

“New supply that miners would produce in 14 days was accumulated in just 5 trading days in the ETF sector.”

In the past week, dollar-based entries have surged to around $400 million.

Forecasts for Bitcoin (BTC) and Altcoins

In this section, we will discuss the current analyses from three different experts, starting with Crypto Tony. He anticipates a significant decline next year, but mentions that BTC could rise to the $110,000 threshold before that.

Crypto Rover indicated that the total money supply has reached a breaking point for BTC. Sharing a graph correlating M2 money supply with BTC, he anticipates a breakout above $68,000.

The final analyst, Moustache, stated:

“Altcoin/TOTAL2 (monthly) is approaching a bullish crossover. As often mentioned, this is one of the most significant signals. This last occurred in 2020, leading to the start of the Altcoin bull market.”

If historical data supports this, it could indicate a substantial altcoin rally for 2024 and 2025. Analysts are largely predicting a comprehensive rally for cryptocurrencies beginning in the last quarter of 2024.