This week marks a significant macroeconomic period for cryptocurrency investors. Several major developments are underway, including the recent release of PMI data. The Federal Reserve has begun cutting interest rates, and these reductions are expected to continue. However, concerns about a potential recession are causing unease among investors.

US PMI Data Insights

The continuation of economic growth may help alleviate recession fears, allowing investors to breathe easier. Indeed, when we share graphs from previous rate-cutting cycles, we often note that markets have declined alongside these reductions. To maintain strength in risk markets during interest rate cuts, we must not encounter a scenario where recession triggers further rate reductions.

Current Economic Indicators

The ideal scenario for cryptocurrency investors is one where there is no recession and interest rates are decreasing. Key indicators that suggest we are avoiding economic stagnation include GDP and PMI data. GDP figures will be released on Thursday, and the PMI data has just been announced.

The PMI is derived from surveys of purchasing managers in relevant sectors. For instance, the Services PMI indicates the status of purchase volumes, demand, and sales in the service industry. It serves as an early warning indicator for recessions.

- US Services PMI Announced: 55.4 (Expectation: 55.2 Previous: 55.7)

- US Manufacturing PMI Announced: 47 (Expectation: 48.6 Previous: 47.9)

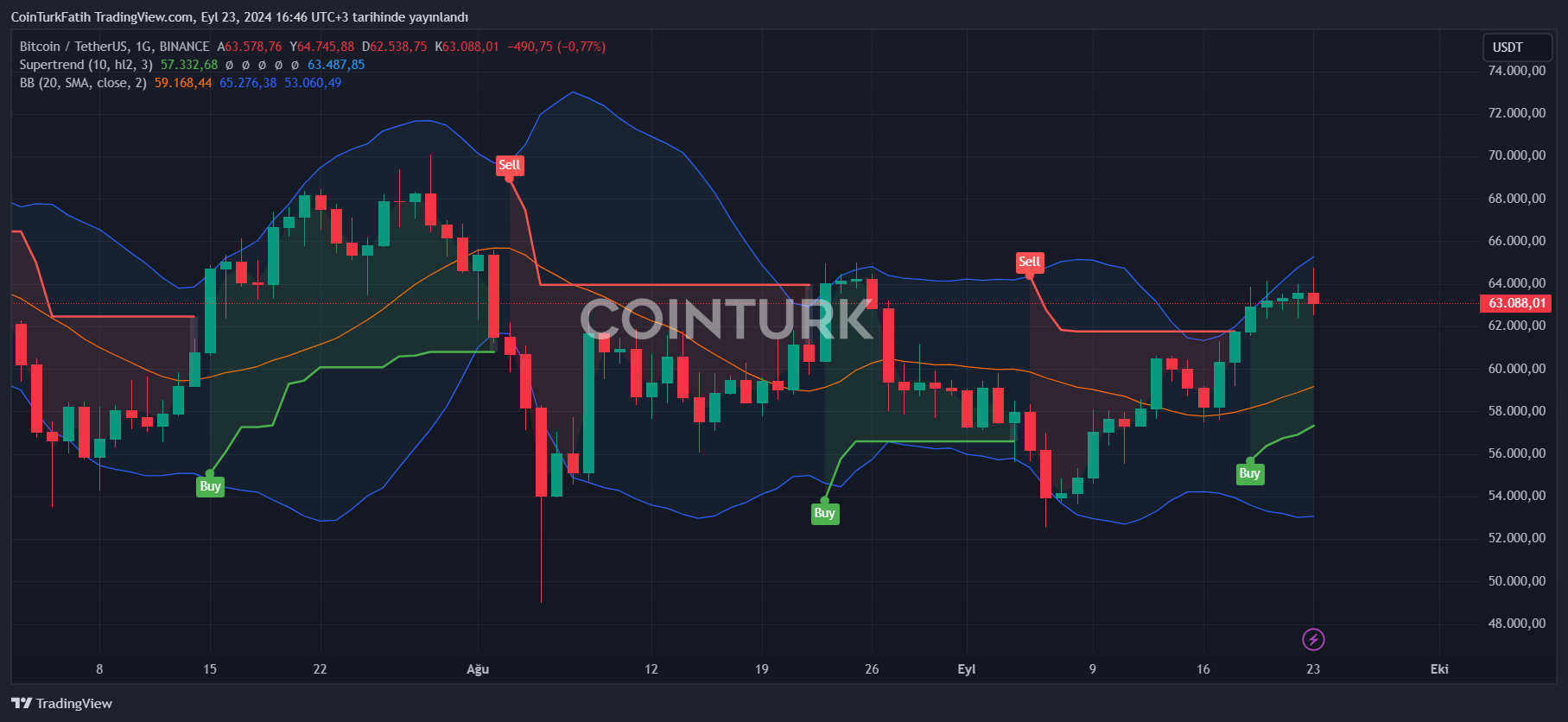

Following these data releases, Bitcoin  $102,260 has decreased to $63,000. The manufacturing PMI remaining below 50 signifies contraction in that sector, thus fueling recession concerns. Although the Services PMI fell short of expectations, it remains at a relatively high level. These incoming data suggest a negative outlook for cryptocurrencies.

$102,260 has decreased to $63,000. The manufacturing PMI remaining below 50 signifies contraction in that sector, thus fueling recession concerns. Although the Services PMI fell short of expectations, it remains at a relatively high level. These incoming data suggest a negative outlook for cryptocurrencies.

Türkçe

Türkçe Español

Español