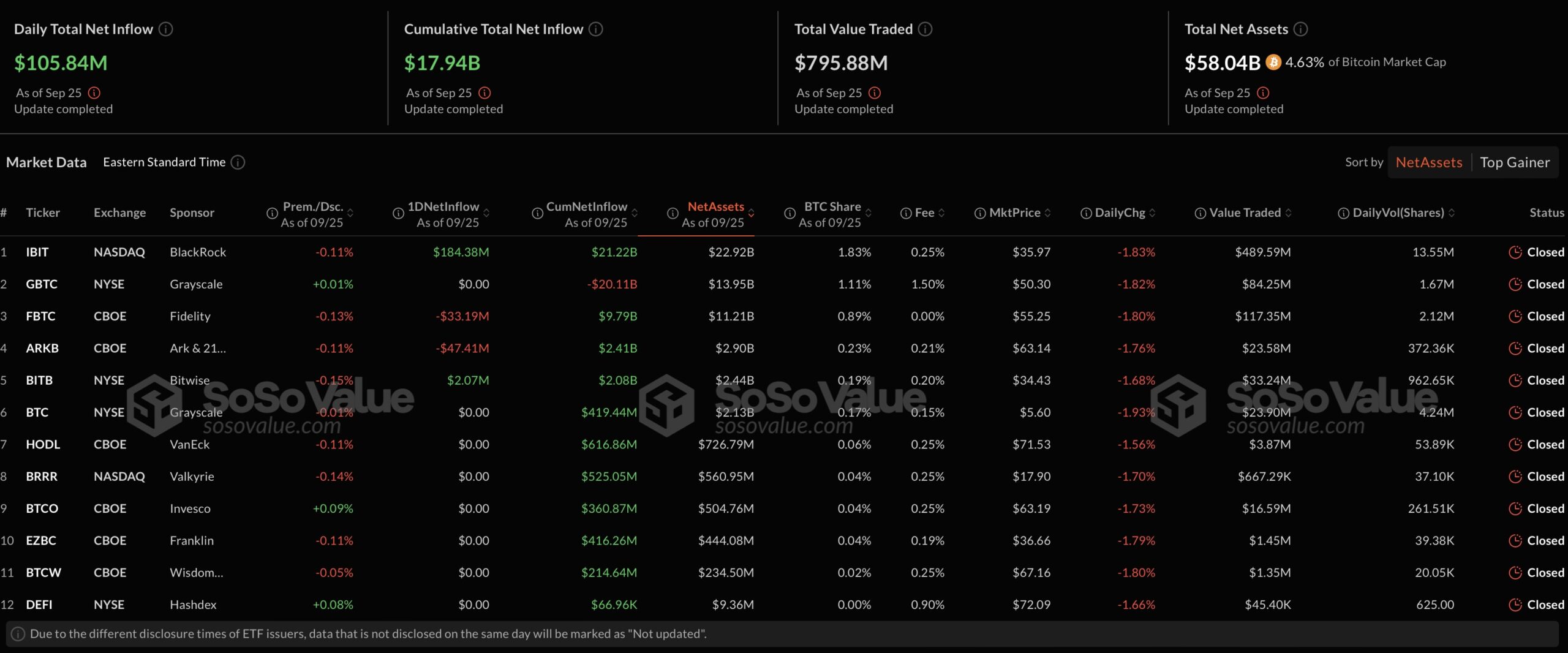

Yesterday, the spot Bitcoin  $105,214 ETFs in the United States experienced significant growth, ending the day with a positive balance of $106 million. The main driver behind this increase was BlackRock’s spot Bitcoin ETF, which recorded the highest inflow in the past month with a total of $184 million. However, major players such as Fidelity and ARK Invest saw outflows from their funds during the same period.

$105,214 ETFs in the United States experienced significant growth, ending the day with a positive balance of $106 million. The main driver behind this increase was BlackRock’s spot Bitcoin ETF, which recorded the highest inflow in the past month with a total of $184 million. However, major players such as Fidelity and ARK Invest saw outflows from their funds during the same period.

Strong Inflows into BlackRock’s ETF

The positive performance of spot Bitcoin ETFs has been greatly influenced by BlackRock’s substantial investment. With the $184 million inflow, the company reached its highest entry level in the past month. This trend indicates a growing interest in Bitcoin among investors and reflects a strengthening of market confidence. The size of BlackRock’s investment has attracted attention in the cryptocurrency world compared to other spot Bitcoin ETFs.

Fidelity also faced a $33 million outflow from its spot ETF, followed by ARK Invest, which recorded a $47 million exit. Despite these outflows from these two major companies, the overall outlook remained positive primarily due to BlackRock’s significant contributions. This scenario may increase interest from other investors and companies in spot Bitcoin ETFs.

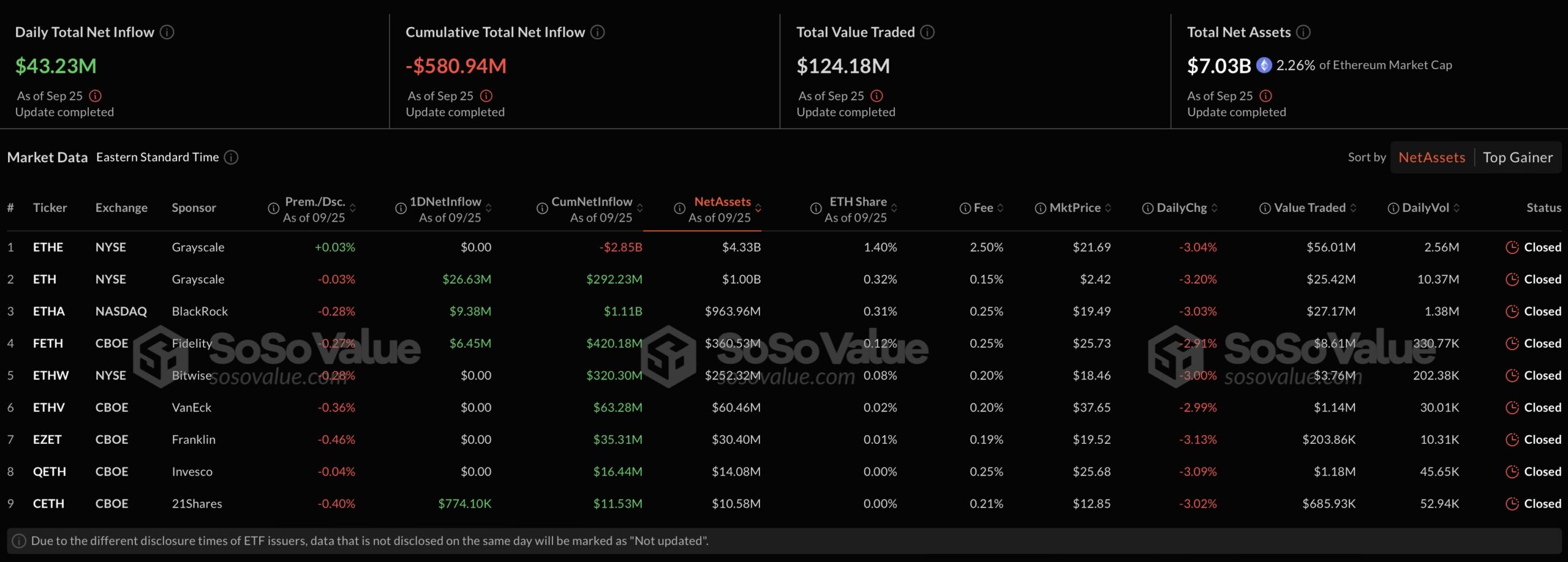

Positive Outlook for Spot Ethereum ETFs

In addition to spot Bitcoin ETFs, spot Ethereum  $3,396 ETFs also closed the trading day positively, with a total inflow of $43 million. This indicates a rising interest in Ethereum investments and suggests that investors are viewing the cryptocurrency market positively overall.

$3,396 ETFs also closed the trading day positively, with a total inflow of $43 million. This indicates a rising interest in Ethereum investments and suggests that investors are viewing the cryptocurrency market positively overall.

The latest developments in the cryptocurrency market indicate that investors’ interest in spot ETFs may increase. The high investments into BlackRock’s fund have supported the positive sentiment in the market, and outflows from other leading companies’ ETFs have not overshadowed the overall positive outlook. Considering the increase in inflows into Ethereum ETFs, there are signals of a general recovery in the cryptocurrency market.