CryptoQuant, in its latest market analysis report, indicates that Bitcoin (BTC)  $84,410 has risen over 23% in the past three weeks. The leading cryptocurrency has gained momentum, climbing from $52,500 to surpass the $65,000 level. One of the primary reasons for this increase is the growing demand for spot Bitcoin ETFs. The analysis company emphasizes that the average purchase price for short-term Bitcoin investors stands at $63,000, a level that is expected to serve as support under current market conditions. However, the futures market exhibits some warning signs.

$84,410 has risen over 23% in the past three weeks. The leading cryptocurrency has gained momentum, climbing from $52,500 to surpass the $65,000 level. One of the primary reasons for this increase is the growing demand for spot Bitcoin ETFs. The analysis company emphasizes that the average purchase price for short-term Bitcoin investors stands at $63,000, a level that is expected to serve as support under current market conditions. However, the futures market exhibits some warning signs.

Critical Level for Short-Term Investors

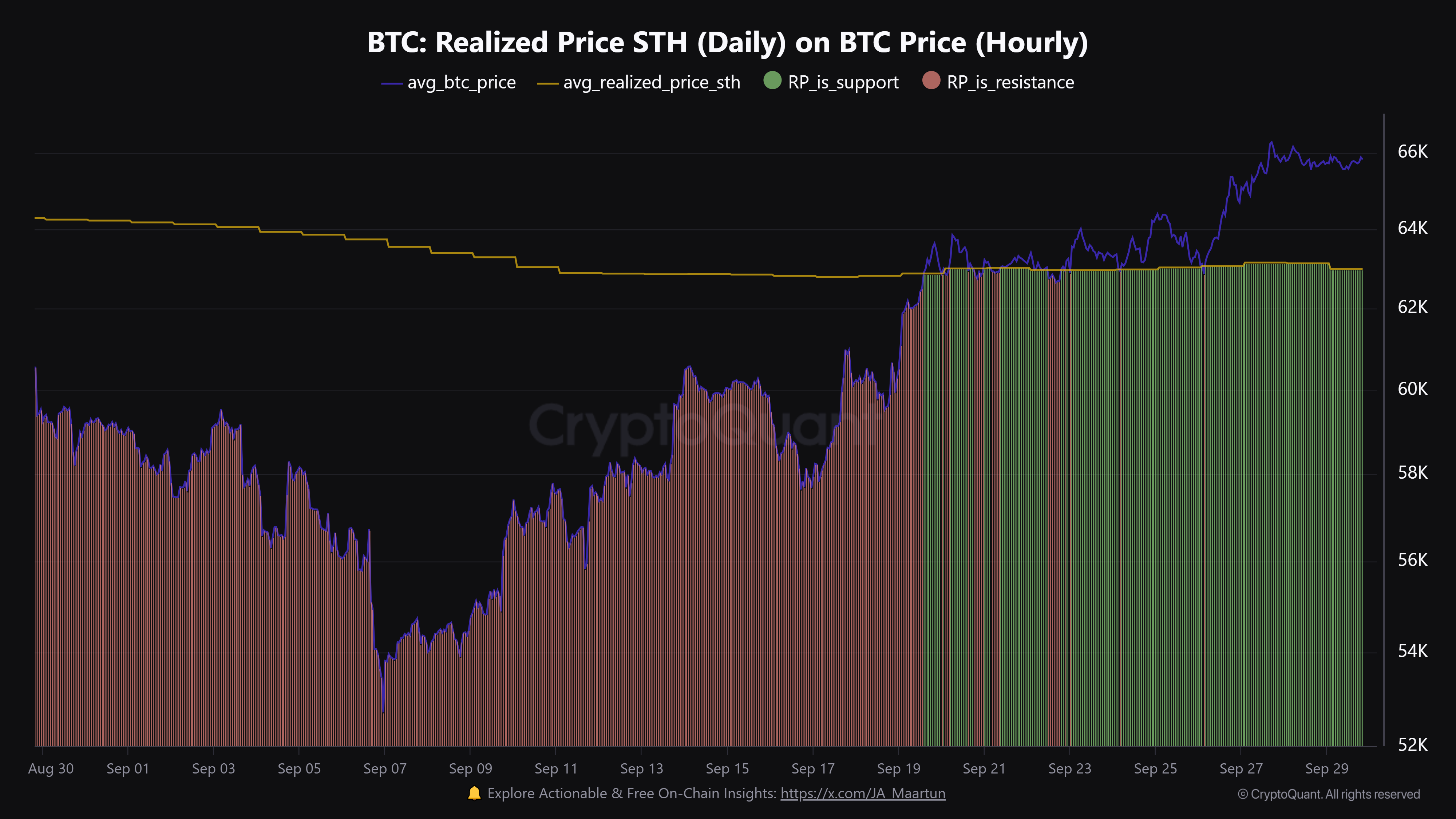

Short-term investors are those who have engaged in Bitcoin trading over the last 155 days. According to CryptoQuant, the average purchase price for these investors is around $63,000.

With the latest surge in BTC, these short-term investors have returned to profitability. This level is expected to play an important role as a support level, meaning that if prices were to decline, it is likely to find support around the $63,000 mark.

On the other hand, there are negative conditions for the market. The futures market shows signs of overheating, with the open interest in futures contracts reaching $19.1 billion. Such high levels have led to price corrections six times over the past six months, and now it seems to be repeating for the seventh time.

Spot ETFs and Long-Term Investors

In addition, the rising demand for spot Bitcoin ETFs is affecting the supply of long-term investors in the market. While this development is seen as a positive sign, it often represents a shift observed towards the end of a bull market. Therefore, investors need to monitor the market closely. Demand for ETFs may increase the retention of BTC by long-term investors but could also signal that the market cycle is nearing its peak.

Overall, there are both positive and risky indicators in the Bitcoin market. The $63,000 level is evaluated as a critical support point for short-term investors, while the overheating in the futures market and intense interest in ETFs require careful observation.

Türkçe

Türkçe Español

Español