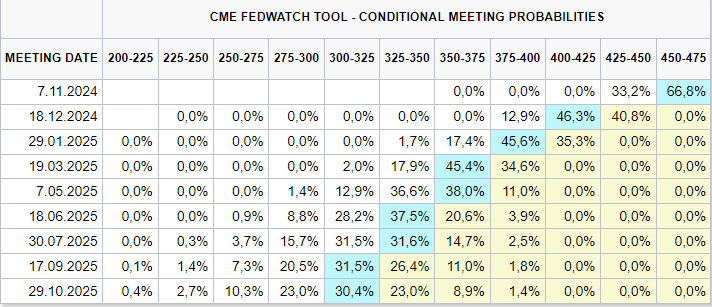

At the beginning of 2025, cryptocurrency traders faced challenging times due to the Federal Reserve’s rate hikes. Rapidly increased interest rates shook risk markets, leading the Fed to delay cuts to ensure success in combating inflation. Consequently, this led to emerging issues in the employment sector.

Fed Statements

Federal Reserve member Goolsbee made comments regarding interest rate cuts and inflation as this article was prepared. The Fed needed to lower rates and enter a period of monetary expansion, with the decline in inflation continuing to indicate such a move. As inflation decreases, the Fed is now lowering interest rates.

Economic Indicators

PMI data shows that certain sectors of the economy are contracting, and recent corporate bankruptcy figures fuel recession concerns. Therefore, the Fed should continue to reduce interest rates swiftly. This situation is likely to contribute to further increases in cryptocurrency values in the coming months.

Goolsbee stated,

“The main topic of our discussion is not whether to reduce by 25 or 50 basis points. The key concern is that we need to make cuts over the next 12 months to reach neutral interest rates. Recent inflation figures indicate that the Fed is moving towards its target, and employment remains strong.

We have significantly lowered inflation. A strike by dockworkers was anticipated, and retailers are stockpiling goods, which will have more impact in the future.”

The decline in mortgage rates, rising geopolitical tensions, and recovery in short-term rates have stalled. These factors represent short-term setbacks for risk markets.

Türkçe

Türkçe Español

Español