A new Ethereum Improvement Proposal (EIP-7781) has emerged that could significantly alter the Ethereum (ETH)  $2,551 network. If approved, this proposal aims to reduce block time by 33%, increase the network’s data capacity, and potentially boost overall transaction volume by up to 50%. According to developers, this change could substantially enhance efficiency, especially for decentralized exchanges and smart contract applications. While EIP-7781 has garnered significant interest from the developer community, it also poses some potential risks for solo stakers.

$2,551 network. If approved, this proposal aims to reduce block time by 33%, increase the network’s data capacity, and potentially boost overall transaction volume by up to 50%. According to developers, this change could substantially enhance efficiency, especially for decentralized exchanges and smart contract applications. While EIP-7781 has garnered significant interest from the developer community, it also poses some potential risks for solo stakers.

Network Efficiency Expected to Improve with Shorter Block Times

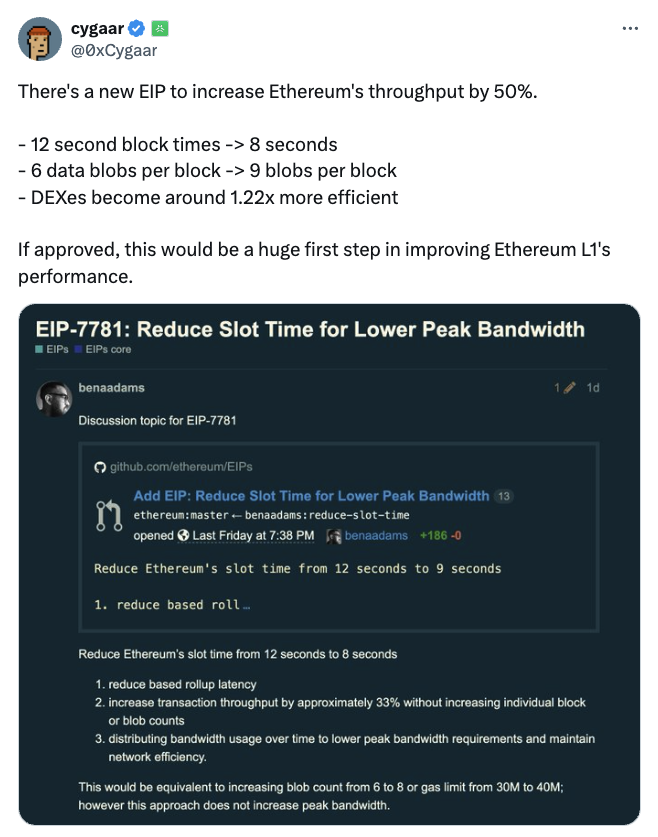

Introduced by Ben Adams, founder of Illyriad Games, on October 5, EIP-7781 targets reducing Ethereum’s block times from 12 seconds to 8 seconds while increasing data capacity. This adjustment is designed to facilitate more transactions on the Ethereum network and reduce latency for rollup solutions. Consequently, the network is expected to distribute its load more evenly over time, resulting in a smoother experience for both users and developers.

This development proposal has received strong support from Cygaar, a researcher at the Ethereum Foundation, who believes it will significantly improve Ethereum’s core layer and facilitate the transition to future Layer 2 solutions. Shorter block times mean that more transactions can occur on the network, allowing decentralized applications to operate more efficiently.

Impact of the Development on Decentralized Exchanges and Smart Contracts

Prominent Ethereum researcher Justin Drake has also expressed a positive outlook on the proposal. He asserts that reducing block time will not only increase transaction speed but also provide a 22% boost in efficiency for decentralized exchanges (DEX). Notably, popular DEX protocols like Uniswap v3 could operate faster and more cost-effectively, potentially resulting in annual arbitration cost savings of up to $100 million.

The reduction in block times will also be a significant advancement for smart contracts on Ethereum. Users can expect transaction approval times to decrease by 33%, leading to swifter transactions. This change is anticipated to balance the network’s transaction load more evenly, alleviating peak congestion moments. However, such improvements may bring about certain challenges.

For solo stakers, the decrease in block time may raise hardware and bandwidth requirements. Faster block processing necessitates more data, which could require solo stakers to upgrade their hardware. Adam Cochran, a partner at Cinnehaim Ventures, indicated that while this change could pressure solo stakers, it could be manageable if gas fee limits remain stable. Nevertheless, the pressures that such changes may impose on solo stakers should not be overlooked.

Türkçe

Türkçe Español

Español