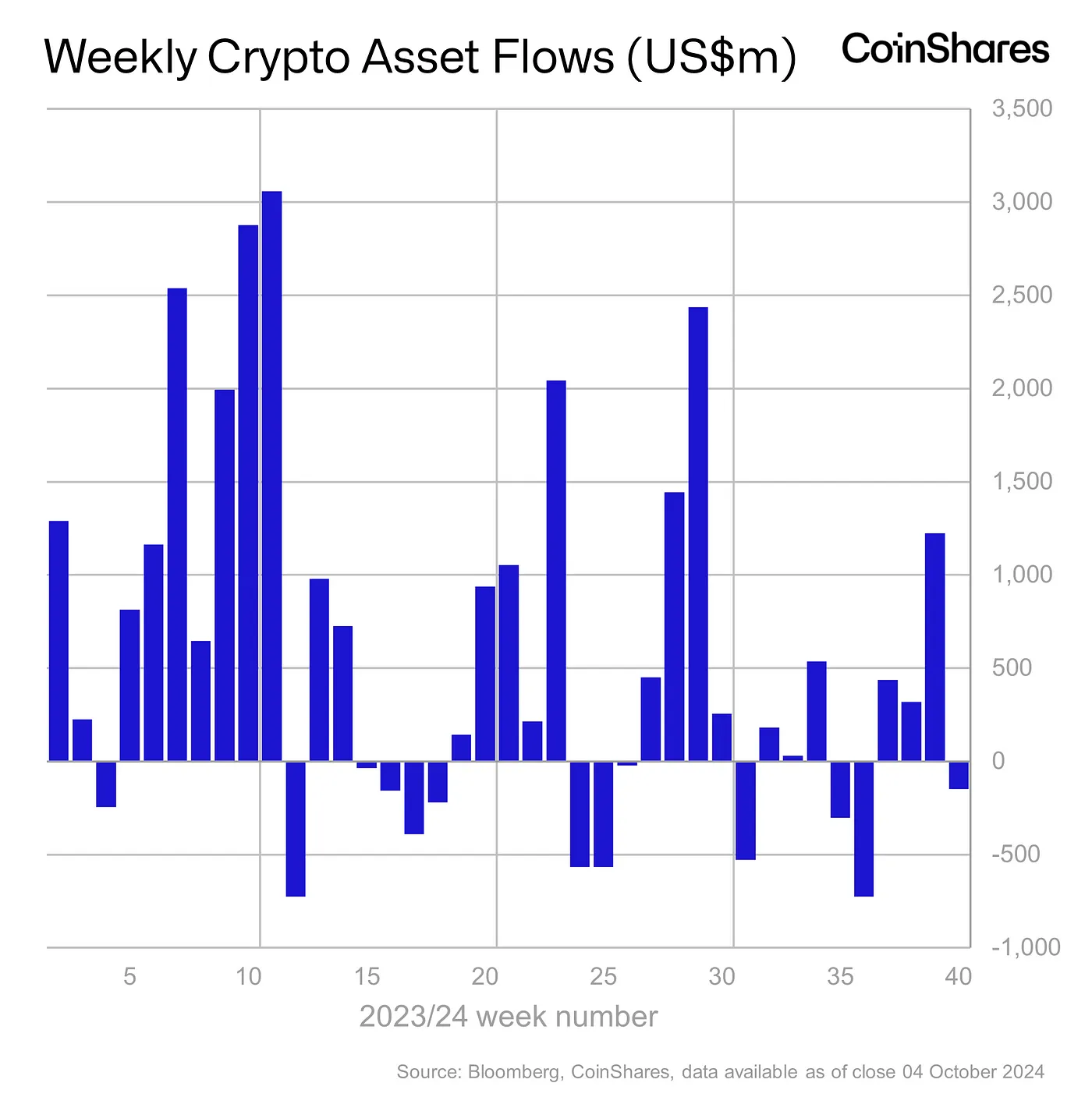

According to CoinShares data, a total of $147 million was withdrawn from digital asset investment products last week. Strong economic data in the United States diminished expectations for significant interest rate cuts, leading to weak market sentiment. Notably, Bitcoin  $96,351-focused withdrawals drew attention, while some investment instruments continued to resist this negative trend.

$96,351-focused withdrawals drew attention, while some investment instruments continued to resist this negative trend.

Significant Bitcoin Withdrawals with Record Inflows in Multi-Asset Products

Last week, investor interest heavily concentrated on Bitcoin, resulting in a withdrawal of $159 million. In contrast, short Bitcoin investment products, which bet against falling Bitcoin prices, saw an inflow of $2.8 million. Ethereum  $3,569 also suffered from this negative trend, experiencing withdrawals of $29 million, indicating continued low interest from investors.

$3,569 also suffered from this negative trend, experiencing withdrawals of $29 million, indicating continued low interest from investors.

Canada and Switzerland Show Optimism, While the U.S. and Germany Remain Pessimistic

Regionally, Canada and Switzerland presented an optimistic outlook, with inflows of $43 million and $35 million, respectively. However, the U.S. experienced outflows of $209 million, Germany faced $8.3 million, and Hong Kong saw $7.3 million in withdrawals. This suggests a loss of confidence among investors in the cryptocurrency market in these regions.

Compared to the previous week, trading volume in digital asset investment products rose by 15%, reaching $10 billion. However, overall trading volume in the cryptocurrency market remained at lower levels, indicating that investors are cautious and avoiding large transactions in a high-uncertainty environment.