Spot Bitcoin  $108,428 ETFs traded in the US experienced a net outflow of $18.66 million on Tuesday, ending a positive inflow streak that had lasted for two days. The outflows primarily occurred across various funds, including Fidelity’s FBTC and Grayscale’s GBTC. Conversely, BlackRock’s IBIT emerged as the only fund to report a positive inflow on the same day.

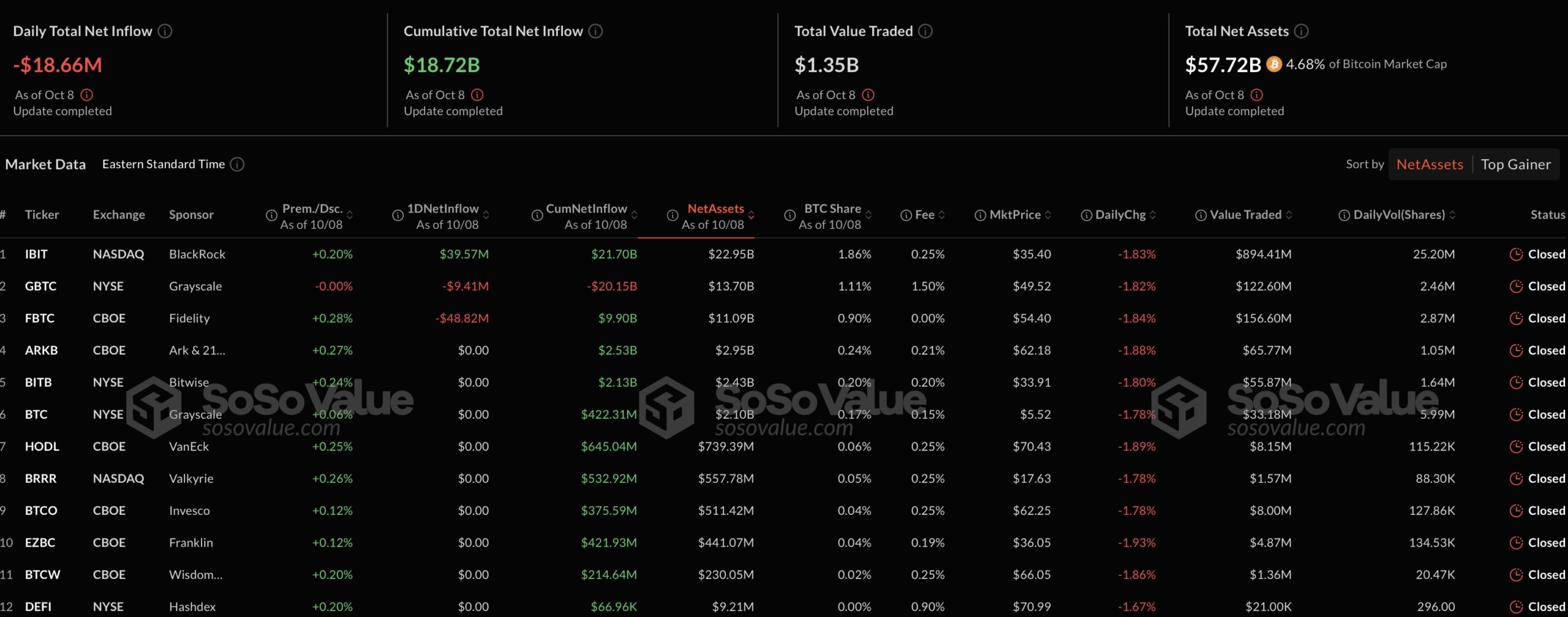

$108,428 ETFs traded in the US experienced a net outflow of $18.66 million on Tuesday, ending a positive inflow streak that had lasted for two days. The outflows primarily occurred across various funds, including Fidelity’s FBTC and Grayscale’s GBTC. Conversely, BlackRock’s IBIT emerged as the only fund to report a positive inflow on the same day.

The Largest Outflow Comes from Fidelity’s Fund

Fidelity’s spot ETF, FBTC, recorded the largest loss of the day with an outflow of $48.82 million. Following closely was Grayscale’s GBTC, which saw a $9.41 million outflow. Notably, Grayscale had not registered any inflows or outflows the previous day, making this situation particularly noteworthy. The total trading volume of 12 spot Bitcoin ETFs increased from $1.22 billion to $1.35 billion.

Another fund that stood out on Tuesday was BlackRock’s IBIT, which moved positively with an inflow of $39.57 million. The remaining nine ETFs did not report any inflows.

Outflows Also Affect Spot Ethereum ETFs

In addition to spot Bitcoin ETFs, US spot Ethereum  $2,551 ETFs recorded a net outflow of $8.19 million on Tuesday. There were no inflows or outflows on Monday, and the largest outflow occurred in Bitwise’s ETHW fund, amounting to $4.54 million. Fidelity’s FETH fund followed with a $3.65 million outflow, while the other seven spot Ethereum ETFs showed no movement.

$2,551 ETFs recorded a net outflow of $8.19 million on Tuesday. There were no inflows or outflows on Monday, and the largest outflow occurred in Bitwise’s ETHW fund, amounting to $4.54 million. Fidelity’s FETH fund followed with a $3.65 million outflow, while the other seven spot Ethereum ETFs showed no movement.

The total trading volume of spot Ether ETFs dropped from $118.43 million the previous day to $102.37 million.

As the second trading day of the week unfolded, Bitcoin’s price saw a minor decline of 0.32%, trading at $62,372. Meanwhile, Ethereum, the leading altcoin, experienced a 0.52% increase, reaching $2,445 during the same timeframe.

Türkçe

Türkçe Español

Español