The eagerly awaited Consumer Price Index (CPI) data from the U.S. was released, prompting discussions regarding its impact on global markets, including the cryptocurrency sector. Alongside annual and monthly CPI figures, core CPI data excluding food and energy costs was also disclosed. The release of these data sets sparked debates about their implications for both the global economy and cryptocurrency market dynamics.

Details of the U.S. CPI Data

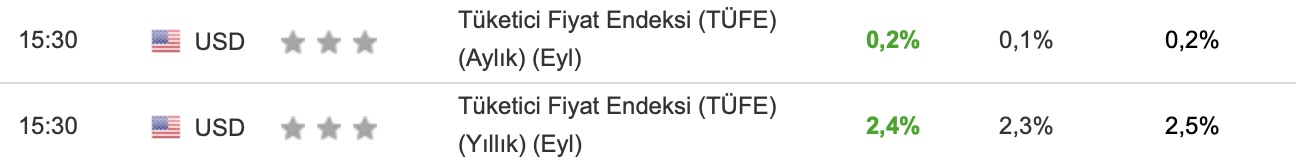

The CPI data for September came in at 2.4 percent year-on-year, surpassing the expected 2.3 percent. In the same period last year, this figure stood at 2.5 percent, indicating continued inflationary pressures. The monthly CPI, however, was recorded at 0.2 percent, higher than the anticipated 0.1 percent, suggesting that inflation in the U.S. is progressing more slowly than expected but is not fully under control.

Additionally, the core CPI was reported at 3.3 percent annually, exceeding the forecast of 3.2 percent and matching the previous period’s figure. On a monthly basis, the core CPI was 0.3 percent, contrasting with a market expectation of 0.2 percent. Core CPI data, which excludes volatile components like energy and food, provides a clearer view of inflation trends.

Possible Effects of Data on the Cryptocurrency Market

The released CPI and core CPI figures echoed through the cryptocurrency market as well. The inflation data exceeding expectations strengthens the belief that the U.S. Federal Reserve may proceed cautiously with interest rate cuts. This situation could create a negative sentiment towards cryptocurrencies, particularly reducing demand for riskier assets like Bitcoin  $108,024.

$108,024.

Generally, higher than expected CPI data leads to an appreciation of the U.S. dollar, while lower data tends to weaken it. Such fluctuations directly affect the cryptocurrency market as well.

Following the CPI data release, attention has turned to the Producer Price Index (PPI) data expected to be announced tomorrow. This inflation indicator is scheduled for disclosure at 15:30 Turkish time.

Türkçe

Türkçe Español

Español