Investors are beginning to take positions in Ethereum (ETH)  $3,102 for a possible price increase. The rise in both open interest and funding rates has created expectations of market movement. While Ethereum’s price currently remains relatively low, there is significant interest in Solana

$3,102 for a possible price increase. The rise in both open interest and funding rates has created expectations of market movement. While Ethereum’s price currently remains relatively low, there is significant interest in Solana  $234 (SOL)-based memecoins, suggesting that accumulating ETH could present an attractive opportunity for investors.

$234 (SOL)-based memecoins, suggesting that accumulating ETH could present an attractive opportunity for investors.

Open Interest and Funding Rates are Rising

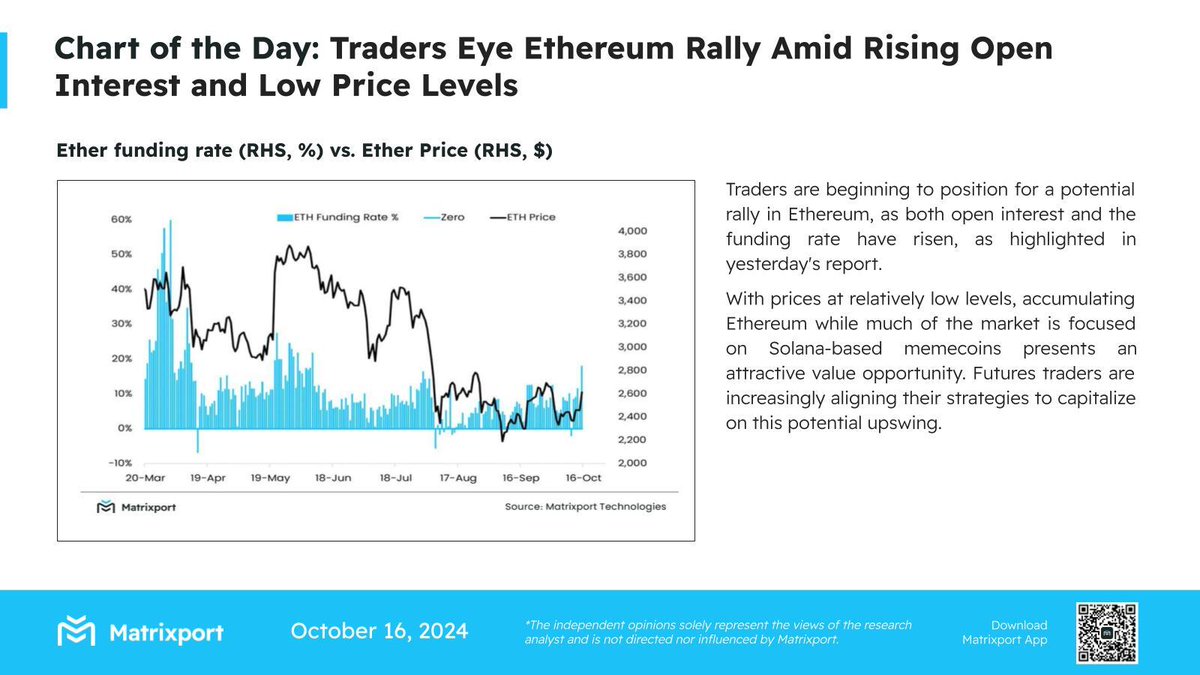

According to a recent report from Matrixport, the increase in Ethereum’s derivative open interest indicates that investors may be preparing for a potential price rise. Traders interested in futures are reshaping their strategies to capitalize on this anticipated movement.

The current low price of ETH is viewed as an opportunity for investors to accumulate. Experts believe that taking positions in Ethereum during this time, when Solana is gaining attention, could yield long-term gains.

ETH Accumulation Becomes Attractive

According to Matrixport, the current low price of ETH might present an opportunity for long-term investors. While the market focuses on Solana and Solana-based memecoins, accumulating ETH could be an appealing option. Historical data suggests that such periods often precede rallies, thus monitoring movements in the Ethereum market is essential.

Market observers interpret the rise in Ethereum’s open interest and funding rates as a signal that investors expect a future price increase. This trend indicates that traders are strengthening their positions to avoid missing out on a potential price surge. Despite the current market’s focus on Solana and memecoins, it may be the right time to take positions in Ethereum.