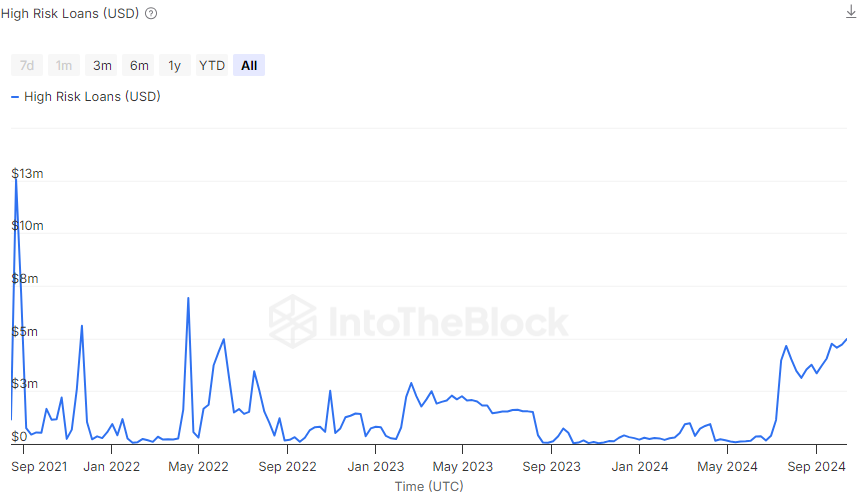

The cryptocurrency market is witnessing a significant increase in high-risk loans. According to data provided by IntoTheBlock, the total amount of these loans rose to 55 million dollars on Wednesday. This figure marks the highest level recorded since June 2022. High-risk loans are defined as those where the loan amount is 5% away from the liquidation price. This means that if the value of the assets given as collateral falls by 5%, the loan will be liquidated.

The Risk of a Liquidation Wave Is Increasing

Cryptocurrency investors lock their cryptocurrencies as collateral while taking loans from decentralized lending protocols. However, if the value of the collateral falls below a certain level, the protocol liquidates the debt and puts the collateral up for sale. If the price of the collateral drops by another 5%, the debt starts to become under-collateralized, triggering liquidation and ensuring debt repayment through the sale of the collateral.

This situation can trigger a process known as a liquidation wave. A liquidation wave leads to rapid price declines due to sequential liquidations. This swift drop in prices causes more loans to be liquidated, making the market even more unstable, affecting both borrowers and regular spot investors.

Market Liquidations and Bad Debts

IntoTheBlock warned that large liquidations can impact collateral values, putting more loans at liquidation risk. The analysis firm emphasized that sudden drops in market values may render the collateral insufficient to cover the loans, resulting in losses for lenders. This situation can lead to an increase in bad debts, negatively affecting market liquidity and complicating the execution of large orders at stable prices.

Bad debts tend to affect not only lenders but the entire market. Lenders’ hesitance to add new liquidity to prevent potential losses disrupts the overall liquidity balance in the market. This can cause significant price fluctuations and liquidity squeezes in the cryptocurrency market.

The rise of high-risk loans in the cryptocurrency market and the potential risk of liquidation indicate that investors and lenders need to act more cautiously. The current market situation suggests that significant losses could occur in the event of a sharp price drop.

Türkçe

Türkçe Español

Español