DeFi operations often present significant complexities for many cryptocurrency users. A recent development aims to streamline these transactions, potentially increasing user engagement and boosting token and Total Value Locked (TVL) figures. This new feature sheds light on the direction of the DeFi sector.

Uniswap’s Bridging Feature

A new feature supported by the Across protocol has been launched across nine different networks. With this permissionless bridging capability, users can now transact across various networks without the hassle of using individual bridges. Uniswap announced this significant update today.

“Transferring assets between networks used to be challenging, requiring external bridges and lengthy processing times.”

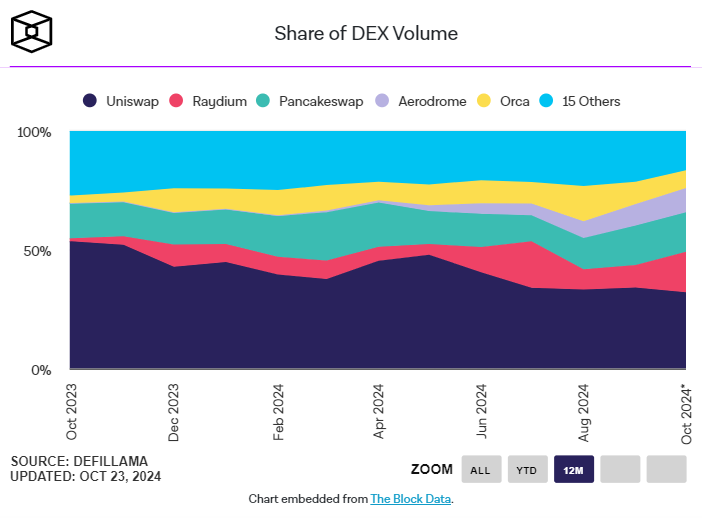

These difficulties have been eliminated. Thanks to the permissionless bridging application, users will manage their assets seamlessly across multiple networks. This attractive capability has been added to the protocol at a time when the overall DeFi transaction volume continues to decline. Which networks will be supported?

The company indicated this is the most requested feature by users. Unlike other bridges, Across operates as a permissionless bridge using decentralized liquidity pools and a relayer network, which Uniswap is leveraging.

UNI Coin Commentary

As the DeFi altcoin is being analyzed, UNI Coin is priced at $7.57. While the latest news may yield positive results for the price in the medium to long term, a drop in BTC price to $66,800 has led to a decline in UNI Coin. UNI Coin, which holds a support level of $7.25, could rebound to $8.64 with improved market sentiment.

If it closes above resistance levels, the goal will be to reach double-digit prices again. Uniswap, one of the largest protocols in the DeFi sector, has experienced significant volatility following the SEC lawsuit this year. Before the ETH ETF approval, the SEC initiated a crackdown on the entire Ethereum ecosystem, impacting major DeFi protocols like Uniswap.

Türkçe

Türkçe Español

Español

$

$