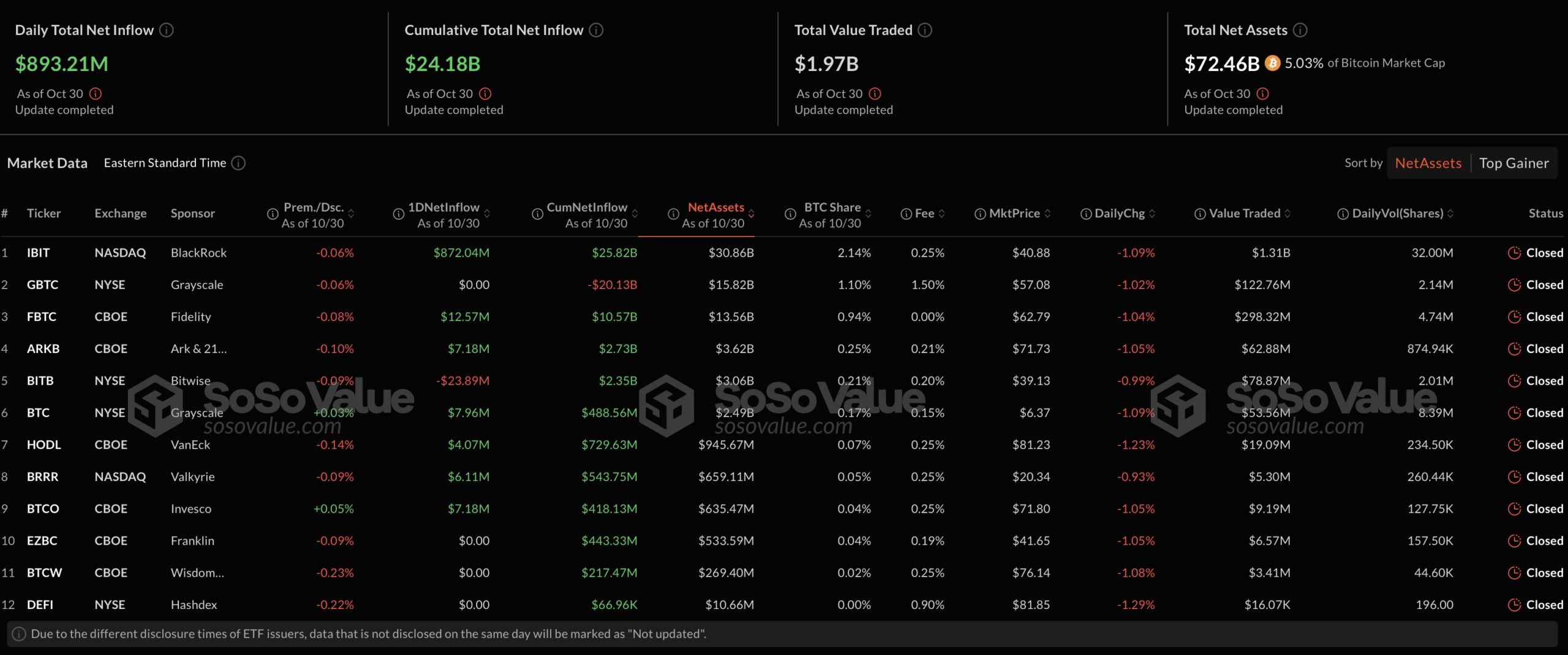

BlackRock’s iShares Bitcoin  $103,714 Trust (IBIT), the largest spot Bitcoin ETF in the United States, achieved a record high with net inflows surpassing $872 million on Wednesday. This marked the highest daily inflow since the fund’s launch in January, outpacing the previous record set in March. According to BTCMarkets analyst Rachael Lucas, this resurgence in the IBIT fund can be attributed to the global trend of central banks lowering interest rates and the impact of expectations for a crypto-friendly administration under Donald Trump. Additionally, total net inflows for all spot Bitcoin ETFs in the U.S. reached $893.21 million on Wednesday, with Fidelity’s FBTC leading with $12.57 million in net inflows, while six other spot Bitcoin ETFs reported more modest figures.

$103,714 Trust (IBIT), the largest spot Bitcoin ETF in the United States, achieved a record high with net inflows surpassing $872 million on Wednesday. This marked the highest daily inflow since the fund’s launch in January, outpacing the previous record set in March. According to BTCMarkets analyst Rachael Lucas, this resurgence in the IBIT fund can be attributed to the global trend of central banks lowering interest rates and the impact of expectations for a crypto-friendly administration under Donald Trump. Additionally, total net inflows for all spot Bitcoin ETFs in the U.S. reached $893.21 million on Wednesday, with Fidelity’s FBTC leading with $12.57 million in net inflows, while six other spot Bitcoin ETFs reported more modest figures.

Investors Turn to Bitcoin Ahead of U.S. Presidential Elections

As the U.S. presidential elections approach, interest in spot Bitcoin ETFs is expected to rise. Lucas highlighted, “Before the elections, Bitcoin ETFs are emerging as a hedge against economic uncertainties,” noting that this period could create significant volatility. Investor interest is keenly focused on polling data and regulatory statements, with the upcoming Federal Open Market Committee (FOMC) meeting and financial reports from tech giants also under close scrutiny.

On Wednesday, total cumulative net inflows into spot Bitcoin ETFs in the U.S. reached $24.18 billion, while total trading volume fell to $1.97 billion compared to the previous day. Bitwise’s BITB reported a net outflow of $23.89 million, marking the only negative flow of the day.

Spot Bitcoin ETFs Near Satoshi Nakamoto Ownership Levels

Bloomberg Senior ETF Analyst Eric Balchunas noted that the record inflows to BlackRock’s funds have brought the total Bitcoin holdings of U.S. spot ETFs to nearly 1 million BTC. Balchunas predicts that by the end of November, spot Bitcoin ETFs could surpass Satoshi Nakamoto’s owned 1.1 million BTC, making them the largest Bitcoin holders.

Meanwhile, spot Ethereum  $2,664 ETFs also saw minor net inflows, with FETH reporting $5.32 million, and CETH showing $2.66 million in net inflows. However, Bitwise’s ETHW recorded a net outflow of $3.63 million. The total trading volume for spot Ethereum ETFs remained at $220 million, falling short of the anticipated strong demand in the sector.

$2,664 ETFs also saw minor net inflows, with FETH reporting $5.32 million, and CETH showing $2.66 million in net inflows. However, Bitwise’s ETHW recorded a net outflow of $3.63 million. The total trading volume for spot Ethereum ETFs remained at $220 million, falling short of the anticipated strong demand in the sector.

As Bitcoin trades around $72,300, approaching its all-time high of $73,500, analysts are evaluating the potential for a new peak in the short term. Presto Research analyst Min Jung stated, “If the resistance at $73,800 is broken, a new rally may begin in the Bitcoin market,” highlighting a possible breakout scenario.

Türkçe

Türkçe Español

Español