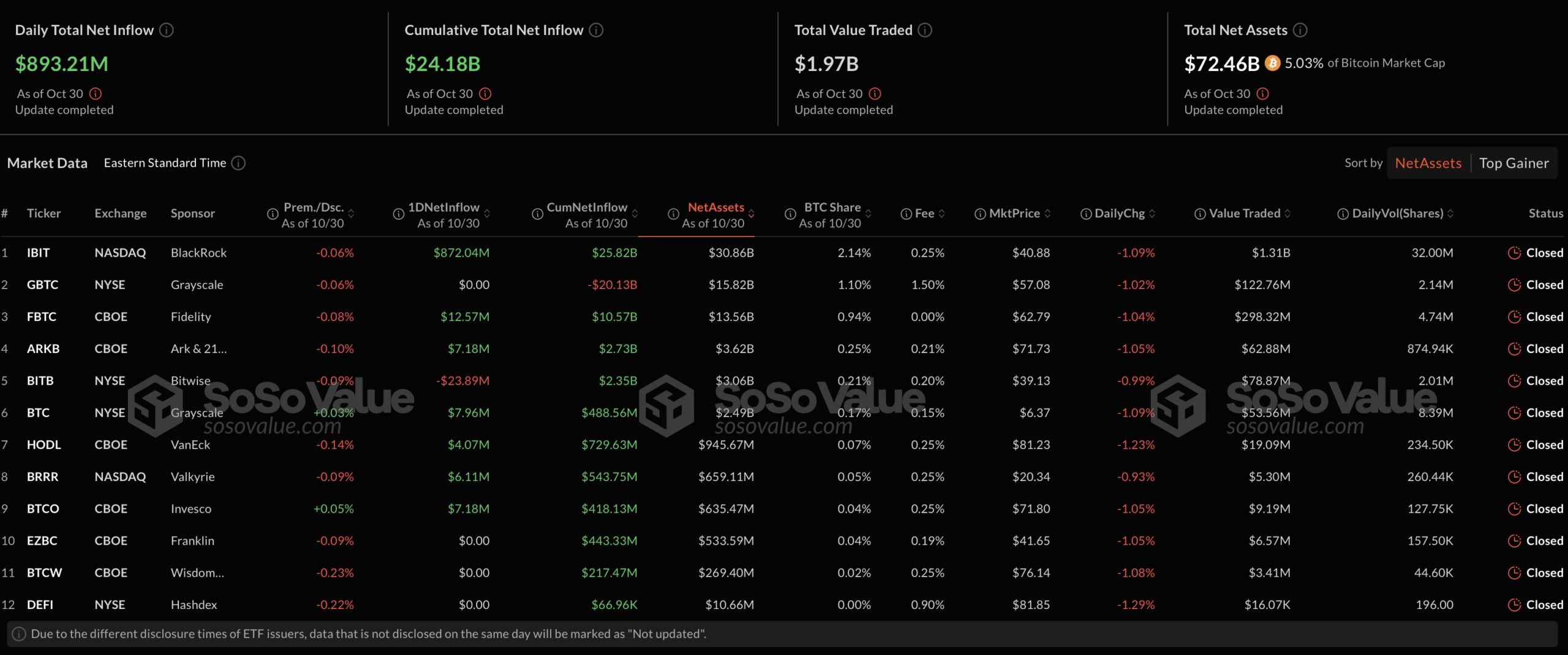

JPMorgan analysts assert that as the US elections approach, Donald Trump’s potential victory could further boost interest in Bitcoin  $91,967. This phenomenon, termed “value loss trading,” highlights a growing demand for Bitcoin and gold ETFs among individual investors. They reported that net inflows into Bitcoin ETFs reached an impressive $4.4 billion in October.

$91,967. This phenomenon, termed “value loss trading,” highlights a growing demand for Bitcoin and gold ETFs among individual investors. They reported that net inflows into Bitcoin ETFs reached an impressive $4.4 billion in October.

Institutional Investors Hold Back on Bitcoin and Gold Futures

The increase in net inflows is primarily attributed to individual investors seeking alternative assets amid currency depreciation. According to JPMorgan’s report, there was a notable $1.3 billion influx into Bitcoin ETFs within just two days. This rising demand is largely driven by individual investors’ interest in alternative assets, reaching the third highest monthly inflow level.

Conversely, the report indicates that institutional investors have recently shown a tendency to pause in Bitcoin futures. Analysis based on changes in open interest in Chicago Mercantile Exchange (CME) Bitcoin futures revealed that Bitcoin has reached an “overbought” state. Analysts from JPMorgan warn that this may introduce volatility into Bitcoin’s pricing, noting a similar stagnation in gold futures.

Positive Expectations for the Cryptocurrency Market in 2025

JPMorgan analysts have painted an optimistic picture for the cryptocurrency market in 2025. Another report published last month examined factors such as the growth of value loss trading and Trump’s potential return to presidency. These predictions, combined with the increasing interest from individual investors, suggest a promising outlook for the future of cryptocurrencies.