Bitcoin  $0.00003 maintains its price around $72,000, showing positive consolidation despite not reaching new peaks in the short term. This situation may increase interest among cryptocurrency enthusiasts as market conditions evolve. What do experts anticipate for cryptocurrencies led by Bitcoin?

$0.00003 maintains its price around $72,000, showing positive consolidation despite not reaching new peaks in the short term. This situation may increase interest among cryptocurrency enthusiasts as market conditions evolve. What do experts anticipate for cryptocurrencies led by Bitcoin?

Bitcoin Price Target

In today’s market assessment, Zeberg expressed the opinion that Bitcoin could reach new highs between $115,000 and $123,000. This target suggests over tenfold earnings potential for altcoins. The analyst noted that the recent surge has triggered a breakout, summarizing the entire process and expectations in the graph below.

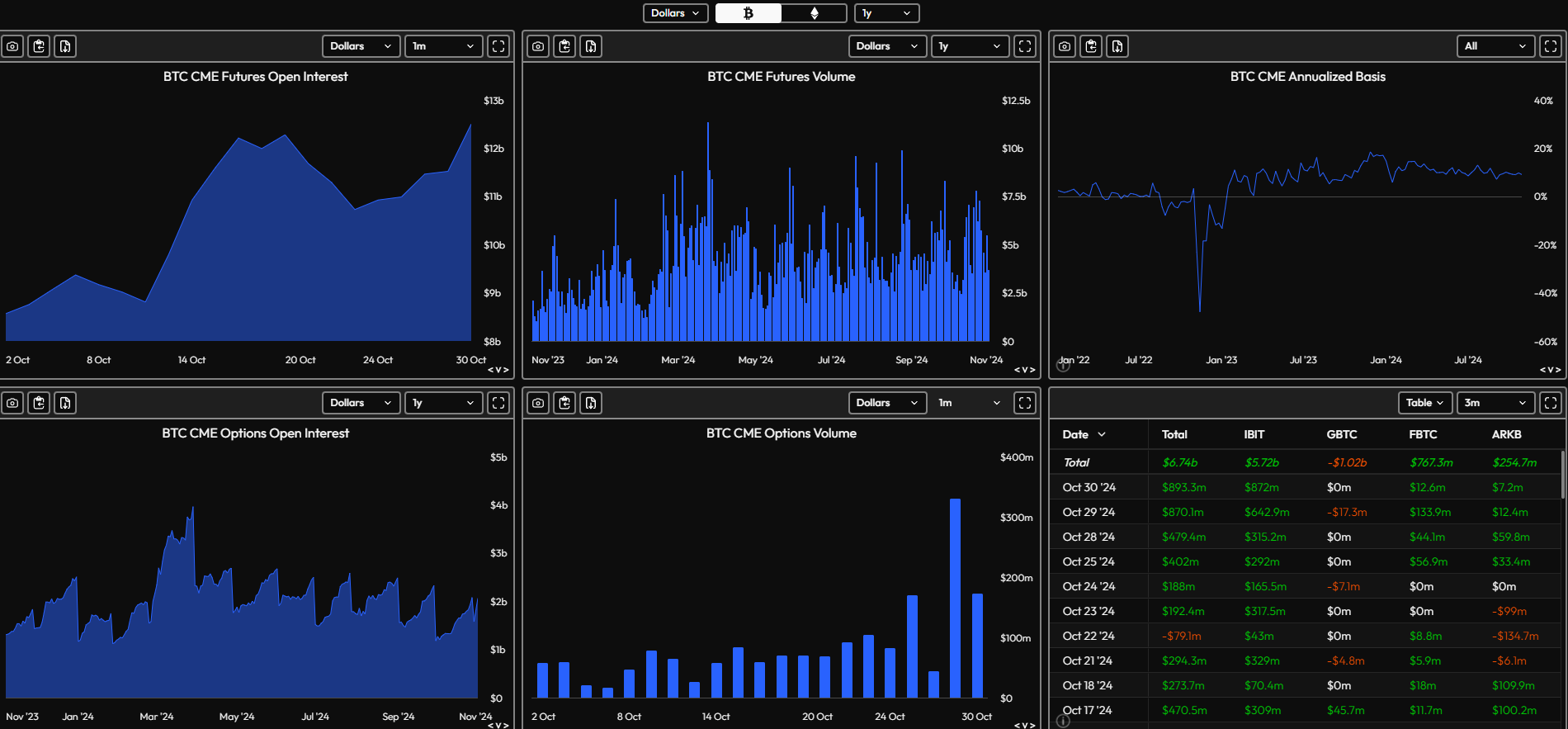

An analyst known by the pseudonym Horse highlights a second significant detail alongside the breakout. BlackRock’s spot Bitcoin ETF has seen approximately $1 billion in inflows within two days. Moreover, CME active positions are climbing to new records, indicating that Bitcoin could be on the brink of a much larger movement in the cryptocurrency market.

The increasing interest from institutional investors suggests a favorable scenario resulting from comprehensive evaluations. The growing engagement of professional investors is likely to empower individual investors as well. This shift in market psychology could lead to heightened risk appetites and improved cash flow from new investors.

Interest Rate Cuts

We are aware of the strong impact of macroeconomic developments on cryptocurrency markets. The Kobeissi Letter positively assessed the recent data showing 2.1%, but there seems to be an issue here. Experts from the analysis platform, who opposed a 50bp cut in the previous meeting, advocate for slower reductions.

“The September PCE inflation, which is the Fed’s preferred inflation measure, decreased to 2.1%, aligning with expectations. The Core PCE inflation remained unchanged at 2.7%, which is above the anticipated 2.6%.”

It has been six months since the decline in core PCE. Did we really need a 50 basis point cut? The August PCE inflation has also been revised from 2.2% to 2.3%. Both core PCE and CPI inflation remain high and stubborn.”

If the current trend continues, experts caution that there is a risk of stagnation in interest rate cuts, indirectly warning cryptocurrency investors as well.

Türkçe

Türkçe Español

Español