Three significant economic indicators from the U.S. will be released today at 15:30 Turkey time, attracting attention from the cryptocurrency and global markets. The Unemployment Rate, Non-Farm Payroll, and Average Hourly Earnings data are crucial and may lead to market fluctuations. Observers believe these critical indicators will determine market trends.

Unemployment Rate Will Provide Insights into the Economy

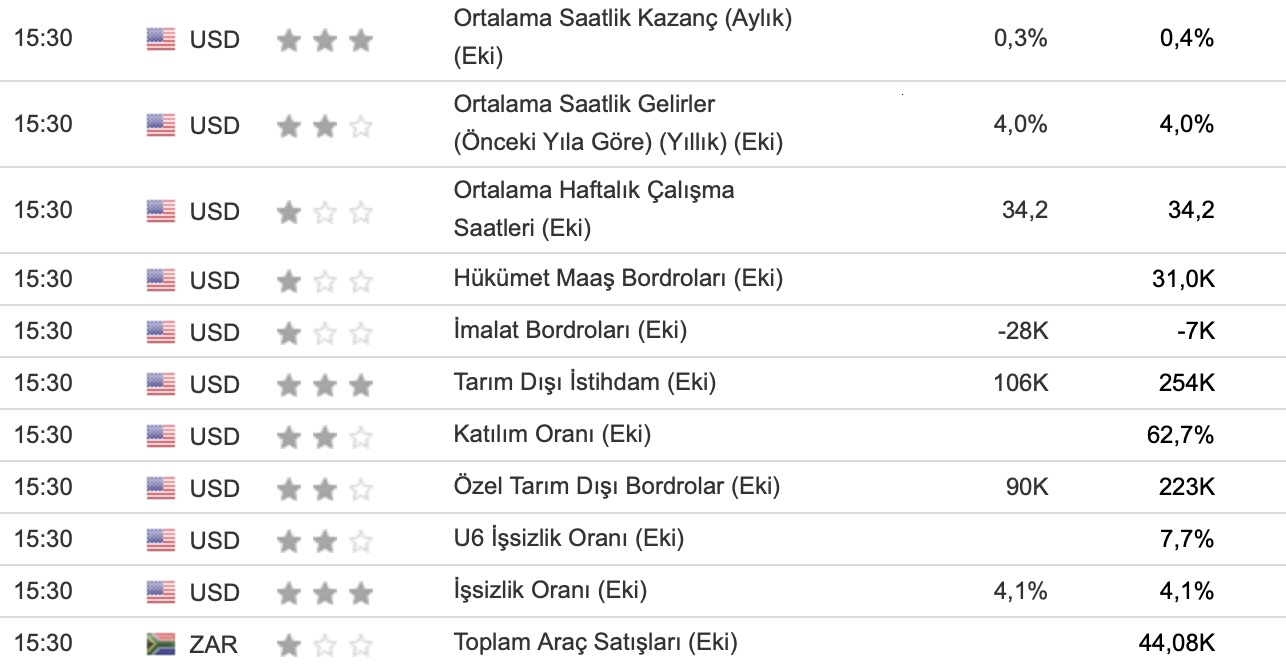

The first data point, the Unemployment Rate, analyzes the joblessness situation in the U.S. Expectations indicate that the unemployment rate will remain at 4.1%. This figure represents the proportion of unemployed individuals relative to the total workforce actively seeking employment.

A decrease in unemployment may positively impact the U.S. dollar since it can encourage consumer spending and bolster the economy. An increase in the working population may also enhance the positive effect on the Gross Domestic Product (GDP). Market participants closely monitor low unemployment rates as indicators of the country’s economic health.

Non-Farm Payroll and Average Hourly Earnings Will Influence Markets

Another important indicator is the Non-Farm Payroll data, which reflects changes in employment numbers outside the agricultural sector. The expected rise in employment for October is projected at 106,000, down from 254,000 in the previous month. An increase in non-farm employment can positively drive the U.S. dollar, as new job opportunities can enhance consumption and strengthen the economy.

Additionally, the Average Hourly Earnings, which is anticipated to rise by 0.3%, will be a focal point. Increases in hourly earnings indicate potential inflationary pressures, serving as a signal for future consumer price trends. This data may reflect positively on the U.S. dollar since rising earnings directly influence consumer spending and inflation expectations.

These three data releases from the U.S. have the potential not only to affect the U.S. economy but also to stir global finance and cryptocurrency markets.