Bitcoin  $84,534 has yet to reach the anticipated peaks, but hopes remain high due to ongoing consolidation at elevated levels. Prices below $60,000 no longer exist, and with the elections just hours away, traders are eagerly awaiting a significant breakout. What are the market predictions from QCP Capital analysts?

$84,534 has yet to reach the anticipated peaks, but hopes remain high due to ongoing consolidation at elevated levels. Prices below $60,000 no longer exist, and with the elections just hours away, traders are eagerly awaiting a significant breakout. What are the market predictions from QCP Capital analysts?

Weekly Assessment

In their market note shared over the last 24 hours, analysts highlighted the Core PCE data released on Thursday. The figures exceeded expectations, and while the Non-Farm Payroll (NFP) came in surprisingly low, the potential for revisions due to hurricane impacts limited its influence.

“Thursday’s Core PCE data was slightly higher than anticipated (2.7% actual versus 2.6% expectation). However, Friday’s NFP data surprised to the downside (12,000 actual versus 110,000 expectation), causing the DXY to recover and reclaim the 104 level.”

Despite the weak NFP data, the U.S. unemployment rate remained unchanged at 4.1%. The market’s expectation for a 25 basis point rate cut in November rose to a 96.4% probability.”

Losses in stocks were balanced on Friday by Amazon’s earnings reports. Treasury yields, which fell in response to the NFP data, climbed back to a four-month high. Such performance before the elections is not surprising.

“Brent and WTI experienced slight gains following news of Iran preparing a retaliation attack against Israel. BTC surged to $73,600 this week, teasing its all-time high expectations. Despite BTC’s remarkable performance, ETH remained relatively quiet, failing to surpass $2,700.”

Will Cryptocurrencies Rise?

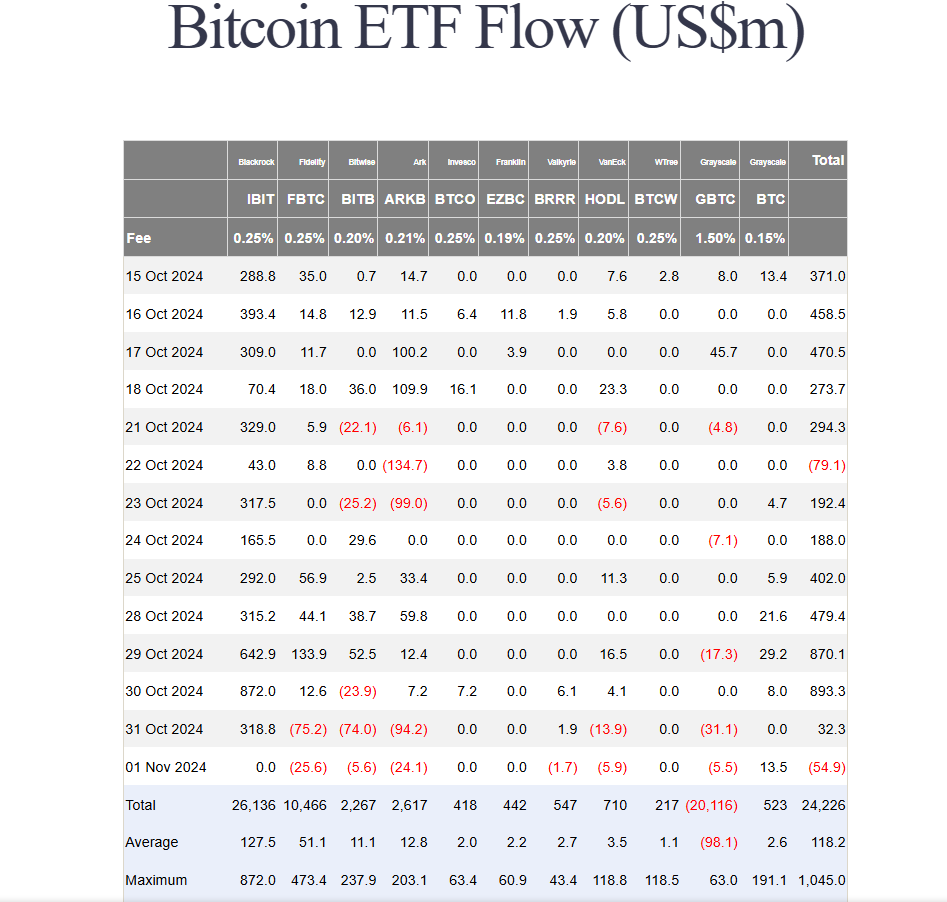

With recent developments and the reasons for the volatility known, will cryptocurrencies increase? Throughout the week, there was an inflow of $2.1 billion into ETFs. BlackRock experienced a massive inflow of $872 million in a single day, marking the largest since the listing in January. This indicates a growing appetite among professional traders.

Experts expect increasing market interest;

“Despite Bitcoin dropping below $69,000 on Friday, both total BTC futures and options open interest remain high at $40.65 billion and $25.3 billion respectively, showing significant ongoing interest in the market.”

The options market indicates BTC’s 7-day implied volatility is at 74.4%, notably higher than the 41.4% historical volatility, suggesting significant risk premiums related to the elections.

Forecasts regarding Trump’s victory have decreased from 66% to 57% for Trump and 43% for Harris on Polymarket. Regardless of the outcome, it is believed that the elections will trigger a sell-off, similar to the Nashville Bitcoin conference.

Thus, analysts do not anticipate a significant movement post-election results as expected.

Türkçe

Türkçe Español

Español