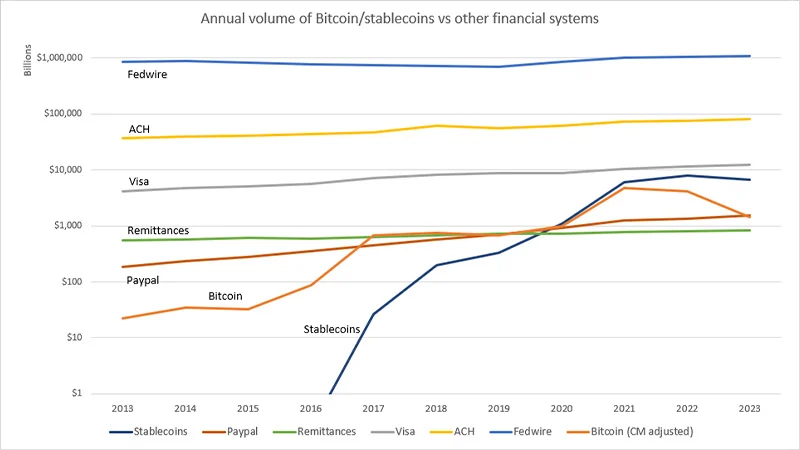

Brian Armstrong, CEO of the U.S.-based cryptocurrency exchange Coinbase, shared a notable graph on the X platform that highlights Visa’s transaction volumes. The graph indicates a lack of significant growth in Visa’s annual transaction volume from 2013 to 2023, while showcasing a rapid increase in the transaction volumes of stablecoins. Particularly since mid-2016, the transaction volume of stablecoins has steadily risen and is approaching that of Visa.

Rapid Growth of Stablecoin Transaction Volumes

The transaction volume of stablecoins has experienced a sharp increase, especially after 2016. The stagnation of Visa’s transaction volume during the same period confirms the growing popularity and use cases of stablecoins. This steady rise in stablecoin transaction volume indicates that cryptocurrencies are gaining influence in the financial world.

The trend highlighted by Armstrong suggests that digital payment systems are now competing with traditional financial channels. This situation points to the potential for stablecoins to reach transaction volumes comparable to established financial systems like Visa in the future.

Bitcoin and PayPal Transaction Volumes

The graph also emphasizes the fluctuations in Bitcoin’s (BTC) annual transaction volume. Since 2013, Bitcoin’s transaction volume has generally increased, experiencing a decline around 2021 but maintaining an upward trend overall. Currently, Bitcoin’s annual transaction volume is at levels comparable to PayPal. This increase indicates that cryptocurrencies are being recognized not only as investment tools but also as payment methods.

Additionally, the graph features annual transaction volumes from traditional systems like Fedwire and ACH. However, these conventional systems’ transaction volumes remain considerably higher when compared to the volumes of stablecoins and Bitcoin  $89,988.

$89,988.