The recent decline in Bitcoin  $106,983 prices is associated with new U.S. data, and Powell has indicated a pause in interest rate cuts. Initially, any late-starting interest rate cuts were offset by a significant 50 basis point adjustment. However, as inflation approaches the 2% target, fluctuations prompt the Fed to issue stabilizing statements.

$106,983 prices is associated with new U.S. data, and Powell has indicated a pause in interest rate cuts. Initially, any late-starting interest rate cuts were offset by a significant 50 basis point adjustment. However, as inflation approaches the 2% target, fluctuations prompt the Fed to issue stabilizing statements.

Interest Rate Cuts and Cryptocurrency

The Fed has begun cutting interest rates after reaching their peak. This year, a 100 basis point reduction was anticipated, which remains largely unchanged. Nevertheless, recent data have led to remarks from Fed members indicating a potential pause in interest rate cuts. During the writing of this article, Fed member Goolsbee made significant statements.

Key excerpts from his speech summarize as follows:

“The current Fed policy still exhibits a restrictive stance. I do not believe that interest rates will return to pre-pandemic levels. I still feel good about a 12 to 18 month path to the neutral interest rate. Long-term rates may be rising due to expected higher growth or because markets believe the Fed could slow down rate cuts. The Fed needs to understand why the 10-year yields are rising and should track long-term rates. The inflation data coming in the new months is crucial for the Fed; it must reach 2%. Rates might need to decrease over the next year. The Fed will not change its inflation targets. Core PCE remains very high. If there is disagreement on the neutral interest rate, it would be sensible to start slowing the pace of rate cuts. As long as inflation continues to decline, interest rates will be much lower than they currently are. The fundamental story of the economy remains falling inflation and a cooling labor market towards full employment.”

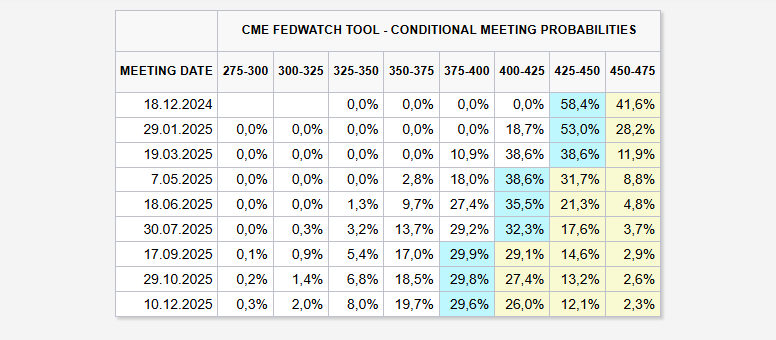

After revisions in U.S. data, market participants have lowered their forecasts for interest rate cuts in 2025. Additionally, consecutive statements about the potential for a pause have slightly negatively impacted risk markets.

As the likelihood of a cut in December weakens, the potential for rate pauses has emerged in the next two meetings. However, this entire picture could change with lower inflation data in the future.

Türkçe

Türkçe Español

Español