Investors accustomed to Bitcoin’s consecutive price peaks are currently waiting calmly for future developments. The recent drop in BTC has negatively impacted altcoins, a typical occurrence even in bullish markets. Continuous upward trends are not inherent to cryptocurrencies, and sustained profits without psychological pressure are not logical.

Bitcoin and Bull Market

Interest in Bitcoin  $117,930 has significantly increased among U.S.-based companies, with Trump’s election victory serving as a major motivation. MicroStrategy, holding over 250,000 BTC alone, aims to continue purchasing over the next three years, indicating a reluctance to sell. Kyle pointed out the demand in his evaluation.

$117,930 has significantly increased among U.S.-based companies, with Trump’s election victory serving as a major motivation. MicroStrategy, holding over 250,000 BTC alone, aims to continue purchasing over the next three years, indicating a reluctance to sell. Kyle pointed out the demand in his evaluation.

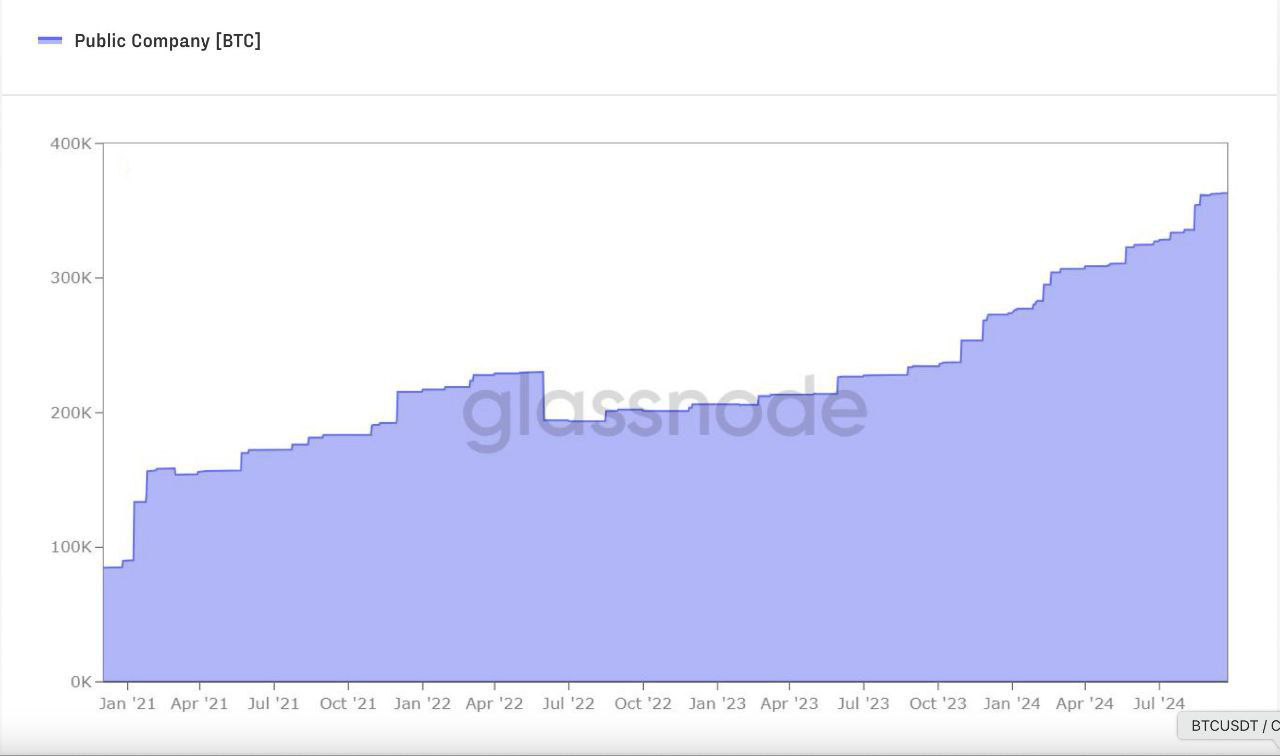

“Public companies are accumulating Bitcoin like never before; corporate reserves currently hold about 400,000 BTC!”

“Leading this is MicroStrategy, which possesses 252,000 BTC. Michael Saylor’s bold move lays the groundwork for Bitcoin to become a fundamental corporate asset. This is just the beginning!”

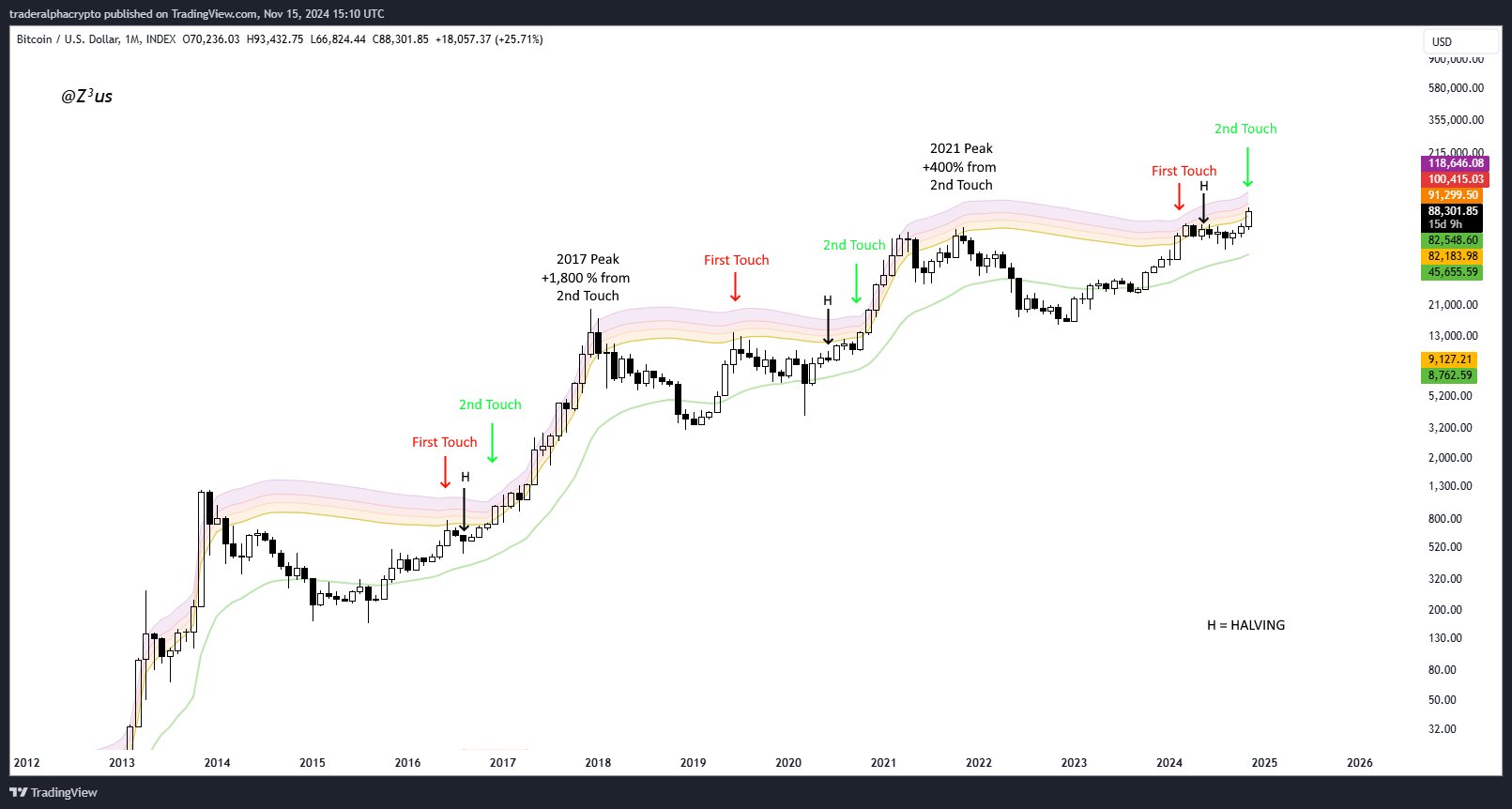

An analyst known as Z3usCrypto mentions that historical conditions are beginning to form for a 12-month bull market.

“Breakout bands are a great tool for defining Bitcoin bull market phases. Typically, we see the first touch of the bands before halving, followed by a correction around the halving.

After halving, it re-enters the upper channel and stays there for 12 months, indicating the parabolic phase of the bull market. I believe there’s a lot of upward potential from here.”

Dogecoin and ETH

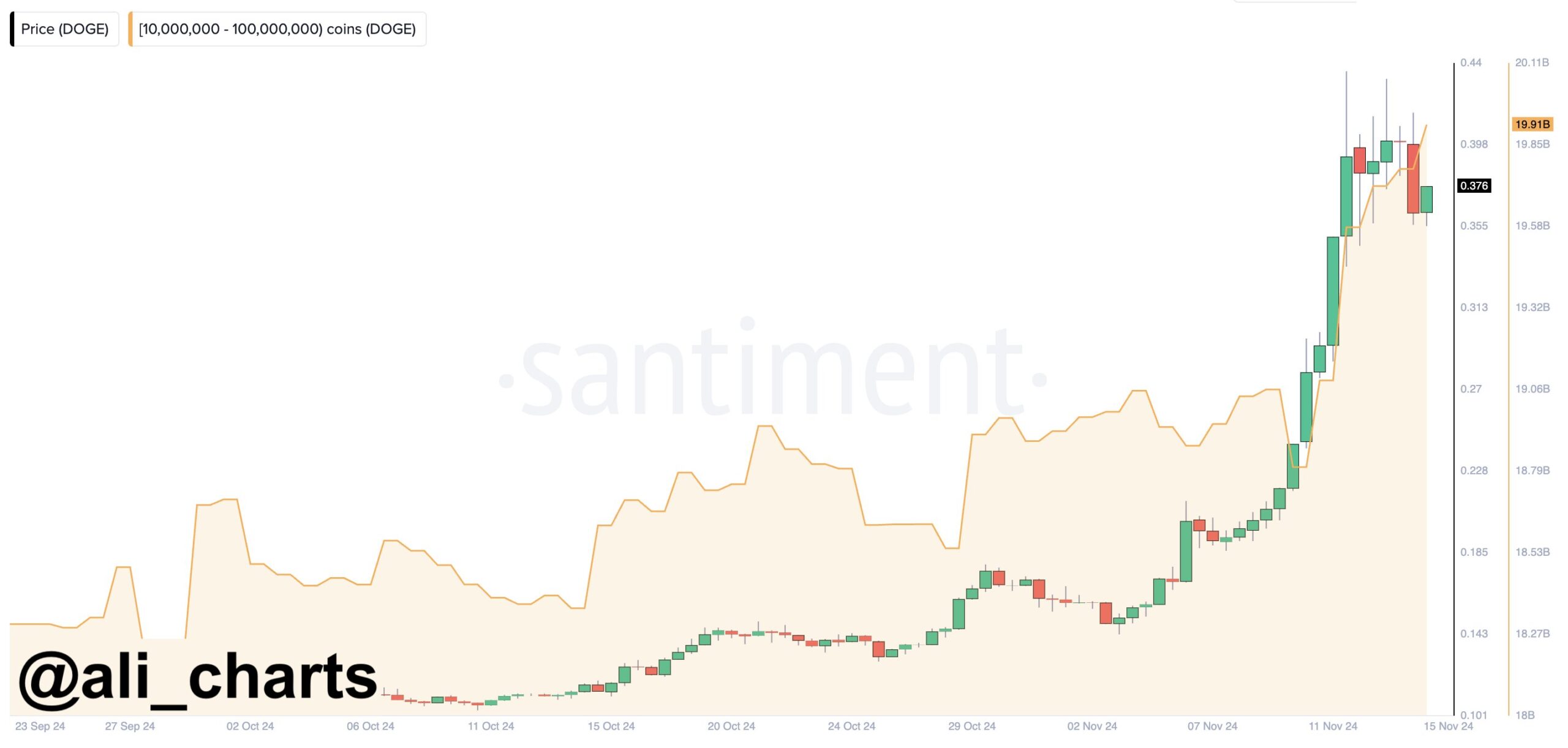

The rise of DOGE has currently stalled, with the meme coin king starting the day down 10% at $0.36. Ali Charts highlights the actual focus on whale accumulation despite fluctuations in the graph.

“Dogecoin  $0.252229 whales purchased about $56 million worth of 140 million $DOGE in the last 24 hours!”

$0.252229 whales purchased about $56 million worth of 140 million $DOGE in the last 24 hours!”

Continued interest from whales reflects confidence in further rises. However, Bitcoin prices must maintain closes above $90,000 to avoid losing momentum towards six-figure price targets. Additionally, Cowen reiterated his view that the ETHBTC pair would see a dip until the second week of January.

Türkçe

Türkçe Español

Español