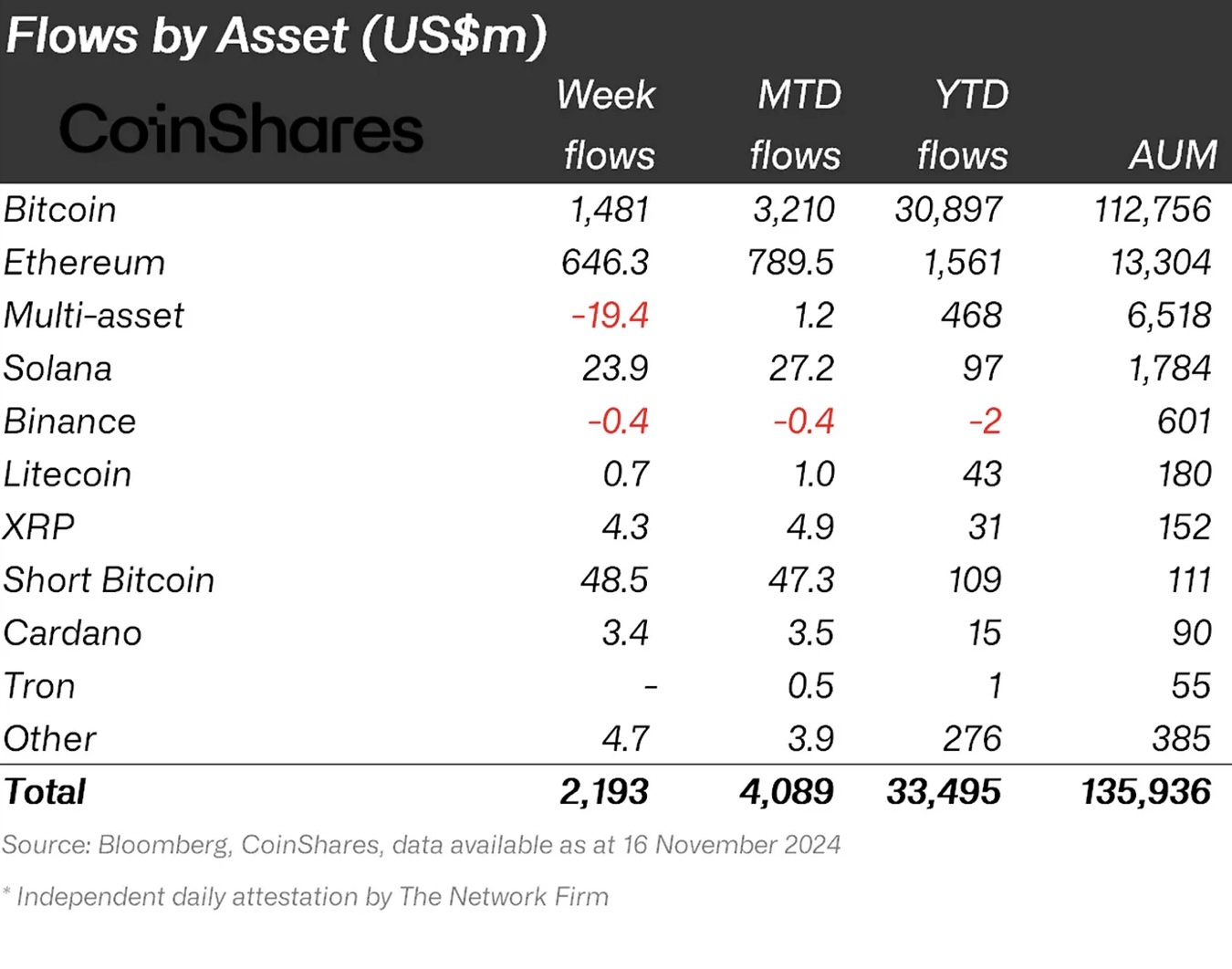

Last week, cryptocurrency-based investment products witnessed an influx of $2.2 billion. This surge was triggered by relaxed monetary policies following the U.S. elections and a positive market sentiment. Since the beginning of the year, total inflows have reached a record $33.5 billion. Bitcoin (BTC)  $103,914 hitting an all-time high led to $3 billion in inflows at the start of the week, followed by an outflow of $866 million later on. All this activity propelled the total assets under management (AuM) in cryptocurrency-based investment products to peak at $138 billion.

$103,914 hitting an all-time high led to $3 billion in inflows at the start of the week, followed by an outflow of $866 million later on. All this activity propelled the total assets under management (AuM) in cryptocurrency-based investment products to peak at $138 billion.

Notable Movements in Bitcoin and Ethereum

Bitcoin attracted a total inflow of $1.48 billion last week, leading the cryptocurrency market. However, as the price reached record levels, investors shifted towards short-based cryptocurrency investment products, contributing $49 million to short Bitcoin investment products.

Ethereum (ETH)  $2,674, the king of altcoins, broke its prolonged downtrend with an inflow of $646 million. This movement is linked to updates in the Beam Chain network by Justin Drake and the impact of U.S. election results.

$2,674, the king of altcoins, broke its prolonged downtrend with an inflow of $646 million. This movement is linked to updates in the Beam Chain network by Justin Drake and the impact of U.S. election results.

U.S. Leads Regional Inflows

The highest regional inflow into cryptocurrency-based investment products occurred in the U.S., totaling $2.2 billion. Hong Kong, Australia, and Canada followed with inflows of $27 million, $18 million, and $13 million, respectively. Positive investor sentiment in these countries reflected the confidence brought by the U.S. presidential elections. In Europe, however, the picture was mixed; while countries like Sweden and Germany saw outflows, other regions maintained a more positive stance.

The cryptocurrency market continues to remain active due to loose monetary policies and political developments. Bitcoin’s record-breaking performance and regional investment disparities illustrate the dynamic nature of the market.

Türkçe

Türkçe Español

Español