Despite disappointing earnings reports from NVDIA and weakening U.S. markets, Bitcoin  $91,967 has surpassed $98,000. The prospect of reaching a six-figure price target has transitioned from a laughable goal to a potential reality. Although this scenario may be discouraging for altcoin investors, it could also bring them some relief if Bitcoin consolidates at these six-figure levels. What do the latest predictions from QCP Capital suggest?

$91,967 has surpassed $98,000. The prospect of reaching a six-figure price target has transitioned from a laughable goal to a potential reality. Although this scenario may be discouraging for altcoin investors, it could also bring them some relief if Bitcoin consolidates at these six-figure levels. What do the latest predictions from QCP Capital suggest?

QCP Capital’s Insights on Crypto

QCP Capital has been skeptical about the feasibility of six-figure price targets this year. However, after Trump’s surprising victory in the polls, investors who struggled to find opportunities in October have started to reap massive gains in Bitcoin.

In their latest assessment released before Bitcoin crossed the $98,000 mark, QCP Capital noted the following:

“Following last night’s rally, Bitcoin reached an all-time high of $97,900 this morning. The rise is attributed to increasing optimism in crypto, fueled by headlines highlighting Bitcoin’s growing importance in the institutional world and rising capital inflows.

MicroStrategy is expected to raise $2.6 billion to purchase more Bitcoin, surpassing the $100 billion market cap and driving peak trading volumes in the U.S.

Acurx Pharmaceuticals reportedly purchased Bitcoin worth $1 million, with many corporate treasuries following MicroStrategy by adding Bitcoin to their reserves.

Intense buying in January call options has occurred as Trump’s inauguration approaches.

What Comes Next?

With Bitcoin maintaining levels above $97,000, it is closer than ever to the $100,000 milestone. Throughout the week, we observed aggressive demand in March and June call options, indicating a long-term bullish sentiment for next year from investors.

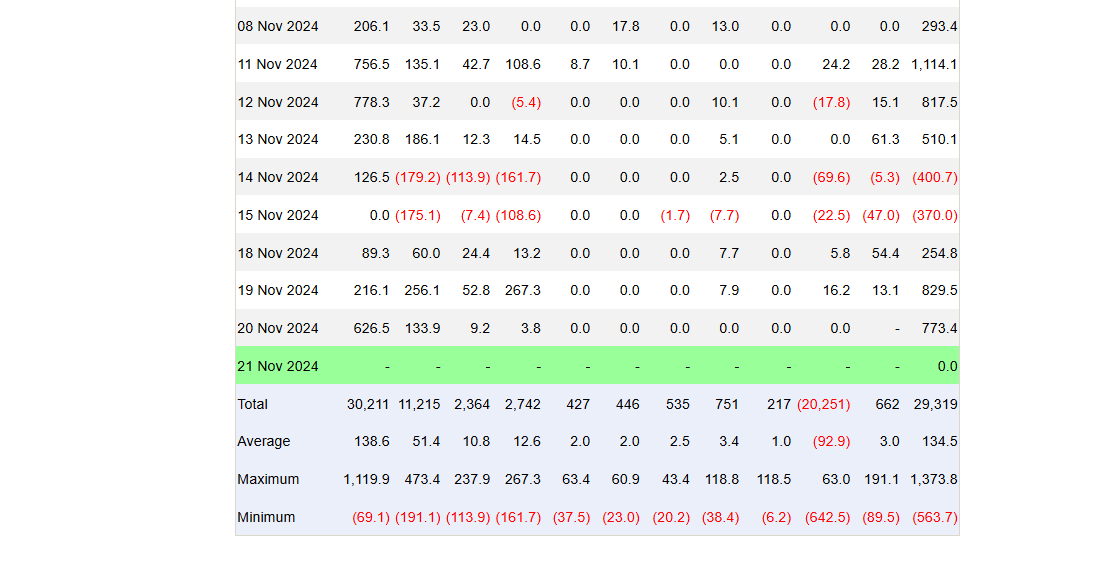

BTC spot ETFs have seen a total net inflow of $1.84 billion, extending the winning streak to three days. The BTC ETF has been the largest driving force behind capital inflows into Bitcoin this year, with U.S.-based ETFs accounting for a net influx of $29.4 billion.

Given the ongoing easing of monetary policy by global central banks and continued strong demand for BTC, it is likely that Bitcoin prices will sustain support as we approach year-end.”

Will Cryptocurrencies Rise?

The recent launch of IBIT options shows that 75% of calls are dominant, confirming market bullish expectations for next year. The pressures on the crypto markets from regulatory lawsuits in recent years have the potential to reverse, opening doors for much larger gains in cryptocurrencies.

Moreover, the approval of spot ETF applications for altcoins under the new SEC administration will be exciting. The market will attempt to price in expectations until Trump’s inauguration on January 20, 2025, after which concrete actions could either support a rise or lead to disappointment and downturns.

Currently, the prevailing sentiment for December, January, February, and March is that a strong bullish trend is likely to continue. As Ethereum  $3,139 breaks past the $3,800 level, liquidity will begin to flow into altcoins, contingent upon Bitcoin consolidating at six-figure levels and finding a peak to linger at.

$3,139 breaks past the $3,800 level, liquidity will begin to flow into altcoins, contingent upon Bitcoin consolidating at six-figure levels and finding a peak to linger at.