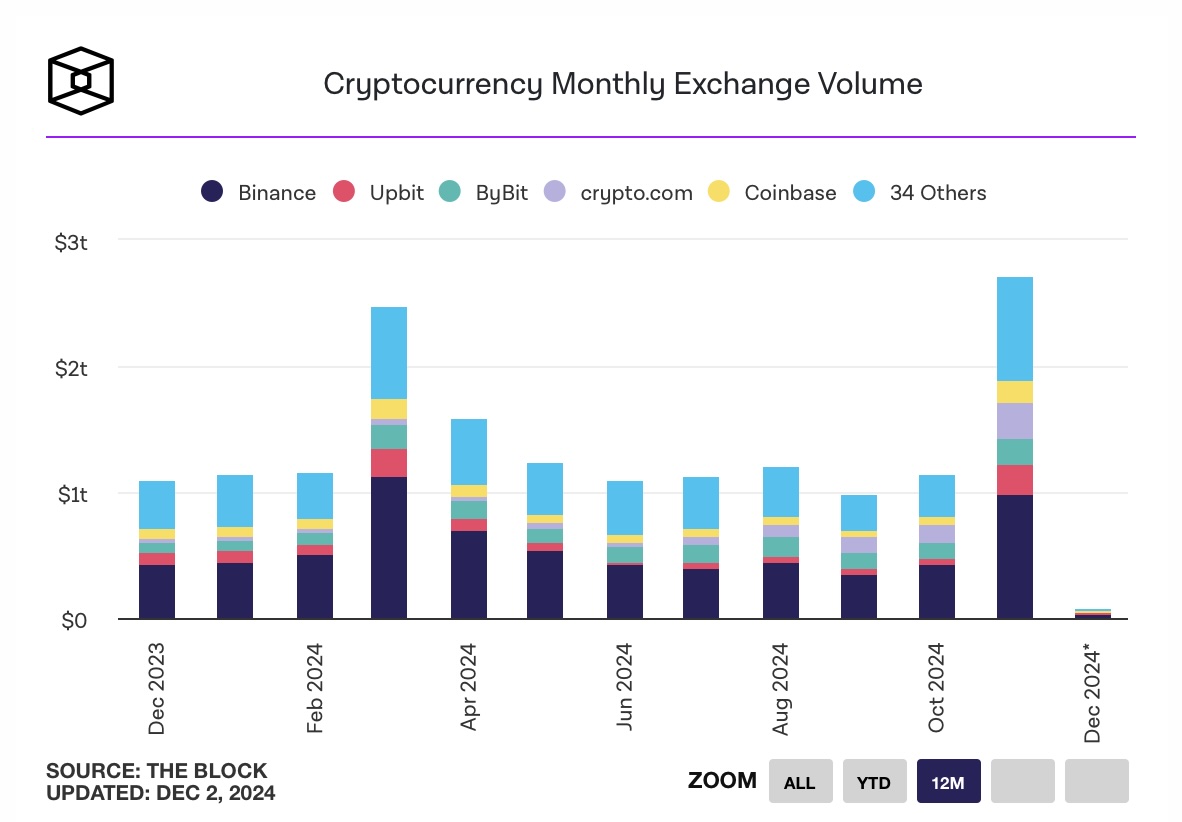

The monthly spot trading volume in the cryptocurrency market surged to 2.71 trillion dollars in November, marking the highest level since May 2021. This figure signifies more than double the previous month’s volume of 1.14 trillion dollars. Dominating this trading volume, the world’s largest cryptocurrency exchange, Binance, accounted for 36% of it, executing trades worth 986 billion dollars. Other major exchanges such as Crypto.com, Upbit, and Bybit also recorded monthly trading volumes exceeding 200 billion dollars.

Record Levels in Bitcoin and Ethereum Futures

In November, Bitcoin futures trading volume reached a historic high of 2.59 trillion dollars. Similarly, Ethereum (ETH)  $3,139 futures reached 1.28 trillion dollars, marking the highest level since May 2021. This surge was fueled by the cryptocurrency-friendly policies of re-elected Donald Trump.

$3,139 futures reached 1.28 trillion dollars, marking the highest level since May 2021. This surge was fueled by the cryptocurrency-friendly policies of re-elected Donald Trump.

Trump’s re-election propelled Bitcoin (BTC)  $91,967 to a new record value of 99,635 dollars. During this period, Solana

$91,967 to a new record value of 99,635 dollars. During this period, Solana  $143 (SOL) also entered a rising trend, reaching its all-time high on November 21. The cryptocurrency index GMCI 30 saw a 62.3% increase last month, highlighting the overall upward movement of the market.

$143 (SOL) also entered a rising trend, reaching its all-time high on November 21. The cryptocurrency index GMCI 30 saw a 62.3% increase last month, highlighting the overall upward movement of the market.

SEC Chairman Gensler’s Resignation and Market Impact

Another notable development in November was the resignation of SEC Chairman Gary Gensler. Gensler, known for his aggressive regulations in the cryptocurrency sector, was viewed positively by market players following his departure.

Augustine Fan, Director of Analysis at SOFA.org, emphasized the optimism in the market, stating, “Most of the rally concentrated on major assets like Bitcoin.” The positive sentiment in the sector indicates that interest in cryptocurrencies is likely to continue in December.