The Solana  $126-based memecoin, Hawk (HAWK), experienced a significant market value decline of over 90% shortly after its launch. Initially, the altcoin reached a market value of $400 million, but this figure rapidly diminished to $37 million. Despite the sharp drop, Hailey Welch, the creator of the altcoin, asserted that her team did not partake in any sales.

$126-based memecoin, Hawk (HAWK), experienced a significant market value decline of over 90% shortly after its launch. Initially, the altcoin reached a market value of $400 million, but this figure rapidly diminished to $37 million. Despite the sharp drop, Hailey Welch, the creator of the altcoin, asserted that her team did not partake in any sales.

Claims of Manipulation and Team Control for Coin Launch

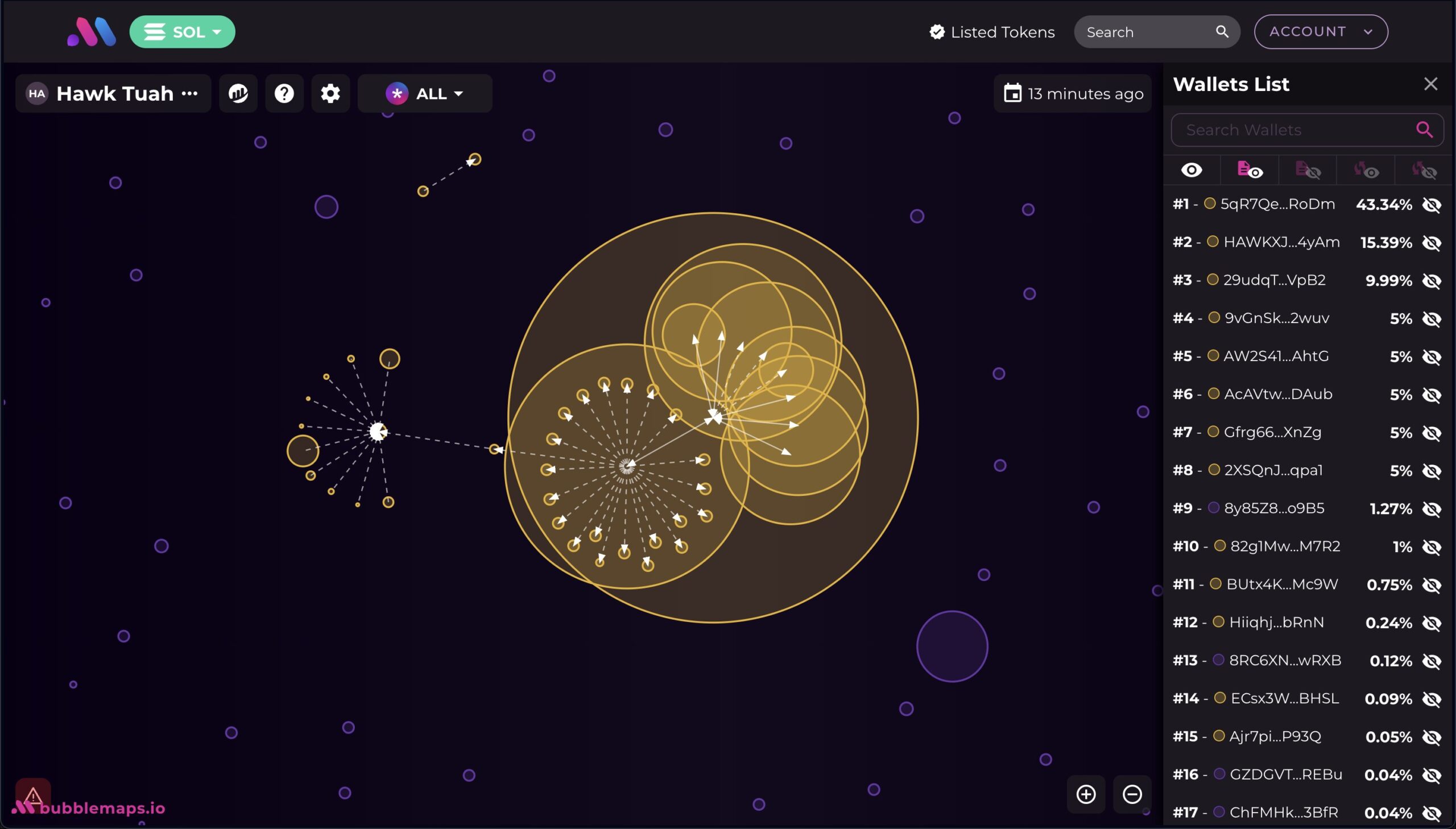

According to data from DexScreener, HAWK coin was launched on November 29 at 16:00. The rapid rise of the altcoin prompted allegations of manipulation from some users. The blockchain data visualization platform Bubblemaps revealed that a group of wallets controlled 96% of the total supply, raising questions about the distribution of the coin.

However, Welch firmly rejected these allegations. In a statement made on the social media platform X, she claimed, “The team has not sold any coins, and not a single Key Opinion Leader received free coins.” Welch noted that high transaction fees were implemented to prevent early buy attempts, but these fees were later reduced.

Team Defends Adherence to Tokenomics

The OverHere team, responsible for launching HAWK, also denied the manipulation allegations. They emphasized that the 96% supply control seen on Bubblemaps relates to addresses used during the distribution process. According to their tokenomics, only 10% of the total supply was allocated to Welch and her team, limited by a 12-month token lock period and a three-year linear release plan.

The OverHere team stated, “Hailey’s team absolutely did not sell any coins.” Welch reiterated that the manipulation claims were false and that the project embraced a community-oriented approach.

The swift decline in HAWK’s launch is viewed as part of the typical volatility seen in the memecoin landscape. Nonetheless, Welch and her team aim to restore user confidence and establish transparency in their operations.

Türkçe

Türkçe Español

Español