In recent weeks, Bitcoin  $91,967 has experienced a steep decline exceeding 30% from its all-time high in early October. It tested a low of below $81,000, marking its lowest point since April, before bouncing back approximately $5,000. However, technical indicators and investor behavior suggest this recovery might be short-lived, as another bearish wave looms on the horizon.

$91,967 has experienced a steep decline exceeding 30% from its all-time high in early October. It tested a low of below $81,000, marking its lowest point since April, before bouncing back approximately $5,000. However, technical indicators and investor behavior suggest this recovery might be short-lived, as another bearish wave looms on the horizon.

Historical Patterns Signal Further Decline

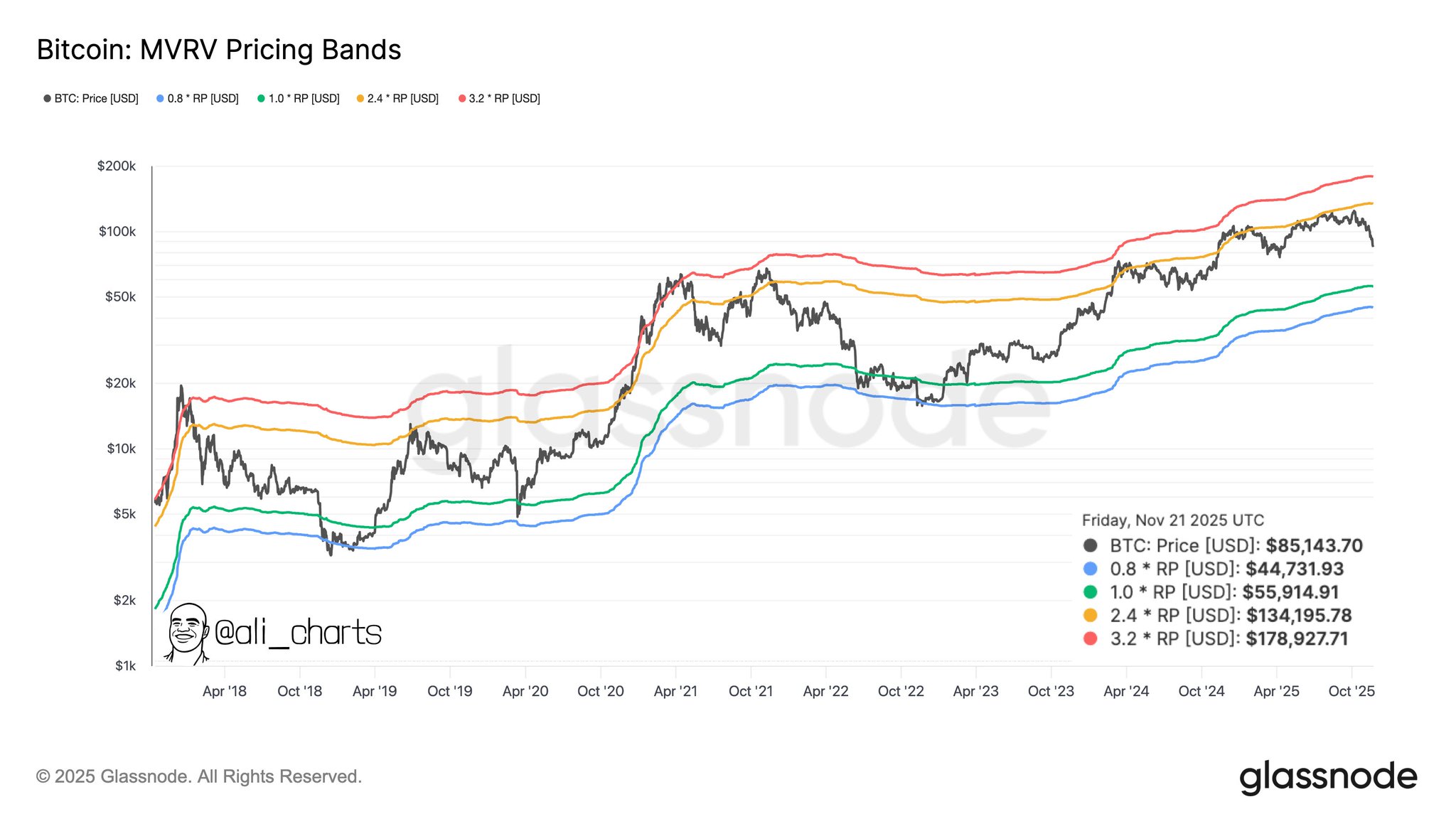

Crypto analyst Ali Martinez underscores the potential for a deeper descent by examining Bitcoin’s historical lows within certain price bands. Martinez points out that Bitcoin has previously hit bottom within the green and blue bands, and should this pattern repeat, the price could plummet to $44,700. Such a drop would reflect an additional 50% loss from current prices.

Investor sentiment is darkening, particularly among “whale” investors who have begun offloading significant amounts of BTC. This ongoing sell-off from long-standing investors signals a growing distrust within the market.

Furthermore, there has been over $1.2 billion withdrawn from U.S. spot Bitcoin ETFs in the last week, reinforcing this negative trend. BlackRock’s IBIT fund is among those experiencing the most significant outflows.

Increased Bitcoin Transfers to Exchanges

Martinez’s data reveal that 20,000 BTC, approximately $2 billion in value, have been moved to exchanges in the past week, indicating mounting selling pressure. According to the analyst, this significant transfer to centralized exchanges may lead to further price weakening in the short term.

Additionally, the broader crypto market has seen a significant drop in capital inflow over the past three months. Funding has plummeted from $86 billion to $10 billion, highlighting a sharp decrease in risk appetite. These signals suggest that not just Bitcoin, but the entire cryptocurrency market, is at risk of facing another period of instability.