The activity of Binance USD (BUSD) has experienced a precipitous decline since regulators commenced scrutinizing the US dollar-pegged stablecoin of Binance, the world’s preeminent cryptocurrency exchange.

Descending to the Lowest Ebb in Two Years

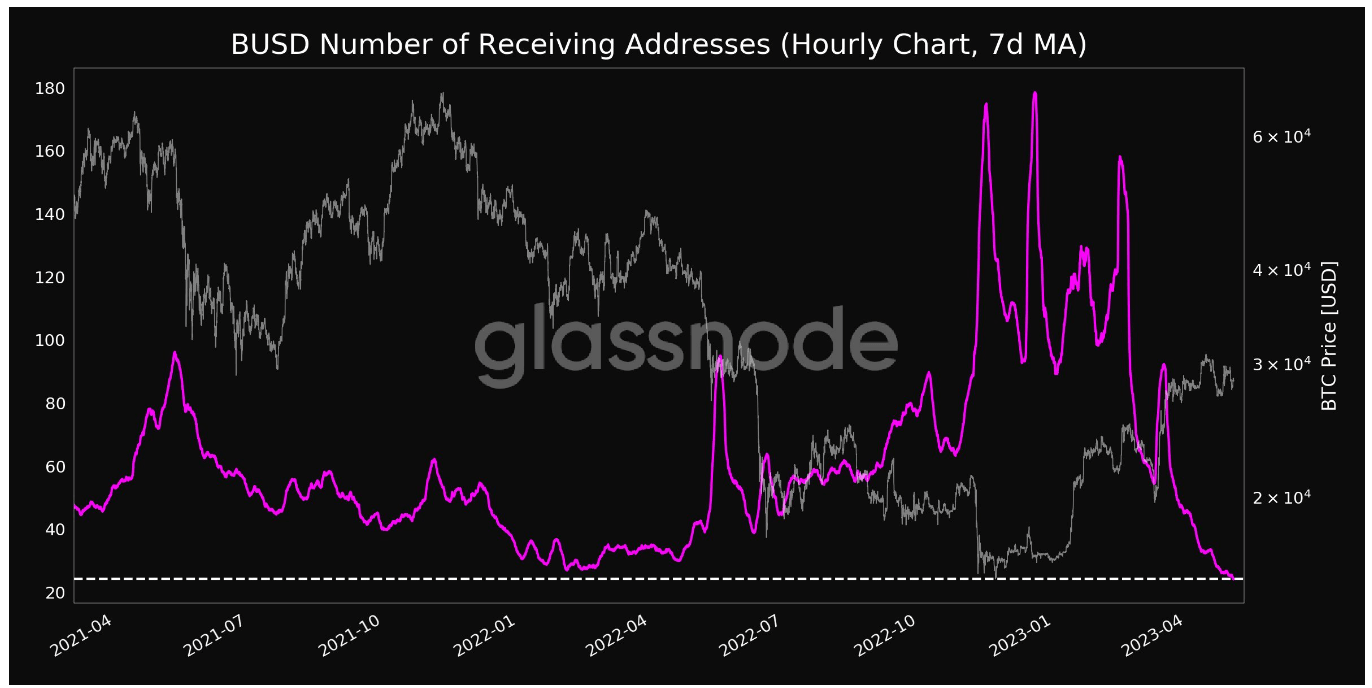

Glassnode, a crypto data platform employing a seven-day moving average to monitor metrics, disclosed that the quantity of wallet addresses dispatching and receiving BUSD has reached its lowest point in two years.

The diminished activity of BUSD, a collaborative endeavor between Binance and financial services purveyor Paxos, arises in the wake of Paxos receiving a Wells notice from the US Securities and Exchange Commission (SEC) in February. The US regulatory body classified BUSD as an unregistered security. Subsequent to the Wells notice, Binance CEO Changpeng Zhao declared that the cryptocurrency exchange would convert approximately $1 billion worth of extant BUSD within the Industry Recovery Fund into Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

Furthermore, the cryptocurrency exchange commenced the removal of BUSD trading pairs for altcoins, including STEPN (GMT), NEAR Protocol (NEAR), and Avalanche (AVAX).

USDT Ascends as BUSD Hemorrhages

CoinMarketCap data reveals that the market capitalization of BUSD, which once exceeded $23 billion, has plummeted to $6 billion. As BUSD hemorrhages, the market capitalization of Tether’s USDT has surged beyond $82 billion. USDC, the second-largest stablecoin issued by Circle, boasts a market capitalization surpassing $50 billion.

While BUSD’s value deteriorated, USDT, the most dominant US dollar-pegged stablecoin in the cryptocurrency market, expanded its supremacy. Examining the stablecoin supply on the Ethereum network specifically, USDT possesses a supply exceeding 36 billion tokens, whereas USDC’s supply approximates 29 billion tokens. BUSD’s supply on the Ethereum network barely surpasses 6 billion.

Some observers contend that the USDT supply has consistently served as a harbinger of rising Bitcoin prices or the overall cryptocurrency market. Simon Cousaert, Director of Research at The Block, posited last month, “Tether typically issues new USDT in response to heightened demand and escalating expectations. This demonstrates that fresh capital is entering the system, often deployed to purchase BTC, ETH, and other cryptocurrencies.”