Bitcoin price continues to lose important support levels one by one. So when will cryptocurrencies rise? The current Bitcoin price is at $26,300 and the loss compared to yesterday has exceeded almost $1,000. Where is the Bitcoin price going, which fell 4,000 dollars below the 2023 peak? Current price forecasts and market commentary are with you.

Bitcoin (BTC) for the First Time

Bitcoin (BTC) price fell below the critical $27,000 support for the first time since March 2023. However, critical on-chain data does not point to panic selling for now. Will the recovery begin? Today, Bitcoin price extended its May losses to 10%. The latest CPI statistics supported a positive shift in market sentiment. However, concerns over the US debt ceiling and a possible recession are adding to fears.

In the last 11 days, there has been a net sale of around 266,000 Bitcoins along with declining volumes. The fact that assets bought during the January rise are being sold shows that recession concerns are increasing. As the Fed starts to cut interest rates, US markets usually face recession and stocks fall. Now, if the ceiling is announced in June, the cuts will have to start in 9-12 months, which increases the possibility of a recession in the medium term.

One of the critical indicators of previous Bitcoin price crashes is a frenzied selling by long-term investors. At the moment, however, this does not seem to be the case for the current price correction. While there has been selling, it has not been similar to that of the March crash. Currently, the BTC Average Coin Age has remained solid this week despite the US debt ceiling and the growing uncertainty surrounding the currency markets. The Average Coin Age is calculated based on the average days that all coins in circulation remain at their current wallet address.

When Will Cryptocurrencies Rise?

Looking at the chart below, it says that the Coin Age started to increase around May 6, when the Bitcoin price dropped below $29,000. Increased selling from May 1 onwards allowed January purchases to be converted into gains. At the same time, the price lost more than $4,000.

While the recent downtrend appears to be driven by short-term investors and speculators, bullish sentiment among long-term holders could soon put the positive Bitcoin price forecast back on track. Further supporting the positive Bitcoin price forecast, bullish investors’ appetite for risk will increase if the BTC price drops to $25,000.

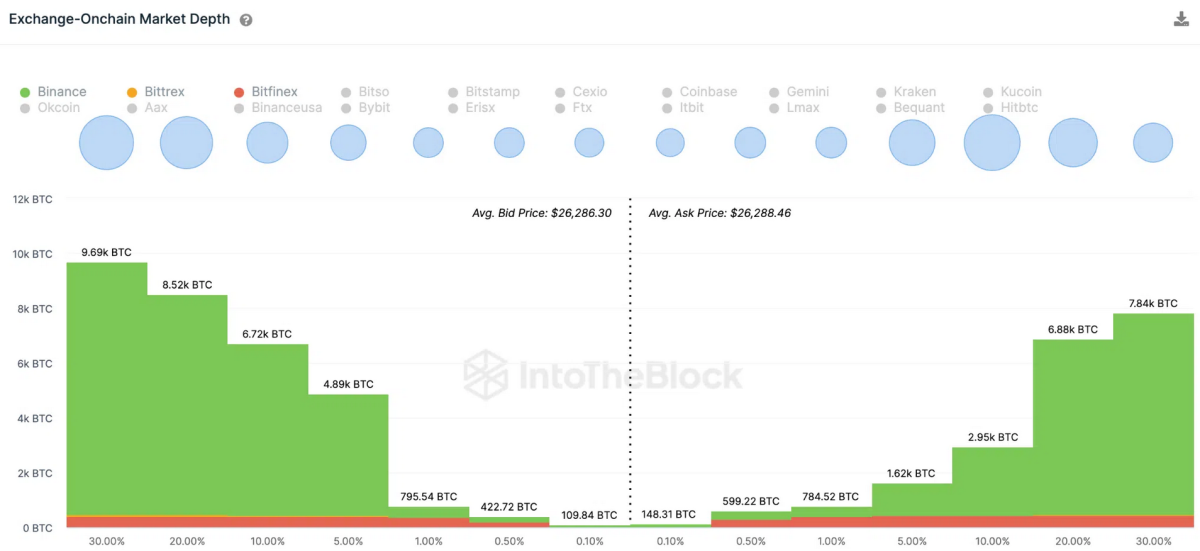

In the image above, you can see the order book density of exchanges. Glassnode and CryptoQuant reports also suggest that the decline could be reversed if the Bitcoin price falls into the $25,000 discount price zone. So we may see one last bearish wave before the upswing for cryptocurrencies.