Bitcoin (BTC) has dropped by more than 3 percent in the last 24 hours, dropping as much as $ 26,160. This was the lowest level seen since March 17. Despite the encouraging macroeconomic conditions for risky assets, BTC’s bullish potential could not be utilized as BTC’s bid liquidity declined. Assessing the decline in the largest cryptocurrency, on-chain data tracking source Material Indicators summarized the price drop as “Welcome to bear heaven”. So what’s next for BTC, let’s take a closer look at what experts say.

Main Support Level: $25,700

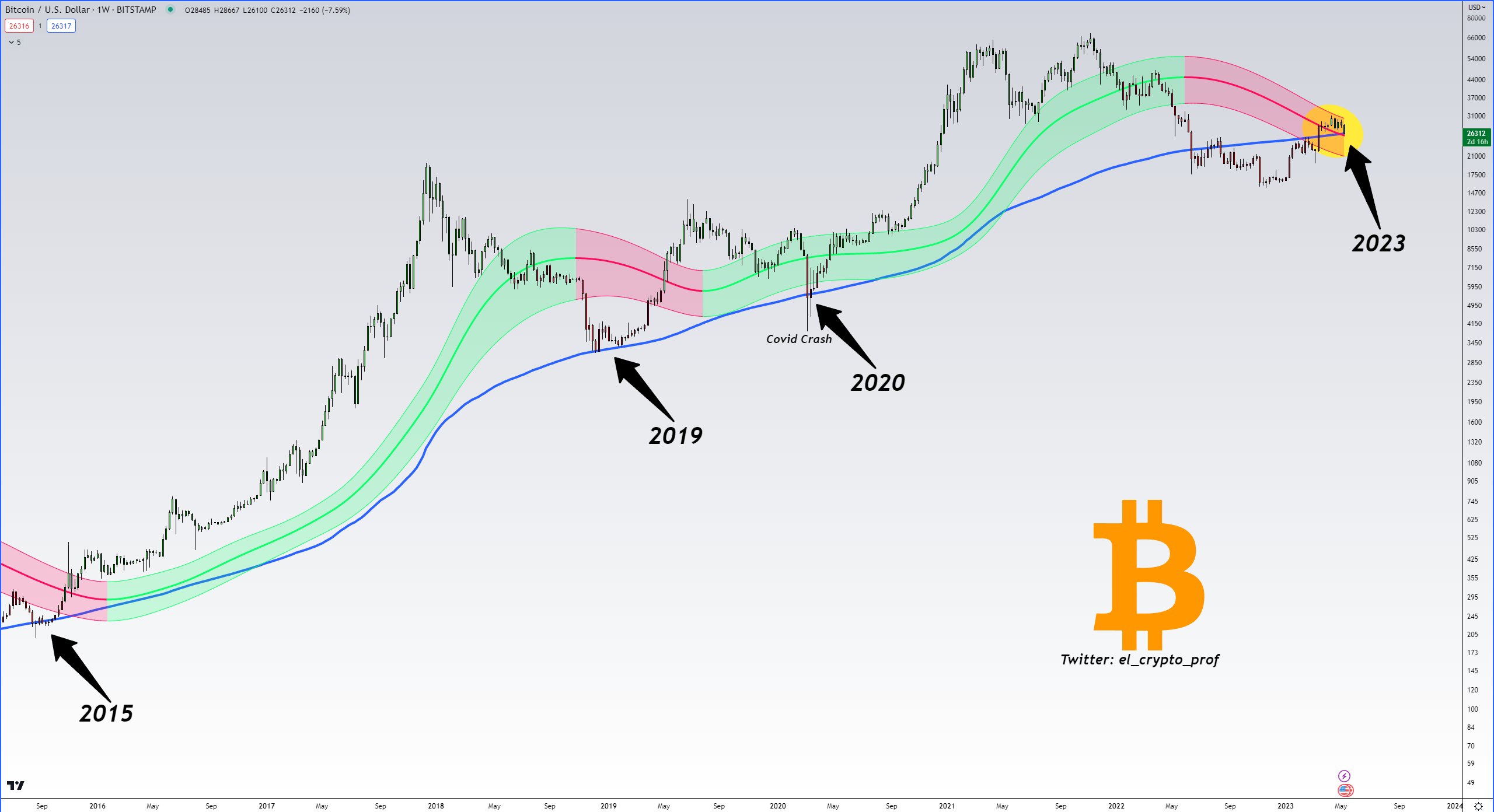

A price chart for Bitcoin uploaded to Twitter on May 11 shows that the main support level is around $25,750 as the largest cryptocurrency overnight overconsumed liquidity.

Market participants are anxiously focused on whether Bitcoin will record a triple top on the daily timeframe. If the triple top, which is currently clearly visible on the price chart, is confirmed, in other words, the formation of a shoulder-head-shoulder pattern, a negative picture will be faced. Commenting on the bearish pattern on the Bitcoin chart, financial commentator Tedtalksmacro said, “We cannot let the crowd win for the shoulder-to-shoulder pattern in Bitcoin. Above $ 27,000, things will get very interesting.” emphasized the importance of $ 27,000.

Cryptocurrency analyst and trader Moustache pointed out that it is already time to retest the 200-week key moving average (WMA), saying that the 200 WMA, a “make-or-break level”, has served as support since mid-March.

Market analysts and pundits have been predicting a pullback to around $25,000 for some time. Among these analysts was Jelle, who said earlier in the day that he expected BTC to drop as low as $25,000 before turning bullish.

Jelle stated that the Relative Strength Index (RSI) does not serve sellers in low timeframes, “Bitcoin headed straight to support, the next main zone of interest is around 24-25 thousand. RSI is failing to push the extremes and this shows that sellers are exhausted. It would make sense for a final drop to $25k, which will be bought quickly.”

Traders Take Buying Positions as BTC Price Declines

Philip Swift, co-founder of trading package DecenTrader and creator of data source LookIntoBitcoin, thinks that despite the decline in Bitcoin price, the worst days will soon be over. In a tweet, he noted that the long/short ratio started to diverge as the price fell, with long positions outweighing short positions.

Data from Coinglass confirms Swift’s assessment. According to the data, the long weight in the long/short ratio is 58.7 percent.