The United States Securities and Exchange Commission (SEC) is investing considerable time and resources into regulating cryptocurrencies, even requesting additional budget from the government to intensify its focus on this field. This trend raises concerns, as the one course of action available to them for an unregulated and guideless crypto market is to battle altcoins through the power of sanctions.

SEC and Altcoins

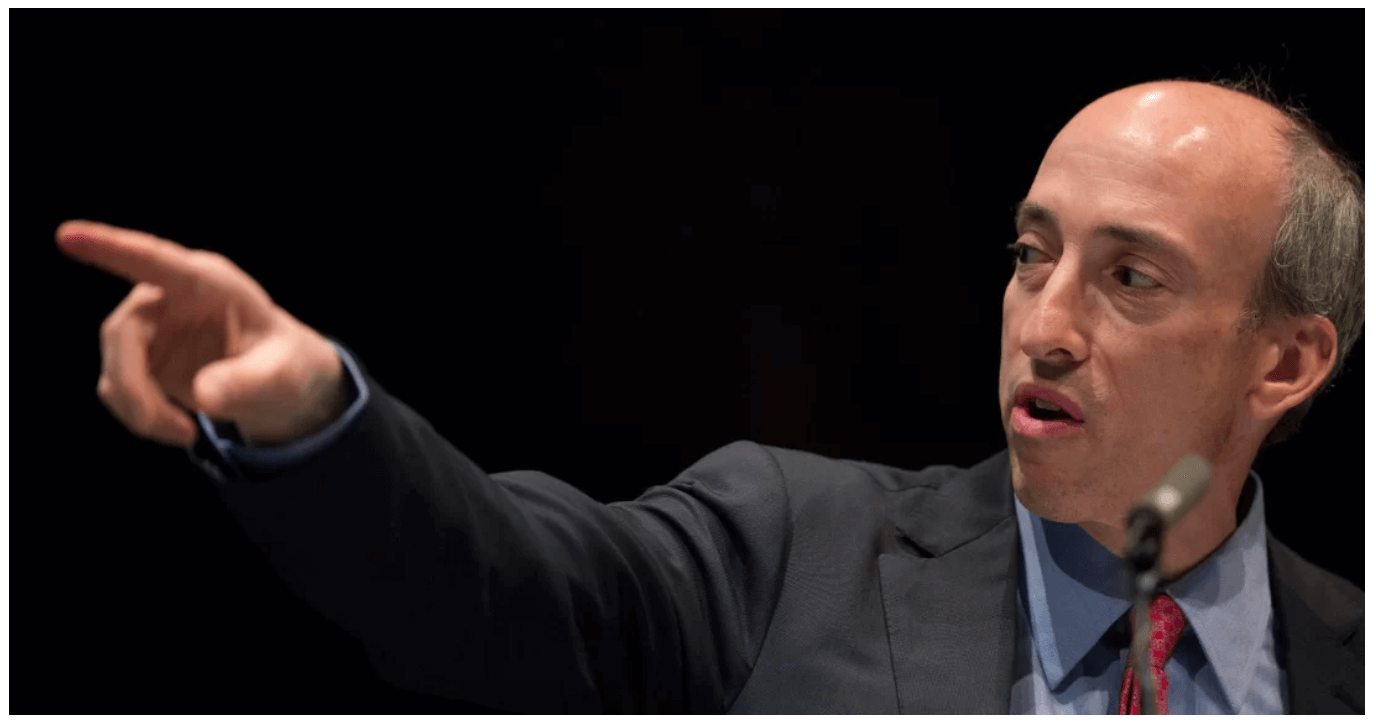

In the coming months, many altcoins are likely to experience what Filecoin faced in the early hours of yesterday. The SEC chairman has stated that all altcoins fall under the categories of securities and investment contracts. Although he chose to remain silent during his statement in the House of Representatives, the commission is taking action based on this perspective.

However, is the issue only with altcoins like FIL and XRP? The answer is no. The SEC recently classified 37 cryptocurrencies as securities. The latest decisions made by the SEC have significant implications for investors, exchanges, and the broader industry, firmly placing certain cryptos in the securities class.

The SEC enforces standards set under the Securities Act of 1933 and further interprets them through several crucial court rulings, thereby declaring many cryptocurrencies as securities. The SEC v. W. J. Howey Co. case established the “Howey Test” criteria to determine whether a transaction can be classified as an investment contract, a type of security. This test checks whether a transaction involves an investment in a common enterprise and primarily anticipates profit from the efforts of others.

Altcoins that are Securities

The SEC has classified 37 cryptocurrencies as securities with its decisions. Unauthorized sale of these altcoins on exchanges serving U.S. customers, and the creation of investment funds focused on their prices, are grounds for litigation. Grayscale received its first notification about the Filecoin fund 24 hours ago, hinting at potential future actions by the SEC that could negatively affect the prices of other altcoins.

Here is the complete list of the altcoins that have been classified as securities:

- XRP (XRP)

- Telegram Gram Token (TON) (Ekim 2019)

- LBRY Credits (LBC) (2021 Mart)

- Decentraland (MANA) (17 Nisan 2023)

- DASH (DASH)

- Power Ledger (POWR)

- OmiseGo (OMG)

- Algorand (ALGO)

- Naga (NGC)

- TokenCard (TKN)

- IHT Real Estate (IHT)

- Kik (KIN)

- Salt Lending (SALT)

- Beaxy Token (BXY)

- DragonChain (DRGN)

- Tron (TRX)

- BitTorrent (BTT)

- Terra USD (UST)

- Luna (LUNA)

- Mirror Protocol mAssets (Multiple Symbols)

- Mirror Protocol (MIR)

- Mango (MNGO)

- Ducat (DUCAT

- Locke (LOCKE)

- EthereumMax (EMAX)

- Hydro (HYDRO)

- BitConnect (BCC)

- Meta 1 Coin (META1)

- Rally (RLY)

- DerivaDAO (DDX)

- XYO Network (XYO)

- Rari (RGT)

- Liechtenstein Cryptoasset Exchange (LCX)

- DFX Finance (DFX)

- Kromatica (KROM)

- FlexaCoin (AMP)

- Filecoin (FIL)

The sale of unregistered securities typically constitutes a violation of U.S. laws. This regulation requires securities to be registered with the SEC before they are sold to the public. In light of the SEC’s new classification, exchanges listing these tokens could face legal scrutiny. Some U.S. exchanges are already listing over a dozen cryptos classified as illegal for sale by the SEC; this could trigger regulatory actions and potentially impact their operations.

If you are trading any of these 37 altcoins, you may be at risk of future litigation from the SEC. The lawsuit against Ripple has remained unresolved for years and has suppressed the expected performance of XRP during the last bull season. Legal proceedings (e.g., for LBC) have already been initiated for some of the altcoins mentioned above.

Türkçe

Türkçe Español

Español