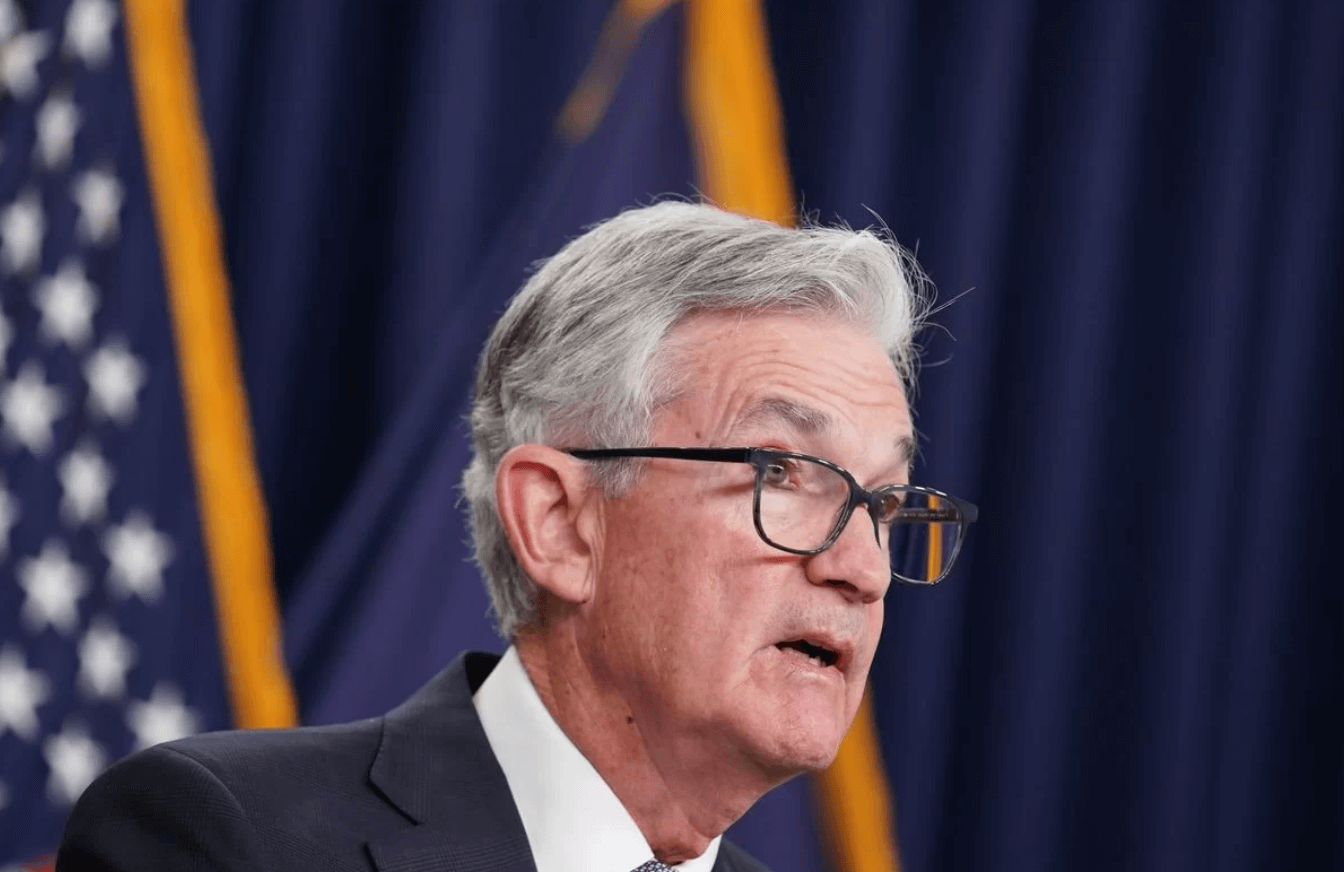

Bitcoin (BTC) and altcoin prices are showing relative stability following significant drops below crucial support levels. This comes in the wake of an improved mood surrounding the US debt ceiling agreement, leading investors to more secure havens. The biggest focus in the Bitcoin and altcoin space is Federal Reserve (Fed) Chair Jerome Powell’s forthcoming speech, where further hints on the Fed’s monetary policy will be sought.

Dollar Rises to the Highest Level of the Last Seven Weeks

Bitcoin retreated to as low as $26,500 on May 18, following the Biden administration’s optimistic remarks about a potential agreement to raise the US debt ceiling this week. This scenario unfolded despite a rally in most risk-oriented assets on expectations that the US will avoid default. The US dollar has reached a seven-week high, pressuring Bitcoin and altcoins.

Hawkish comments from Fed officials throughout the week have also stirred the cryptocurrency market. The focus on the possibility of a prolonged period of higher interest rates in the US has been interpreted as increasing the opportunity cost of holding non-yielding assets.

According to data provided by the crypto data platform CoinMarketCap, Bitcoin is currently trading at $26,874, down 1.76% in the last 24 hours. The largest altcoin, Ethereum (ETH), is changing hands at $1,806, reflecting a 1.16% decrease.

Investors Watch Fed Chair Powell’s Speech

Investors are eagerly awaiting a speech by Fed Chair Powell at the Thomas Laubach Research Conference in Washington, D.C. for further insight into the Fed’s monetary policy. The speech will take place at 18:00, prior to the conference, during a panel on “Perspectives on Monetary Policy.”

The general consensus among Fed officials who have made statements throughout the week is that inflation is too high, the Fed needs to remain hawkish to bring down inflation, and this could potentially necessitate further interest rate hikes. Hence, Powell’s comments on monetary policy will be closely watched.

Although Fed fund futures indicate markets are still positioning for the Fed to pause rate hikes in June, interest rates are expected to remain high for a prolonged period. This could result in Bitcoin and altcoins remaining under pressure. On the other hand, market experts opine that there could be an upside, particularly if economic conditions in the US deteriorate and the Fed officially pauses rate hikes.

Türkçe

Türkçe Español

Español