Ethereum (ETH), the second largest cryptocurrency by market value, has recently experienced a tumultuous period. Following Bitcoin’s 1.5% decrease over the past week, Ethereum has held relatively steady, registering a minor increase of 0.2% and essentially maintaining a sideways movement. The resilience in ETH’s price could be attributed to certain on-chain data.

Ethereum’s Future is Influenced by These

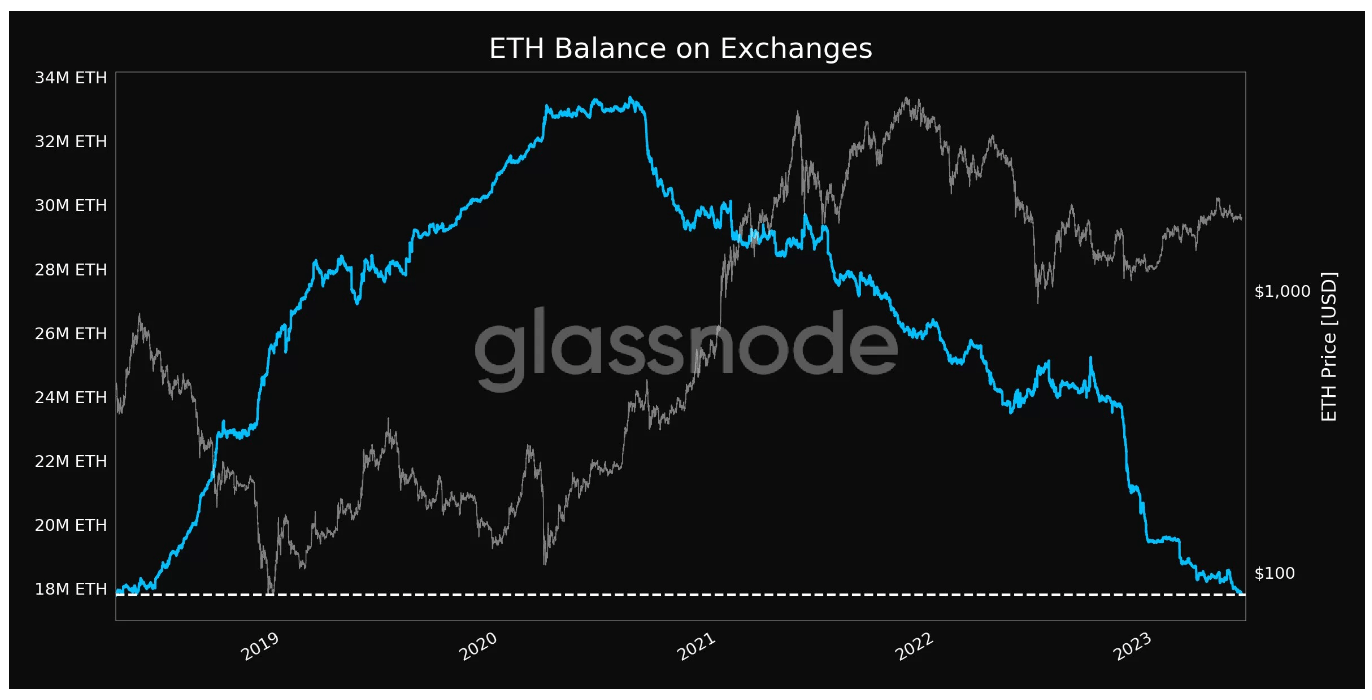

The quantity of ETH on cryptocurrency exchanges has dropped to a level unseen since July 2016. According to data shared by Glassnode, as of Thursday, the ratio of ETH on exchanges to total ETH stood at 14.85%. This marks a development that hasn’t been seen since 2016, when ETH was just beginning to make a name for itself.

During the 2021 bull market, the amount of ETH on exchanges was recorded at about 25%. The introduction of the Shapella update sparked a significant staking frenzy in the Ethereum network. More than 4.4 million ETH have been staked since this update, and this number continues to rise. The reduction of ETH on exchanges and the increase in staked coins are certainly good news for investors. A large amount of ETH on exchanges could pave the way for substantial selling pressure. Thus, the more ETH that is staked and locked up, the greater the potential for positive price movements for ETH. Another reason for the decrease in ETH on exchanges could be the general market condition, as trade volume on one of the world’s largest exchanges, Binance, fell by 48% in April.

ETH Price Analysis

Looking at the Ethereum price analysis, it seems hope continues for ETH. The ETH/USD pair, currently trading at around $1,820, could target $1,910 again if the $1,830 resistance is breached. This critical resistance level has been tested twice before but has yet to be broken on a daily basis. As much as this resistance is significant for ETH, so is the $1,750 support level.

Another factor that could affect the ETH price and the future of Ethereum is, of course, regulations and news coming from the US. The SEC’s ongoing war against cryptocurrencies and its view of most as securities has caused fear in the market. Gaining certainty on this issue could provide comfort for Ethereum investors.

Türkçe

Türkçe Español

Español