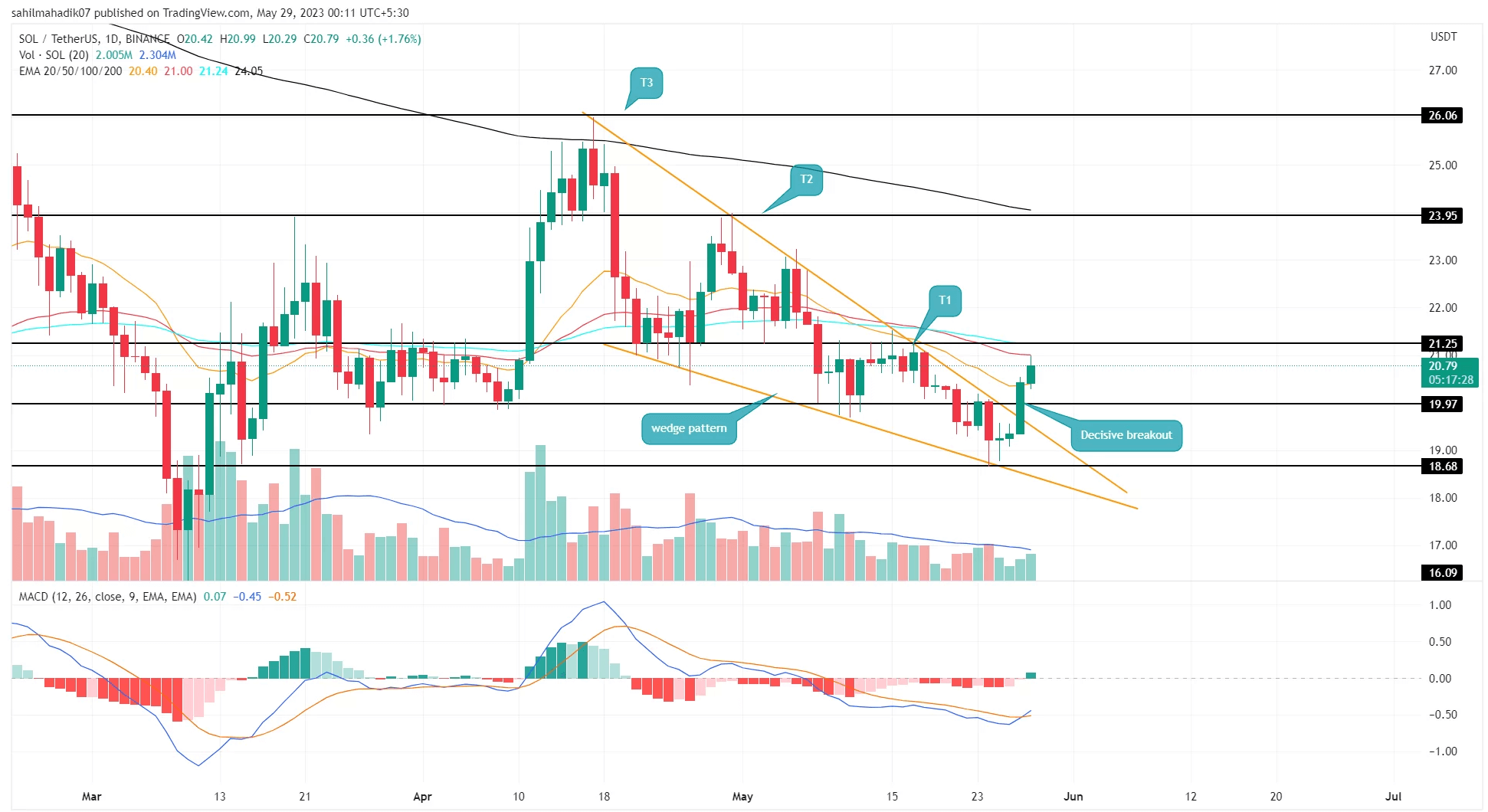

In the midst of the recent downturn in the cryptocurrency market, Solana (SOL) was experiencing selling pressure, trading between two converging trend lines of a falling wedge pattern. In such a chart formation, the price essentially declines gradually under a falling trend, and eventually, it is expected that buyers will seize control of the trend and drive the price upwards. Indeed, an upward breakout in a falling wedge formation signals the end of a decline or the onset of a new recovery rally. This is exactly the situation for Solana’s SOL.

Solana Price Analysis

The SOL price made a strong break from the resistance trend line of the falling wedge formation on May 25. Prior to this breakout, the altcoin price made numerous reversals from the falling resistance trend line of the falling wedge formation over five weeks. This breakout from the falling resistance trend line of the formation indicates that buyers have taken trend control over the price and have mobilized.

Currently, the Solana price is trading at $20.77, a rise of 5.95% in the last 24 hours. The green candles on the price chart reveal that the transition to an uptrend is exceptionally sharp, indicating high investor interest in the altcoin.

However, the altcoin’s price may make a minor pullback to test the broken falling trend line as a support level. If buyers can manage to keep the price above the resistance trend line, they could drive it to the $26 level with a rally reflecting a 25% increase.

Can Solana Price Reach $26?

The price completing the falling wedge formation and reaching the target level signifies a strong recovery for Solana. The target level suggested by the falling wedge formation is currently $26, however, the SOL price may face hurdles at $21.25 and $24 that could slow its ascent before it reaches $26.

Technical indicators for SOL like the Moving Average Convergence Divergence (MACD) bullish crossover between the blue line and the orange signal line signify a shift from a bearish trend to a bullish one. The 50 and 100-day Exponential Moving Averages (EMA) near the $21.17 level are acting as high supply zones for the buyers.

Türkçe

Türkçe Español

Español